Some of the headlines I read very early this morning pointed to the positive bias that futures were showing in our market, and how this was an indication that fears of Egypt falling apart had subsided as that situation didn't get worse over the weekend.

Well, I'm not sure what source of news the authors of those kinds of headlines were getting, but I was immediately struck by the apparent audacity of such a statement. Now as you know I don't trade news or fundamentals, but to say the situation in Egypt didn't get worse over the weekend was to imply that we aren't smart enough to know better. It seemed like an overt attempt to quell any fears that investors and traders may have regardless of reality.

You may or may not agree with me about what I've just said (it is opinion after all), but my Stratfor sources have stated that whatever the outcome in Egypt, it probably won't be trivial.

Enough said.

I was expecting to see some measure of weakness today, even if it came before or after a rally, but we never really had any serious selling pressure the entire trading day. I doubt this is an "all's clear" signal though and a bounce certainly wasn't out of the question either and that was the end result as the major indexes managed to post some decent gains.

Market data released this morning included the December personal income number, which increased 0.4%. That was only a bit below estimates. Personal spending was up 0.7% and that was a bit higher than expectations. Core personal consumption was flat.

The December Chicago PMI posted a 68.8, which was its highest total since 1988.

But market data didn't seem to matter much to the market today as a rally appeared to be in the cards regardless.

Here's today's charts:

Not much to say about NAMO and NYMO today. One is on a buy and one a sell.

NAHL and NYHL are both flashing sells.

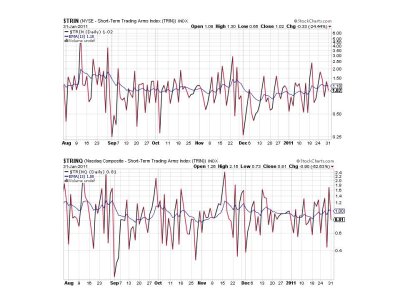

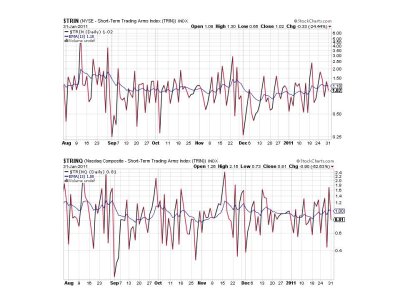

Two buys for TRIN and TRINQ.

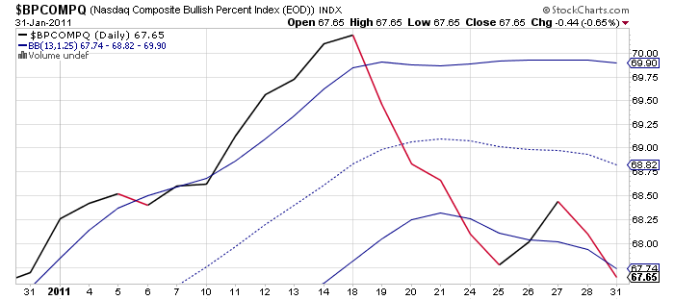

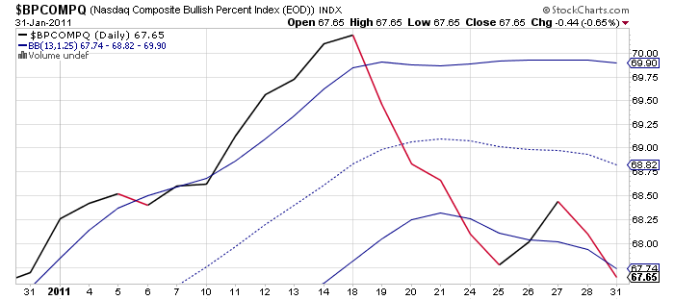

BPCOMPQ dropped back below the lower bollinger band, which triggers a sell condition for this signal. That's notable for the moment as this is trend indicator and that has now issued two sells in a short period of time.

So the system remains on a sell after today's trading. I remain somewhat bearish with this sell signal, but I am not overly bearish as the Fed apparently wants a higher market and continues to deploy QE2. But I have to respect my signals, and for now they are on a sell.

Tomorrow we get fresh IFTs, which makes me more comfortable knowing I can now redeploy capital into the markets if I get another buy signal from the sentinels.

Well, I'm not sure what source of news the authors of those kinds of headlines were getting, but I was immediately struck by the apparent audacity of such a statement. Now as you know I don't trade news or fundamentals, but to say the situation in Egypt didn't get worse over the weekend was to imply that we aren't smart enough to know better. It seemed like an overt attempt to quell any fears that investors and traders may have regardless of reality.

You may or may not agree with me about what I've just said (it is opinion after all), but my Stratfor sources have stated that whatever the outcome in Egypt, it probably won't be trivial.

Enough said.

I was expecting to see some measure of weakness today, even if it came before or after a rally, but we never really had any serious selling pressure the entire trading day. I doubt this is an "all's clear" signal though and a bounce certainly wasn't out of the question either and that was the end result as the major indexes managed to post some decent gains.

Market data released this morning included the December personal income number, which increased 0.4%. That was only a bit below estimates. Personal spending was up 0.7% and that was a bit higher than expectations. Core personal consumption was flat.

The December Chicago PMI posted a 68.8, which was its highest total since 1988.

But market data didn't seem to matter much to the market today as a rally appeared to be in the cards regardless.

Here's today's charts:

Not much to say about NAMO and NYMO today. One is on a buy and one a sell.

NAHL and NYHL are both flashing sells.

Two buys for TRIN and TRINQ.

BPCOMPQ dropped back below the lower bollinger band, which triggers a sell condition for this signal. That's notable for the moment as this is trend indicator and that has now issued two sells in a short period of time.

So the system remains on a sell after today's trading. I remain somewhat bearish with this sell signal, but I am not overly bearish as the Fed apparently wants a higher market and continues to deploy QE2. But I have to respect my signals, and for now they are on a sell.

Tomorrow we get fresh IFTs, which makes me more comfortable knowing I can now redeploy capital into the markets if I get another buy signal from the sentinels.