Price wise I should be optimistic; but after Friday's unemployment numbers & watching the health care bill pass through the house, I'm dreading how the market might react once the dust settles.

The good news is the S&P 500 put in a perceived higher swing low at 1029.38 and retraced over 50% from the previous 1101.36 swing high.

Yet still I believe there are some pretty good reasons to stay on your Bearish guard.

For instance while on the weekly chart we did climb back into the rising wedge, we still haven't closed above overhead resistance from Oct 2007's peak descending red trendine.

On the monthly chart I've drawn in a rising price channel and we can see we closed right at the channel. Can we break though it?

On Friday the S&P 500 closed with 235 (47%) of their stocks above the 20 day simple moving average. Is this supposed to be Bullish? I actually don't know the answer to this question if you have an opinion feel free to chime in.

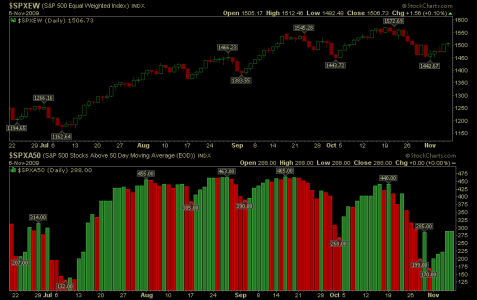

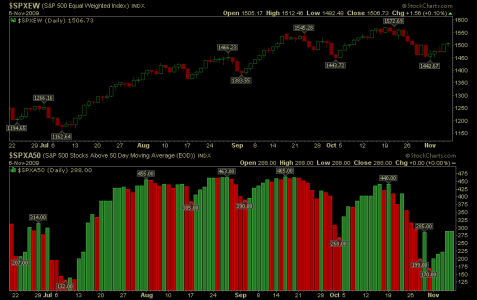

The top chart below is the S&P 500 Equal weighted chart. This shows the price action when you equally weigh all 500 stocks. I just wanted to point out this chart made a lower swing low in October. Following $SPXEW are the number of stocks above their 50, 150, & 200 day moving average or $SPXA50, $SPXA150, & $SPXA200.

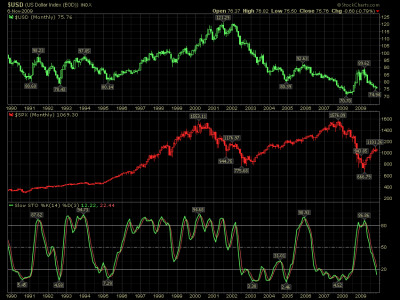

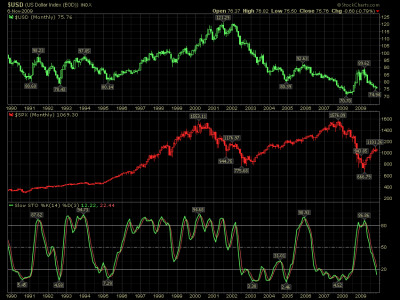

As for the Dollar here is a 20 year monthly chart with the S&P 500 below to provide us a frame of reference. In case you haven't noticed, in October the Slow Stochastic turned below 20.

My long-term-trending system I've affectionately dubbed the "Axial Drifter" remains on a buy. However, it's a weak buy so I'm watching it closely. Of my 9 indicators, S3 is flashing a sell for the 5th consecutive day. Going back to 2006 S3 has not given a false ghosting signal. Out of the previous full blown "make an exit" sell signals, S3 lead the way 2.5 out of 5 times.

Have a great week and take care... JTH

The good news is the S&P 500 put in a perceived higher swing low at 1029.38 and retraced over 50% from the previous 1101.36 swing high.

Yet still I believe there are some pretty good reasons to stay on your Bearish guard.

For instance while on the weekly chart we did climb back into the rising wedge, we still haven't closed above overhead resistance from Oct 2007's peak descending red trendine.

On the monthly chart I've drawn in a rising price channel and we can see we closed right at the channel. Can we break though it?

On Friday the S&P 500 closed with 235 (47%) of their stocks above the 20 day simple moving average. Is this supposed to be Bullish? I actually don't know the answer to this question if you have an opinion feel free to chime in.

The top chart below is the S&P 500 Equal weighted chart. This shows the price action when you equally weigh all 500 stocks. I just wanted to point out this chart made a lower swing low in October. Following $SPXEW are the number of stocks above their 50, 150, & 200 day moving average or $SPXA50, $SPXA150, & $SPXA200.

As for the Dollar here is a 20 year monthly chart with the S&P 500 below to provide us a frame of reference. In case you haven't noticed, in October the Slow Stochastic turned below 20.

My long-term-trending system I've affectionately dubbed the "Axial Drifter" remains on a buy. However, it's a weak buy so I'm watching it closely. Of my 9 indicators, S3 is flashing a sell for the 5th consecutive day. Going back to 2006 S3 has not given a false ghosting signal. Out of the previous full blown "make an exit" sell signals, S3 lead the way 2.5 out of 5 times.

Have a great week and take care... JTH