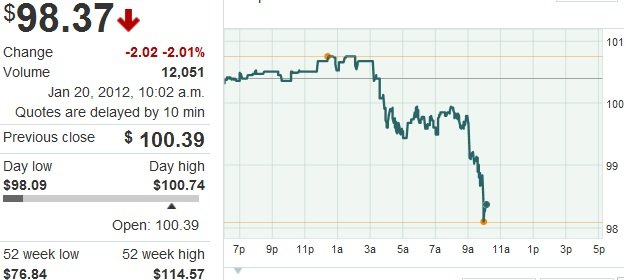

I am NOT happy about that my friend but I am Happy about this!:suspicious:

Jan. 18, 2012, 12:01 a.m. EST

Oil and gas acquisition targets

By Kirk Spano

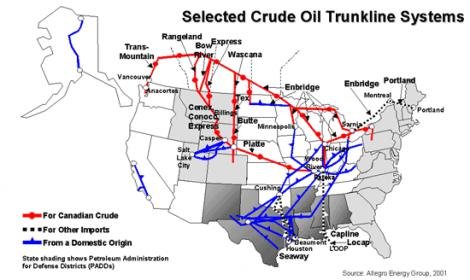

As discussed last week, improvements in hydraulic fracturing has led to vast opportunities for

oil and gas service companies that can stay on the right side of the EPA. As most readers know, fracking is also providing significant growth for many oil and gas exploration and production companies in America. This rapid growth is now also creating the circumstances for increased mergers and acquisition activity.

Among the fastest growing oil and gas companies and those with the biggest potential are those involved with the Bakken and Three Forks formations in the Williston Basin of North Dakota and to a lesser extent Montana. North Dakota's rich reserves and friendly attitude towards drillers makes it a prime place for oil and gas production. As of last month North Dakota drillers reached

500,000 barrels of oil (and equivalents) per day of production. That curve, presuming no outright shut down of fracking by the Federal Government,

appears likely to hit 1,000,000 barrels per day within a few years.

http://www.marketwatch.com/story/oil-and-gas-acquisition-targets-2012-01-18

http://www.marketwatch.com/story/obama-administration-to-reject-keystone-pipeline-2012-01-18?link=MW_latest_news