The market gave up some of its impressive gains today, but October was still a huge month for the bulls, with the S&P 500 finishing the month with a gain of almost 11%.

The sell-off began overseas as the elation over the agreements reached last week at the EU Summit wore off. Some of the bourses saw losses of more than 3% on the day.

And the dollar soared in response as the I fund realized a loss of 5.19% by the close.

Here's today's charts:

NAMO and NYMO have been bouncing around in positive territory for most of October, but I doubt November will be as bullish. Not that we can't rally, but I suspect we have some downside work to do soon. Today may have begun that process. Both signals are in a sell condition at the moment and possibly poised to move lower.

NAHL and NYHL are also in sell conditions.

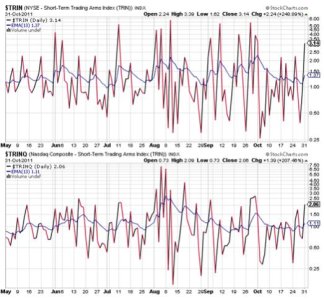

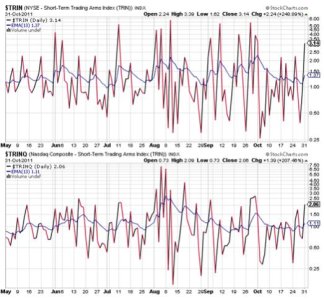

TRIN and TRINQ spiked higher on today's sell off, but are suggesting moderately oversold conditions overall. We could get a bounce tomorrow on these readings, but will it hold?

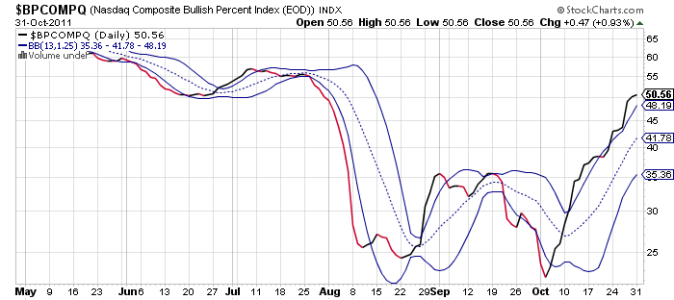

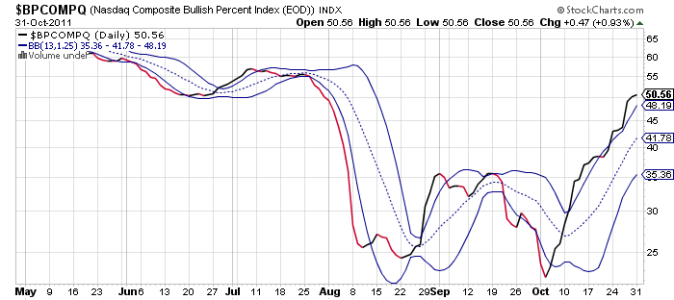

BPCOMPQ leveled off a bit, but remained in a buy status.

So all but one signals (BPCOMPQ) are in a sell condition, but the system remains on a buy.

Obviously, we could be turning lower after today's action. The bears largely capitulated last week and bullish levels are rising. That's a prescription for weakness in the short term, but further out we could still see this market move to higher levels as we approach the holidays. I am wary of the "expectation" for higher prices later in the quarter, however. For this reason, and in spite of the bullish looking charts, I plan to remain conservative in my approach.

The sell-off began overseas as the elation over the agreements reached last week at the EU Summit wore off. Some of the bourses saw losses of more than 3% on the day.

And the dollar soared in response as the I fund realized a loss of 5.19% by the close.

Here's today's charts:

NAMO and NYMO have been bouncing around in positive territory for most of October, but I doubt November will be as bullish. Not that we can't rally, but I suspect we have some downside work to do soon. Today may have begun that process. Both signals are in a sell condition at the moment and possibly poised to move lower.

NAHL and NYHL are also in sell conditions.

TRIN and TRINQ spiked higher on today's sell off, but are suggesting moderately oversold conditions overall. We could get a bounce tomorrow on these readings, but will it hold?

BPCOMPQ leveled off a bit, but remained in a buy status.

So all but one signals (BPCOMPQ) are in a sell condition, but the system remains on a buy.

Obviously, we could be turning lower after today's action. The bears largely capitulated last week and bullish levels are rising. That's a prescription for weakness in the short term, but further out we could still see this market move to higher levels as we approach the holidays. I am wary of the "expectation" for higher prices later in the quarter, however. For this reason, and in spite of the bullish looking charts, I plan to remain conservative in my approach.