It was a pretty thin week as economic reports go. But the market continued its climb regardless of a lack of catalysts. I suppose we could attribute it to momentum if nothing else. In spite of the fact that we've come a long way in a short period of time, I don't think we see any significant selling pressure for at least another week, and maybe not till early April. OPEX is next week and that should keep a bid under the market. We are also approaching the end of the 1st quarter so some window dressing may be in order. But again, after the run-up we've seen many traders may elect to close out the quarter early and not push their luck. Time will tell. To the charts:

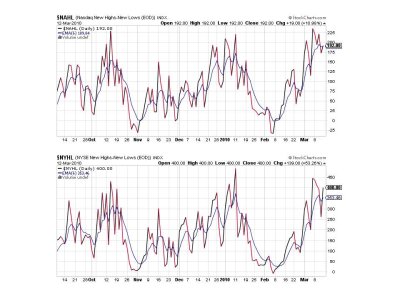

Are we seeing some topping action here? Perhaps, but there's a very good chance the first serious dip gets bought.

More topping action? Maybe short term.

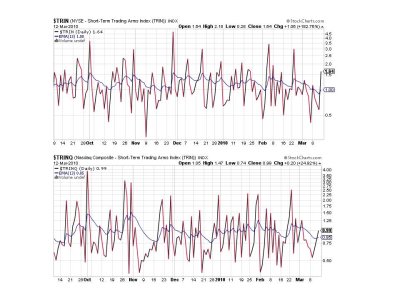

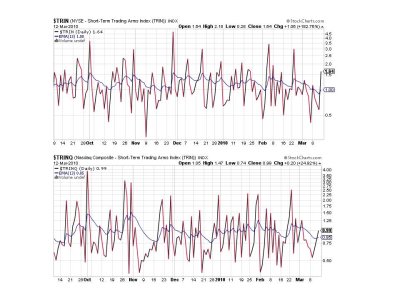

Both have flipped to sells here.

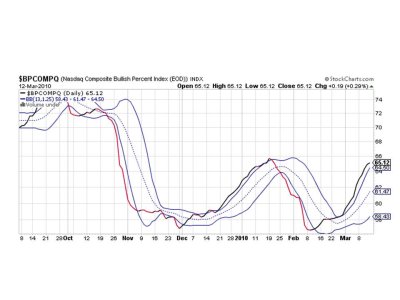

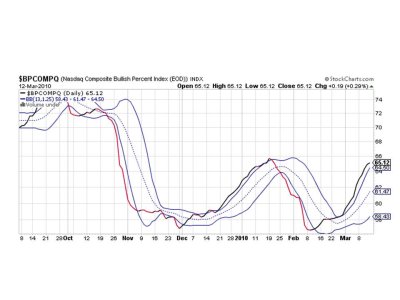

Still rising, but maybe getting ready to move sideways for a bit? Too early to really tell at this point.

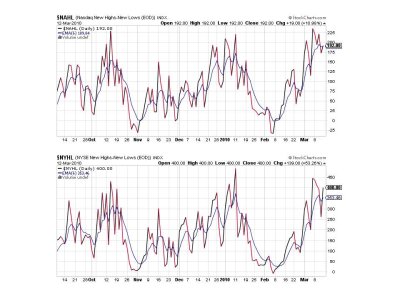

So we have 4 of 7 signals on a sell, but the system remains on a buy until all 7 signals roll over to a sell at the same time. Looking at the signals I don't get the impression that's going to happen just yet. However, having said that I think most of this up-leg is now behind us, so I wouldn't expect more than a few more percentage point gains before we head back down again.

I'll post Top 15 and Top 50 charts tomorrow. See you then.

Are we seeing some topping action here? Perhaps, but there's a very good chance the first serious dip gets bought.

More topping action? Maybe short term.

Both have flipped to sells here.

Still rising, but maybe getting ready to move sideways for a bit? Too early to really tell at this point.

So we have 4 of 7 signals on a sell, but the system remains on a buy until all 7 signals roll over to a sell at the same time. Looking at the signals I don't get the impression that's going to happen just yet. However, having said that I think most of this up-leg is now behind us, so I wouldn't expect more than a few more percentage point gains before we head back down again.

I'll post Top 15 and Top 50 charts tomorrow. See you then.