-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

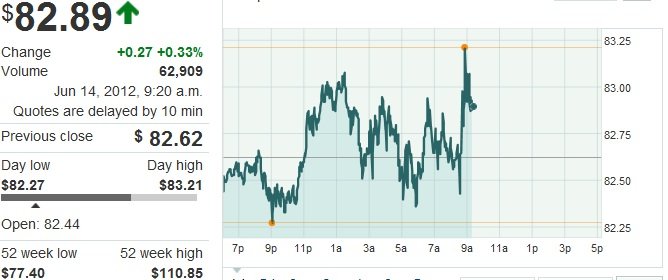

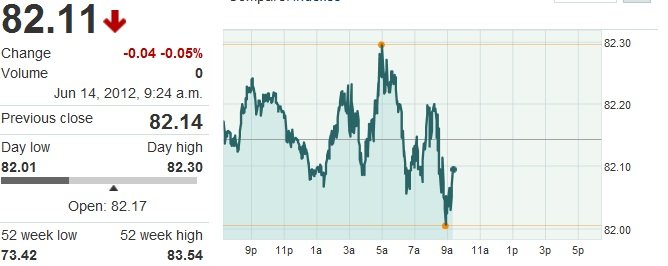

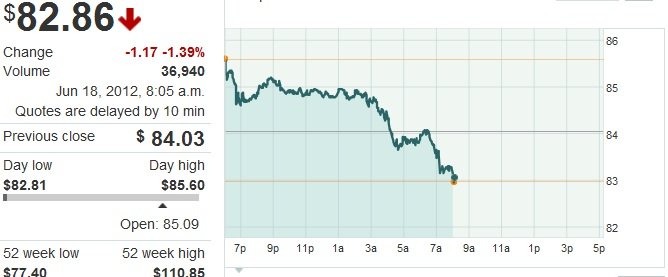

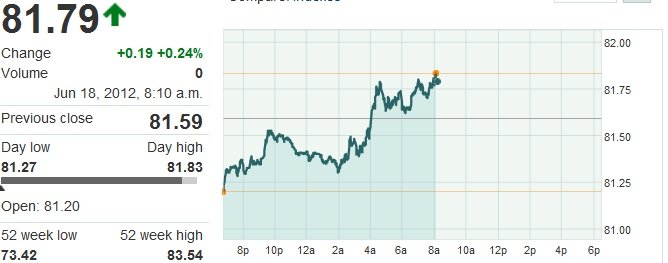

Dollar still falling, good for equities.

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

| Market Update |

[TD="align: right"][/TD]

Market Overview - Yahoo! Finance - The basics of investing.3:30 pm : Crude oil came off its pit session low of $82.37 per barrel and traded higher with help from a modestly weaker dollar and OPEC’s decision to keep its daily oil production ceiling unchanged at 30 million barrels. The energy component settled with a gain of $1.29 at $83.85 per barrel, narrowly beneath a session high of $84.04 per barrel that was set moments prior to pit close. Natural gas popped following bullish inventory data that showed a lower-than-anticipated build. It continued to move higher for the remainder of floor trade, settling 14.7% higher at its session high of $2.50 per MMBtu.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Buster

TSP Talk Royalty

- Reaction score

- 109

This $1.00 or $2.00/bbl price rise STILL doesn't justify a .15 to .16 cent increase at the pumps..WTF!..How bad do these G.D. oil companies want to screw the average car driver? and everything else tied to fuel prices? ..The $3.30/gal was there when Oil was over $100.00/bbl..nothing justifies theses gas prices when oil is around $84.00/bbl....this is total BS!!!

Buster

TSP Talk Royalty

- Reaction score

- 109

You're preaching to the Choir Buster. CROOKS!:nuts:

I know..sorry, I was just venting..:embarrest:

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

OKEDOKEY I do that all of the time!:laugh:I know..sorry, I was just venting..:embarrest:

Mcqlives

Market Veteran

- Reaction score

- 24

This $1.00 or $2.00/bbl price rise STILL doesn't justify a .15 to .16 cent increase at the pumps..WTF!..How bad do these G.D. oil companies want to screw the average car driver? and everything else tied to fuel prices? ..The $3.30/gal was there when Oil was over $100.00/bbl..nothing justifies theses gas prices when oil is around $84.00/bbl....this is total BS!!!

How does this sound for a justification?...The summer blend is harder to process and the natural gas creates a competitive environment which, during the extraction of helium, increases the demand for coal based energy products. All of these things cause the government to invest in green energy companies that will go bankrupt, thus sustaining higher fuel prices.:nuts:

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Yeah! What he said!How does this sound for a justification?...The summer blend is harder to process and the natural gas creates a competitive environment which, during the extraction of helium, increases the demand for coal based energy products. All of these things cause the government to invest in green energy companies that will go bankrupt, thus sustaining higher fuel prices.:nuts:

Buster

TSP Talk Royalty

- Reaction score

- 109

Report: Don't worry much about quakes and fracking

The controversial practice of hydraulic fracturing to extract natural gas does not pose a high risk for triggering earthquakes large enough to feel, but other types of energy-related drilling can make the ground noticeably shake, a major government science report concludes.Even those man-made tremors large enough to be an issue are very rare, says a special report by the National Research Council. In more than 90 years of monitoring, human activity has been shown to trigger only 154 quakes, most of them moderate or small, and only 60 of them in the United States. That's compared to a global average of about 14,450 earthquakes of magnitude 4.0 or greater every year, said the report, released Friday.

Report: Don't worry much about quakes and fracking - Yahoo! News

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Pipe Baby Pipe!:nuts:

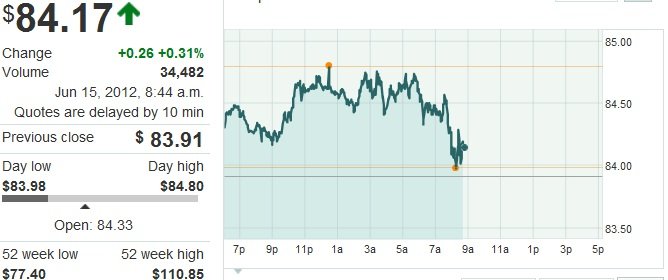

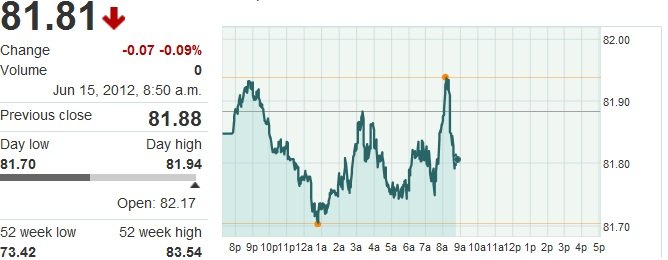

Oil Prices Keep Falling, But a Strange Gap Persists

By Matthew Philips on June 15, 2012

Oil Prices Keep Falling, But a Strange Gap Persists

By Matthew Philips on June 15, 2012

Oil Prices Keep Falling, But a Strange Gap Persists - BusinessweekOil prices are down more than 20 percent since mid-March. Yet that hasn’t erased a strange anomaly in the market: the gap between two essentially identical types of oil. North American light, sweet crude, also known as West Texas Intermediate, trades just below $84 while its international equivalent, known as Brent, is priced at $97.

Why would two similar products sell for such different prices? The problem is getting hold of WTI and connecting supply with demand. The gusher of new domestic oil production coming out of shale deposits in North Dakota, Texas, and Oklahoma has outstripped the country’s pipeline capacity to move it around. The result is a supply glut that has built up in the middle of the country, lowering the price of WTI. Refineries along the Gulf Coast would love to get their hands on more cheap domestic crude, but they can’t simply call an oil supplier and have a load of cheaper WTI delivered whenever they want. While pipeline projects to solve the problem are just getting underway, there’s still no easy way to get large quantities of WTI down to the country’s refining hub along the Gulf Coast. So refiners remain trapped, forced to keep taking more expensive imported oil.