Now it's ugly. Yesterday I felt that although the seven sentinels issued a sell signal, we were due for some moderate trading, if not a rally. I'd seen this setup before and wanted to give the market a bit more time before I threw in the towel, but the charts are not looking good at all. The underlying bullishness that's been so steady for the last 8 months is starting to appear as though it's disappeared.

Normally I would have sold my position today after yesterday's SS sell signal, but I'd given the market one more day to prove itself. Tomorrow morning is make or break time as I won't hold on any longer without some solid buying taking hold on volume. It is time to get defensive, even if only partially for those who are still bullish. But this is beginning to feel like a slope of hope.

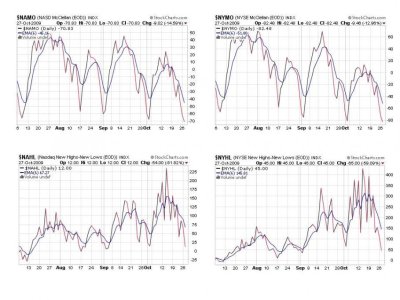

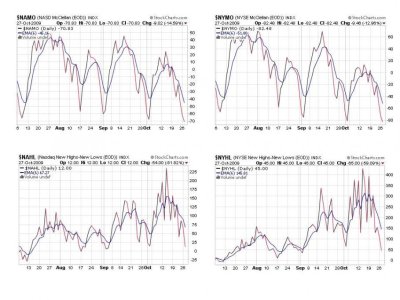

Here's the charts:

All four are now as low as we've seen them in the past few months. The intermediate does appear to be under attack at this point.

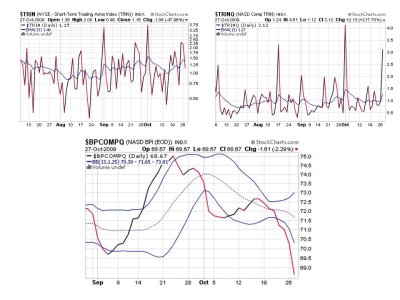

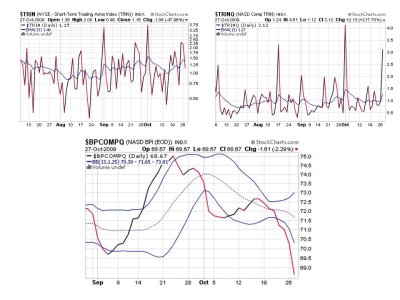

TRIN flashed a buy, but TRINQ spiked higher. BPCOMPQ is beginning to pick up momentum. That had me worried yesterday and today it followed through.

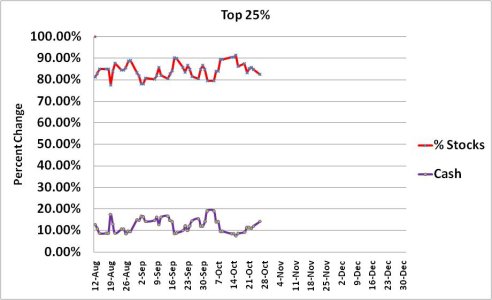

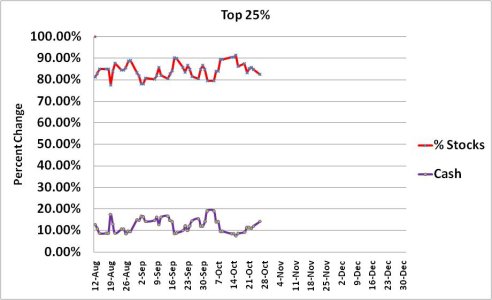

As I posted in my account thread this morning, we can see our top 25% are still solidly bullish as of the opening bell today.

So there you have it. We are oversold and ready for a rally, but the intermediate term does not look good. The SS is now on a sell as of yesterday with follow-through today. I expect to begin taking some chips off the table tomorrow, but I may decide to hold some stocks in case we do turn. This is the last week of October so Monday we have some new IFTs to get reinvested with if this market decides to turn back up again.

I had hoped to see a better day from the bulls today, even if it was modest, but that was not the case. We could get it tomorrow, but I'll be looking to sell into any rally in any event.

It also appears that there is rotation from small caps to large caps as the S&P fared much better than the Wilshire today. That is something to watch moving forward.

Normally I would have sold my position today after yesterday's SS sell signal, but I'd given the market one more day to prove itself. Tomorrow morning is make or break time as I won't hold on any longer without some solid buying taking hold on volume. It is time to get defensive, even if only partially for those who are still bullish. But this is beginning to feel like a slope of hope.

Here's the charts:

All four are now as low as we've seen them in the past few months. The intermediate does appear to be under attack at this point.

TRIN flashed a buy, but TRINQ spiked higher. BPCOMPQ is beginning to pick up momentum. That had me worried yesterday and today it followed through.

As I posted in my account thread this morning, we can see our top 25% are still solidly bullish as of the opening bell today.

So there you have it. We are oversold and ready for a rally, but the intermediate term does not look good. The SS is now on a sell as of yesterday with follow-through today. I expect to begin taking some chips off the table tomorrow, but I may decide to hold some stocks in case we do turn. This is the last week of October so Monday we have some new IFTs to get reinvested with if this market decides to turn back up again.

I had hoped to see a better day from the bulls today, even if it was modest, but that was not the case. We could get it tomorrow, but I'll be looking to sell into any rally in any event.

It also appears that there is rotation from small caps to large caps as the S&P fared much better than the Wilshire today. That is something to watch moving forward.