It almost seems a given at this point that oil will continue its march higher in the face of unrest across the Middle East and North Africa. And today was no exception as oil managed to hit a fresh two-year closing high.

But the market did manage to post some modest gains in spite of the upward pressure on oil. And we might have had bigger gains if wasn't for a report that Libyan fighter jets fired on the oil terminal city of Masra El Brega. Those kind of headlines are only going to roil the markets and it would seem likely that we'll see more news reports like this as we move forward.

In market data, the ADP Employment Change report showed that February's private payrolls jumped by 217,000, which was significantly higher than the 163,000 that was expected.

Also released today was the Fed's latest Beige Book, which basically said that wage pressures remain steady, even though overall economic activity improved.

But market data has largely been ignored of late as geopolitical concerns have trumped economic reports, good or bad.

Here's today's charts:

A bit of improvement today for NAMO and NYMO. NAMO is still on a sell, while NYMO is sitting right on its trigger point.

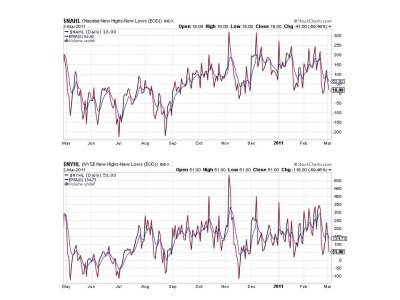

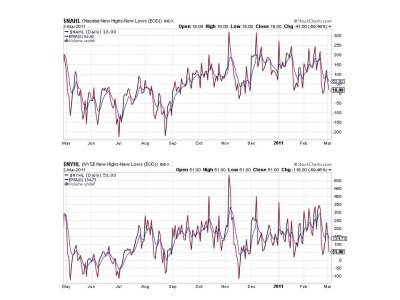

NAHL and NYHL fell lower today and remain on sells.

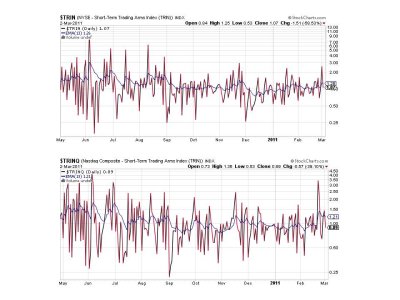

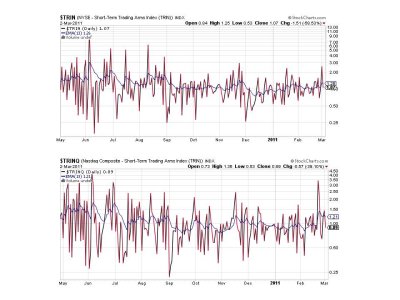

TRIN and TRINQ managed to flip back to buys.

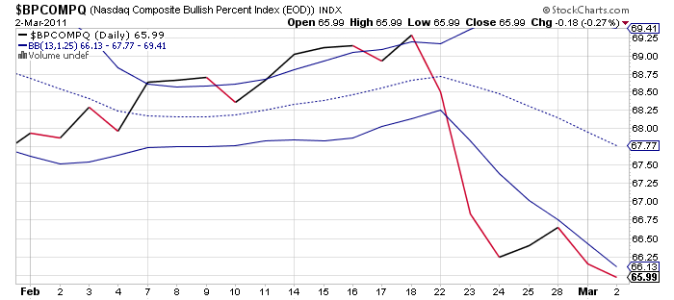

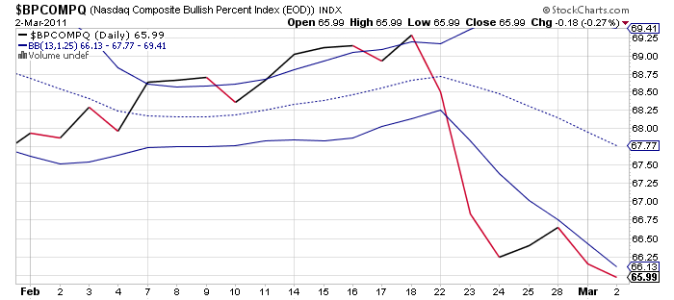

BPCOMPQ dropped lower and remains on a sell. This signal in particular is not looking bullish. In fact, five of the last seven trading days have been negative here, but overall damage has been somewhat contained. Still, this is a trend indicator and I don't like what I'm seeing.

So the system remains on a buy, but the market is under pressure and could go either way over the coming days. I believe the longer term is still up, but it wouldn't take a lot more damage to get a confirmed sell signal out of the Seven Sentinels. If the situation in the oil producing nations stabilizes, the picture may improve quickly, but I doubt the unrest will calm down anytime soon. There are a lot of moving parts now and we can never be sure when a major geopolitical event might occur. The potential is certainly there.

But the market did manage to post some modest gains in spite of the upward pressure on oil. And we might have had bigger gains if wasn't for a report that Libyan fighter jets fired on the oil terminal city of Masra El Brega. Those kind of headlines are only going to roil the markets and it would seem likely that we'll see more news reports like this as we move forward.

In market data, the ADP Employment Change report showed that February's private payrolls jumped by 217,000, which was significantly higher than the 163,000 that was expected.

Also released today was the Fed's latest Beige Book, which basically said that wage pressures remain steady, even though overall economic activity improved.

But market data has largely been ignored of late as geopolitical concerns have trumped economic reports, good or bad.

Here's today's charts:

A bit of improvement today for NAMO and NYMO. NAMO is still on a sell, while NYMO is sitting right on its trigger point.

NAHL and NYHL fell lower today and remain on sells.

TRIN and TRINQ managed to flip back to buys.

BPCOMPQ dropped lower and remains on a sell. This signal in particular is not looking bullish. In fact, five of the last seven trading days have been negative here, but overall damage has been somewhat contained. Still, this is a trend indicator and I don't like what I'm seeing.

So the system remains on a buy, but the market is under pressure and could go either way over the coming days. I believe the longer term is still up, but it wouldn't take a lot more damage to get a confirmed sell signal out of the Seven Sentinels. If the situation in the oil producing nations stabilizes, the picture may improve quickly, but I doubt the unrest will calm down anytime soon. There are a lot of moving parts now and we can never be sure when a major geopolitical event might occur. The potential is certainly there.