Another lackluster trading session, but another gain for the S&P, albeit a modest one. The character of this market does not seem to be the same one we had last year. We seem to be in a melt up trend with very little downside action. The Seven Sentinels have been on a buy longer than than they have been in quite some time. That's good news. The system was designed to be an intermediate term indicator, but that's now how it acted last year.

But it's still very early in the year and anything can happen. Here's today's charts:

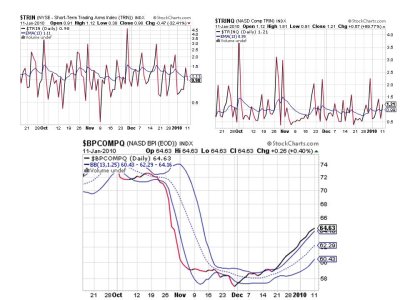

NAMO flipped to a sell today, but the other three signals remained on a buy. In fact we can see NAHL and NYHL are hitting some peaks after today.

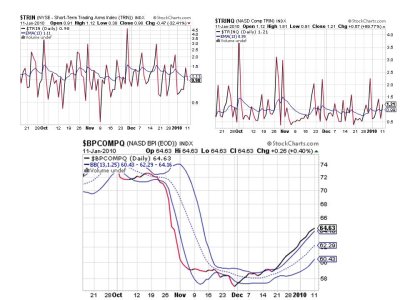

TRIN went to a sell here while TRINQ and BPCOMPQ remain on a buy.

So 5 of 7 signals remain on a buy keeping the system on a buy. What's not to like? I cannot find anything particularly bearish in these charts and as I'd mentioned earlier, market character has seemed to change. Downside action is very limited and lately only happens intraday. So if you're in stocks, hold your position. If you're not, you can wait for a better entry point, but keep in mind this market may not give us one for awhile yet.

This is OPEX and OPEX in January has a recent history of being a very red week. Considering today was Monday and it was pretty lackluster given how Monday's have typically traded, maybe some weakness is at hand. But I wouldn't hang my hat on that.

The only other thing I'd like to point out is the G fund appears to be paying out a higher daily percentage than I've seen in quite some time. Nothing dramatic, but it looks like it has started the year at about a 3.5% clip (last year was 2.97%). Just something I noted. See you tomorrow.

But it's still very early in the year and anything can happen. Here's today's charts:

NAMO flipped to a sell today, but the other three signals remained on a buy. In fact we can see NAHL and NYHL are hitting some peaks after today.

TRIN went to a sell here while TRINQ and BPCOMPQ remain on a buy.

So 5 of 7 signals remain on a buy keeping the system on a buy. What's not to like? I cannot find anything particularly bearish in these charts and as I'd mentioned earlier, market character has seemed to change. Downside action is very limited and lately only happens intraday. So if you're in stocks, hold your position. If you're not, you can wait for a better entry point, but keep in mind this market may not give us one for awhile yet.

This is OPEX and OPEX in January has a recent history of being a very red week. Considering today was Monday and it was pretty lackluster given how Monday's have typically traded, maybe some weakness is at hand. But I wouldn't hang my hat on that.

The only other thing I'd like to point out is the G fund appears to be paying out a higher daily percentage than I've seen in quite some time. Nothing dramatic, but it looks like it has started the year at about a 3.5% clip (last year was 2.97%). Just something I noted. See you tomorrow.