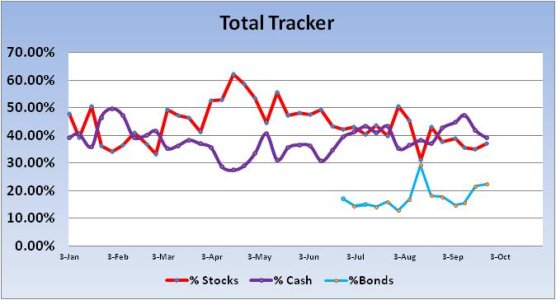

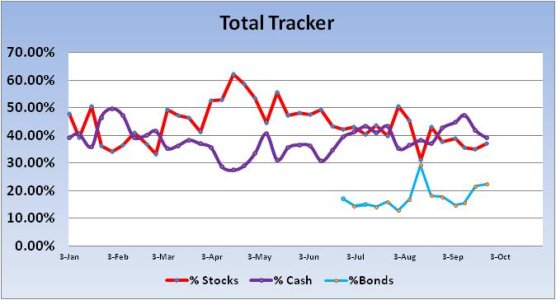

With respect to TSP allocations across our tracker, I don't have data going back nearly as far I'd like. But I do have 122 weeks of information, which is about 2 years and 3 months worth of data. And as I was putting this blog together, I was wondering what the lowest amount of stock exposure was in any given week for the entire tracker during the course of those 122 weeks. And I found that just last month during the week of 13 August we had our lowest collective stock exposure, which was just 31.08%. And during the course of those 122 weeks there were only 12 weeks in which our collective stock exposure was in the 30's. And of those 12 weeks, 7 of them have been over the course of the last 10 weeks.

When looking at this information week to week, we need to realize that at some point we are about as low as we can go because there will always be those who maintain some level of exposure to stocks. I'm not saying there's anything wrong with that, because there isn't. But knowing this we can get a sense of just how bearish we are as a group. And this data says we're pretty darn bearish.

And why shouldn't we be?

While I don't want to get into a debate, many of us do not believe the economy is getting better. The unemployment data certainly suggests that our economy is not getting much traction. And now the Fed is deploying QE3. Will that work any better than QE1 or QE2? And what about the fiscal cliff looming shortly after the election? What about the Bush tax cuts that are set to expire at the end of the year? What about the continuing crises in the European Union? Or the tension in the Middle East? Even the election itself is causing trepidation as businesses just don't know what to expect from law makers moving forward. These are all pretty good reasons for folks to get bearish by themselves, but collectively these issues can make it real difficult to take more risk with our financial portfolio.

Now generally speaking and from a historical perspective, the higher bearish sentiment rises, the more likely it is for the stock market to move higher. But I have to wonder if we, as main street investors, have become largely irrelevant. Main street investors don't seem to be particularly interested in the stock market these days for even more reasons than I've already mentioned. Bonds have been telling us this for quite some time. Can this market really continue to levitate in spite of all the negatives?

These are my thoughts this weekend. It it a bit of a departure from my usual blog these days, but seeing how our low stock allocations are becoming a trend I felt compelled to consider why.

Here's this week's charts:

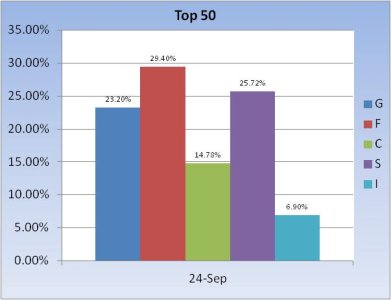

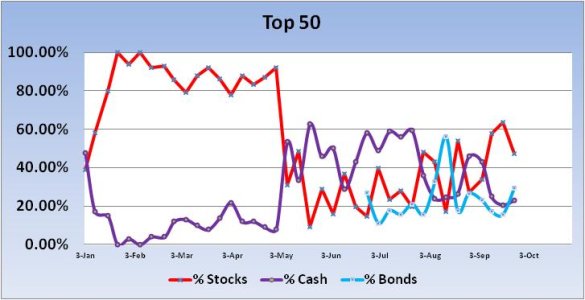

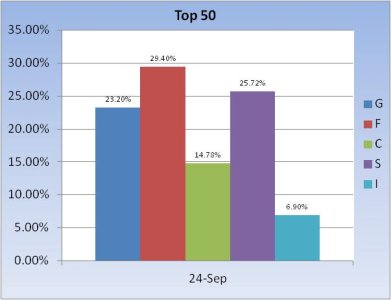

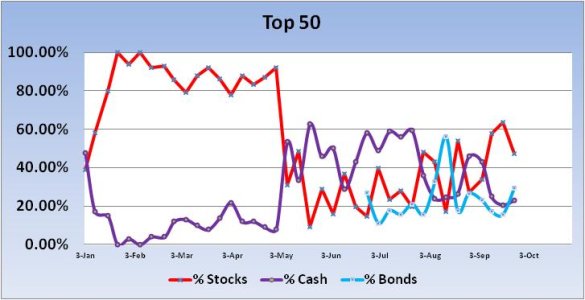

The Top 50 had a modest increase in stock allocations last week (5.84%) to a total stock allocation of 63.8%, but the market ended down for the week. Remember, this group has been wrong about 75% of the time on a week over week basis this year.

This week, they've dropped their collective stock exposure by 16.4% for a total allocation of 47.4%. This suggests we'll see some buying pressure during the course of next week. Perhaps even enough for a weekly gain.

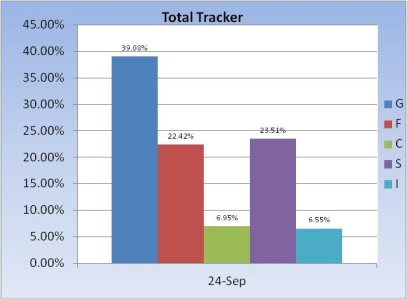

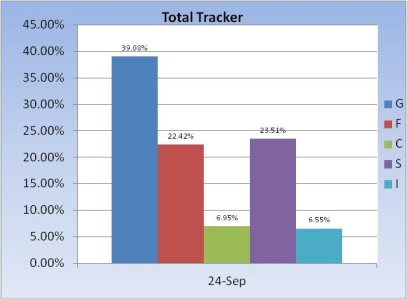

The Total Tracker had a modest in increase in stock exposure for the new week as TSPers hiked stock allocations by 2.05% to a total stock allocation of 37.01%. As I mentioned above, that remains a bearish reading in my eyes.

No surprise that our sentiment survey remained on a buy for next week. In fact, there's only been two weeks this year in which the survey went to a sell condition.

I'm expecting volatile action next week. OPEX is over and the technicals suggest weakness, but sentiment will probably keep some measure of a floor under this market. And then there's all that liquidity too.

When looking at this information week to week, we need to realize that at some point we are about as low as we can go because there will always be those who maintain some level of exposure to stocks. I'm not saying there's anything wrong with that, because there isn't. But knowing this we can get a sense of just how bearish we are as a group. And this data says we're pretty darn bearish.

And why shouldn't we be?

While I don't want to get into a debate, many of us do not believe the economy is getting better. The unemployment data certainly suggests that our economy is not getting much traction. And now the Fed is deploying QE3. Will that work any better than QE1 or QE2? And what about the fiscal cliff looming shortly after the election? What about the Bush tax cuts that are set to expire at the end of the year? What about the continuing crises in the European Union? Or the tension in the Middle East? Even the election itself is causing trepidation as businesses just don't know what to expect from law makers moving forward. These are all pretty good reasons for folks to get bearish by themselves, but collectively these issues can make it real difficult to take more risk with our financial portfolio.

Now generally speaking and from a historical perspective, the higher bearish sentiment rises, the more likely it is for the stock market to move higher. But I have to wonder if we, as main street investors, have become largely irrelevant. Main street investors don't seem to be particularly interested in the stock market these days for even more reasons than I've already mentioned. Bonds have been telling us this for quite some time. Can this market really continue to levitate in spite of all the negatives?

These are my thoughts this weekend. It it a bit of a departure from my usual blog these days, but seeing how our low stock allocations are becoming a trend I felt compelled to consider why.

Here's this week's charts:

The Top 50 had a modest increase in stock allocations last week (5.84%) to a total stock allocation of 63.8%, but the market ended down for the week. Remember, this group has been wrong about 75% of the time on a week over week basis this year.

This week, they've dropped their collective stock exposure by 16.4% for a total allocation of 47.4%. This suggests we'll see some buying pressure during the course of next week. Perhaps even enough for a weekly gain.

The Total Tracker had a modest in increase in stock exposure for the new week as TSPers hiked stock allocations by 2.05% to a total stock allocation of 37.01%. As I mentioned above, that remains a bearish reading in my eyes.

No surprise that our sentiment survey remained on a buy for next week. In fact, there's only been two weeks this year in which the survey went to a sell condition.

I'm expecting volatile action next week. OPEX is over and the technicals suggest weakness, but sentiment will probably keep some measure of a floor under this market. And then there's all that liquidity too.