02/03/26

It wasn't looking good heading into Monday morning, but stocks caught a bid when the opening bell rang and trading began in the new month yesterday. The Dow gained over 500-points, but otherwise it was a more moderate +0.5% kind of day. The stock market stopped the bleeding from last week's selling and with the help from some strong economic data, one of the market leaders was pushed to another new high.

There were plenty of reasons to be nervous coming into this week, and the futures were down sharply on Sunday night giving the bulls a reason to be very concerned. The overnight weakness subsided and while the indices opened on the downside, that tuned out to be the lows of the day.

Silver and gold stabilized so perhaps Friday's crash is done? Bitcoin was in freefall over the weekend, but it bounced back moderately yesterday. Nvidia was down sharply and it is one of the heaviest weighted stocks in many indices, so the market was able to shake that off.

If there is a concern, and this may be getting picky, it is that it is not unusual for the first day of trading in a new month, to be a smoke screen, only to be followed by a move in the opposite direction in the days following. It is a potential Turnaround Tuesday, but what would it be turning around from - last week's pullback, or yesterday's rally?

We got some manufacturing data yesterday and the ISM was above 50 (an indication of growth) for the first time in a year.

That sent yields and the dollar higher, and the plummeting dollar has actually had a nice rebound over the last week, although it is up again some potential resistance in the short-term.

However, as I talked about last week, there is some strong long-term support coming up from 15-year lows, as well as the 200-month moving average. Has the dollar stopped falling? If the economic data can continue to strengthen, that could be the case.

The S&P 500 (C-fund) posted a solid day of gains, and nearly closed at an all time closing high, but it came up 3-points shy, and still has some work to do capture that 7000 level for the first time. The 20-day average continuing to hold is a bullish sign, but without new highs soon, the bears may jump back in the picture.

The market leading Dow Transportation Index certainly appreciated the surprise manufacturing boost as it soared to another new all time high.

While the market likes to throw anything and everything it can at us to get us leaning the wrong way, the bulls remain in charge, and the indices are still climbing that wall of worry.

Google (Alphabet) is scheduled to report after the closing bell on Wednesday, and Amazon on Thursday.

The January jobs report was scheduled to be released this Friday, but the BLS says it could be delayed because of the government shut down.

Additional TSP Fund Charts:

The DWCPF (S-fund) had a nice day but so far it is just retracing some recent losses. It did close back above its 50-day average, which is always good news in a bull market, but the gap hasn't been filled so the bears could have something up their sleeve. A move back above the 2575 area will give the bulls more confidence.

ACWX (I fund) did surprising well despite the big rally in the dollar, although they did short change the I-fund with a 0.10% gain. The trend is strong here with no signs of breaking. It could take a black swan event or some kind of surprise news event to kill this channel. If that channel breaks, the downside could be concerning as support gets thinner down to 68 and 67.

BND (bonds / F-fund) was down as yields rallied yesterday on the ISM data. It remains in its ascending channel where buying the bottom, and selling the top has worked for the bond traders.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

It wasn't looking good heading into Monday morning, but stocks caught a bid when the opening bell rang and trading began in the new month yesterday. The Dow gained over 500-points, but otherwise it was a more moderate +0.5% kind of day. The stock market stopped the bleeding from last week's selling and with the help from some strong economic data, one of the market leaders was pushed to another new high.

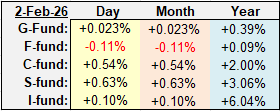

| Daily TSP Funds Return More returns |

There were plenty of reasons to be nervous coming into this week, and the futures were down sharply on Sunday night giving the bulls a reason to be very concerned. The overnight weakness subsided and while the indices opened on the downside, that tuned out to be the lows of the day.

Silver and gold stabilized so perhaps Friday's crash is done? Bitcoin was in freefall over the weekend, but it bounced back moderately yesterday. Nvidia was down sharply and it is one of the heaviest weighted stocks in many indices, so the market was able to shake that off.

If there is a concern, and this may be getting picky, it is that it is not unusual for the first day of trading in a new month, to be a smoke screen, only to be followed by a move in the opposite direction in the days following. It is a potential Turnaround Tuesday, but what would it be turning around from - last week's pullback, or yesterday's rally?

We got some manufacturing data yesterday and the ISM was above 50 (an indication of growth) for the first time in a year.

That sent yields and the dollar higher, and the plummeting dollar has actually had a nice rebound over the last week, although it is up again some potential resistance in the short-term.

However, as I talked about last week, there is some strong long-term support coming up from 15-year lows, as well as the 200-month moving average. Has the dollar stopped falling? If the economic data can continue to strengthen, that could be the case.

The S&P 500 (C-fund) posted a solid day of gains, and nearly closed at an all time closing high, but it came up 3-points shy, and still has some work to do capture that 7000 level for the first time. The 20-day average continuing to hold is a bullish sign, but without new highs soon, the bears may jump back in the picture.

The market leading Dow Transportation Index certainly appreciated the surprise manufacturing boost as it soared to another new all time high.

While the market likes to throw anything and everything it can at us to get us leaning the wrong way, the bulls remain in charge, and the indices are still climbing that wall of worry.

Google (Alphabet) is scheduled to report after the closing bell on Wednesday, and Amazon on Thursday.

The January jobs report was scheduled to be released this Friday, but the BLS says it could be delayed because of the government shut down.

Additional TSP Fund Charts:

The DWCPF (S-fund) had a nice day but so far it is just retracing some recent losses. It did close back above its 50-day average, which is always good news in a bull market, but the gap hasn't been filled so the bears could have something up their sleeve. A move back above the 2575 area will give the bulls more confidence.

ACWX (I fund) did surprising well despite the big rally in the dollar, although they did short change the I-fund with a 0.10% gain. The trend is strong here with no signs of breaking. It could take a black swan event or some kind of surprise news event to kill this channel. If that channel breaks, the downside could be concerning as support gets thinner down to 68 and 67.

BND (bonds / F-fund) was down as yields rallied yesterday on the ISM data. It remains in its ascending channel where buying the bottom, and selling the top has worked for the bond traders.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.