-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Jumping like a Bull Frog around here, $3.17 today in BP GA!Gas up another .09 today to $3.39.....Insane!

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

[TABLE="class: tablewrapper"]

[TR]

[TD="class: econo-reportname, colspan: 2"]EIA Petroleum Status Report

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]

[TD="class: econo-releaseinfo"]Released On 6/20/2012 10:30:00 AM For wk6/15, 2012

[/TD]

[TD="class: actual_consensus_box_numbers"]-0.2 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] 2.9 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-1.7 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] 0.9 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-0.1 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] 1.2 M barrels

[/TD]

[/TD]

[/TR]

[/TABLE]

Economic Calendar - Bloomberg

[/TD]

[/TR]

[/TABLE]

[TR]

[TD="class: econo-reportname, colspan: 2"]EIA Petroleum Status Report

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]

[TABLE="class: actual_consensus_box"] [TR="class: actual_consensus_toprow"] [TD] | Prior | Actual |

| Crude oil inventories (weekly change) | ||

| Gasoline (weekly change) | ||

| Distillates (weekly change) |

[TD="class: econo-releaseinfo"]Released On 6/20/2012 10:30:00 AM For wk6/15, 2012

[/TD]

[TD="class: actual_consensus_box_numbers"]-0.2 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] 2.9 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-1.7 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] 0.9 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"]-0.1 M barrels

[/TD]

[TD="class: actual_consensus_box_numbers"] 1.2 M barrels

[/TD]

[/TR]

[/TABLE]

Economic Calendar - Bloomberg

[/TD]

[/TR]

[/TABLE]

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

I wonder why??????????

Central Gulf Lease Sale Marks First Since Deepwater Horizon Incident

by Karen Boman

|

Rigzone Staff

Wednesday, June 20, 2012

The Bureau of Ocean Energy Management (BOEM) on Wednesday will hold the first Central Gulf of Mexico lease sale since the Deepwater Horizon incident in April 2010.

Central Gulf Lease Sale Marks First Since Deepwater Horizon Incident

by Karen Boman

|

Rigzone Staff

Wednesday, June 20, 2012

The Bureau of Ocean Energy Management (BOEM) on Wednesday will hold the first Central Gulf of Mexico lease sale since the Deepwater Horizon incident in April 2010.

RIGZONE - Central Gulf Lease Sale Marks First Since Deepwater Horizon IncidentFour national environmental groups filed in federal court Monday challenging the lease sale, saying that BOEM officials violated the federal National Environmental Policy Act by not determining the effects of the Deepwater Horizon spill on wildlife, saying BOEM used incomplete information to rewrite an environmental impact statement

Buster

TSP Talk Royalty

- Reaction score

- 109

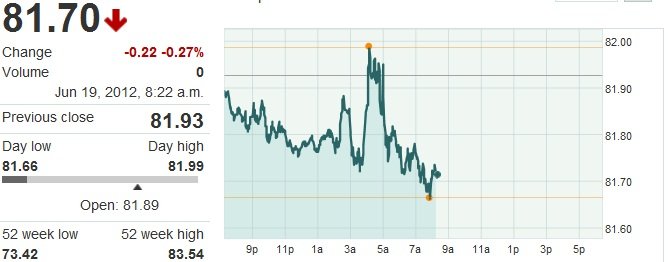

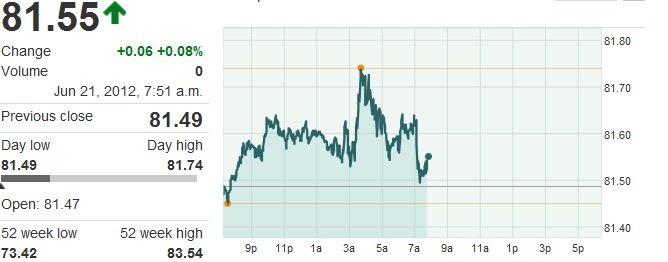

And yet Gas prices keep going up..WTF is going on !?!Crude Settle $81.80 06-20-2012

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

The cheap oil hasn't made it out of Cushing yet!:laugh:And yet Gas prices keep going up..WTF is going on !?!

Buster

TSP Talk Royalty

- Reaction score

- 109

Yeah- that's gotta be it...I mean, What else could it be?The cheap oil hasn't made it out of Cushing yet!:laugh:

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

June 21, 2012, 5:51 a.m. EDT

[h=1]Oil futures see sharp declines after China data[/h]

By Sarah Turner, MarketWatch

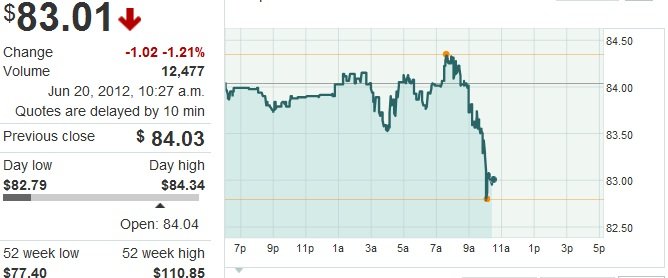

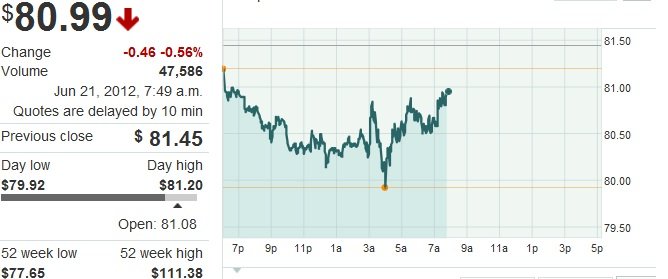

LONDON (MarketWatch) — Crude-oil futures fell sharply in electronic trading Thursday, extending the heavy losses of the previous session, after weak Chinese data raised further concerns about demand trends.

Dashed hopes of more aggressive monetary-policy action from the U.S. Federal Reserve on Wednesday also played a role in the decline for oil, analysts said.

Benchmark U.S. crude oil for August delivery dipped 0.7%, or 58 cents, to $80.83 a barrel in electronic trading during European market hours. Oil futures see sharp declines after China data - Futures Movers - MarketWatch

[h=1]Oil futures see sharp declines after China data[/h]

By Sarah Turner, MarketWatch

LONDON (MarketWatch) — Crude-oil futures fell sharply in electronic trading Thursday, extending the heavy losses of the previous session, after weak Chinese data raised further concerns about demand trends.

Dashed hopes of more aggressive monetary-policy action from the U.S. Federal Reserve on Wednesday also played a role in the decline for oil, analysts said.

Benchmark U.S. crude oil for August delivery dipped 0.7%, or 58 cents, to $80.83 a barrel in electronic trading during European market hours. Oil futures see sharp declines after China data - Futures Movers - MarketWatch

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

I LIKE a Strong Dollar and Cheap Oil, the Markets don't!:suspicious:

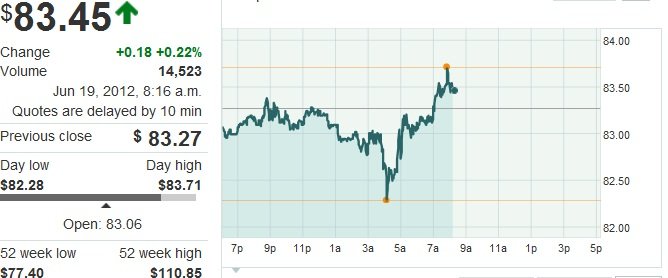

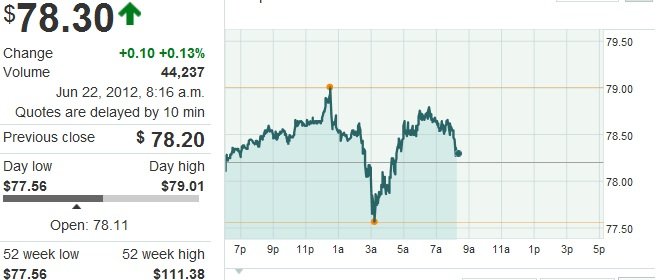

Crude Oil - Electronic (NYMEX) Aug 2012, CLQ2 Future Quote - (NMN) CLQ2, Crude Oil - Electronic (NYMEX) Aug 2012 Future Price

Crude Oil - Electronic (NYMEX) Aug 2012, CLQ2 Future Quote - (NMN) CLQ2, Crude Oil - Electronic (NYMEX) Aug 2012 Future Price

Buster

TSP Talk Royalty

- Reaction score

- 109

I LIKE a Strong Dollar and Cheap Oil, the Markets don't!:suspicious:

Crude Oil - Electronic (NYMEX) Aug 2012, CLQ2 Future Quote - (NMN) CLQ2, Crude Oil - Electronic (NYMEX) Aug 2012 Future Price

View attachment 19286

Great!..Gas will probably Double over night again..

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

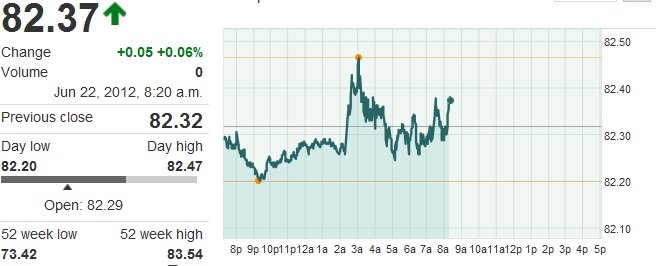

June 22, 2012, 10:14 a.m. EDT

Crude oil trades higher, but stays under $80

Crude oil trades higher, but stays under $80 - Futures Movers - MarketWatch

Crude oil trades higher, but stays under $80

Crude oil trades higher, but stays under $80 - Futures Movers - MarketWatch