02/12/26

Stocks popped higher after the release of the jobs report, which easily beat estimates, but within minutes the indices peaked, rolled over, and ended the day mostly lower or flat. The big three indices were basically flat, but it was a tumultuous day with stocks trading in a wide range despite the flat close. The I-fund was in its own bullish world and tacked on another big gain.

The 130,000 jobs created in January nearly doubled the estimates, and the unemployment rate ticked down to 4.3%. The index futures immediately shot higher and we had a strong open, but things quickly reversed and fell hard in the first hour of trading.

These are the intraday charts for Wednesday's action showing the gap up open, the failure, and a grind back to break even - or at least a move off the lows.

The pop and drop was even more dramatic on the S-fund's DWCPF Index, which did experience a loss.

The reason for the concern was the strong job report data did change the outlook on interest rates for the year, although nothing major. The chances of seeing more than two rate cuts this year has decreased while the chance of no cut, just one cut, or two, all went up slightly.

The 10-Year Treasury Yield rallied early, but moved counter to the stock market as the peak came right at the 200-day average before the yield flipped back over. It closed up on the day giving the F-fund a loss (bonds go down when yields go up.)

The S&P 500 (C-fund) did a dance between the October peak and the all time highs yesterday, so it was another failed attempt at a breakout. It was close to being a negative outside reversal day, which would have waved some red flags, but closing flat helped the bulls avoid it. It is still consolidating sideways so the next move, which is taking its sweet time, will likely be a big one, but will it be up or down?

The bearish Wyckoff Distribution pattern is still in the picture so we can't rule out the downside, but a breakout to new highs could take care of that.

The Nasdaq was flat but the Nasdaq 100 large cap tech index was up modestly. However, it stalled again at the 50-day average.

The Dow Transportation Index pushed above 20,000 for the first time before reversing direction and creating a negative reversal day.

We will get the CPI report on Friday.

Holiday Closing: From tsp.gov - "Some financial markets will be closed on Monday, February 16, in observance of Washington's Birthday (President's Day). The Thrift Savings Plan will also be closed. Transactions that would have been processed Monday night (February 16) will be processed Tuesday night (February 17) at Tuesday's closing share prices."

Additional TSP Fund Charts:

The DWCPF (S-fund) was up big at one point yesterday, down big at another, and closed with a moderate loss somewhere in the middle. The reversal off the lows was impressive given the dramatic push lower after the opening bell. But it did close off its highs by quite a bit as well, and it is back below the neckline of that inverted head and shoulders pattern. It may not be a factor, but technically there is an open gap within that red box down toward 2505.

ACWX (I fund) continues to defy gravity. The dollar was up yesterday, but that didn't stop the I-fund from making another new high. It also pushed right through the top of the channel, and now it may look for that old resistance to become support.

BND (bonds / F-fund) was slammed with yields moving up on the strong jobs data, but look where it came to rest. As I mentioned in the I-fund chart above, the old resistance may turn into support.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks popped higher after the release of the jobs report, which easily beat estimates, but within minutes the indices peaked, rolled over, and ended the day mostly lower or flat. The big three indices were basically flat, but it was a tumultuous day with stocks trading in a wide range despite the flat close. The I-fund was in its own bullish world and tacked on another big gain.

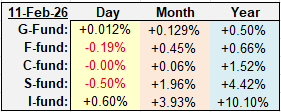

| Daily TSP Funds Return More returns |

The 130,000 jobs created in January nearly doubled the estimates, and the unemployment rate ticked down to 4.3%. The index futures immediately shot higher and we had a strong open, but things quickly reversed and fell hard in the first hour of trading.

These are the intraday charts for Wednesday's action showing the gap up open, the failure, and a grind back to break even - or at least a move off the lows.

The pop and drop was even more dramatic on the S-fund's DWCPF Index, which did experience a loss.

The reason for the concern was the strong job report data did change the outlook on interest rates for the year, although nothing major. The chances of seeing more than two rate cuts this year has decreased while the chance of no cut, just one cut, or two, all went up slightly.

The 10-Year Treasury Yield rallied early, but moved counter to the stock market as the peak came right at the 200-day average before the yield flipped back over. It closed up on the day giving the F-fund a loss (bonds go down when yields go up.)

The S&P 500 (C-fund) did a dance between the October peak and the all time highs yesterday, so it was another failed attempt at a breakout. It was close to being a negative outside reversal day, which would have waved some red flags, but closing flat helped the bulls avoid it. It is still consolidating sideways so the next move, which is taking its sweet time, will likely be a big one, but will it be up or down?

The bearish Wyckoff Distribution pattern is still in the picture so we can't rule out the downside, but a breakout to new highs could take care of that.

The Nasdaq was flat but the Nasdaq 100 large cap tech index was up modestly. However, it stalled again at the 50-day average.

The Dow Transportation Index pushed above 20,000 for the first time before reversing direction and creating a negative reversal day.

We will get the CPI report on Friday.

Holiday Closing: From tsp.gov - "Some financial markets will be closed on Monday, February 16, in observance of Washington's Birthday (President's Day). The Thrift Savings Plan will also be closed. Transactions that would have been processed Monday night (February 16) will be processed Tuesday night (February 17) at Tuesday's closing share prices."

Additional TSP Fund Charts:

The DWCPF (S-fund) was up big at one point yesterday, down big at another, and closed with a moderate loss somewhere in the middle. The reversal off the lows was impressive given the dramatic push lower after the opening bell. But it did close off its highs by quite a bit as well, and it is back below the neckline of that inverted head and shoulders pattern. It may not be a factor, but technically there is an open gap within that red box down toward 2505.

ACWX (I fund) continues to defy gravity. The dollar was up yesterday, but that didn't stop the I-fund from making another new high. It also pushed right through the top of the channel, and now it may look for that old resistance to become support.

BND (bonds / F-fund) was slammed with yields moving up on the strong jobs data, but look where it came to rest. As I mentioned in the I-fund chart above, the old resistance may turn into support.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.