It was off to the races right at the open today as the S&P 500 passed the 1200 line almost immediately. The move never wavered as the major averages settled into a tight trading range and closed near their highs. Volume was very good as was breadth.

It appears our gains were led by news that both Europe and China had solid manufacturing data. Comments by the European Central Bank President was also seen as part of the catalyst as support was pledged for the EU financial system. What was odd, and perhaps a bit unsettling, was a report later in the day that indicated U.S. was willing to participate in a rescue fund for Europe.

As you may have noted, treasuries sold off on the news today and the dollar ended its trading down about 0.8%.

Then there was today's domestic market data, which also supported today's move higher. The ADP Employment Change data showed that private payrolls were up 93,000 in November. That was the highest total for that data point in three years.

The November ISM Manufacturing Index dipped modestly to 56.6 after posting an October reading of 56.9.

October construction spending was up 0.7%, which was a tad better than expected.

Third Quarter Nonfarm productivity increased 2.3%, which was just a bit under an anticipated 2.4% increase, but that was hardly going to dent the overall euphoria already generated by overseas markets.

The Sentinels improved quite a bit as a result of today's big move, but they still remain on a sell as the rally wasn't quite enough to trigger a buy. Here's the charts:

Back to buys for NAMO and NYMO.

NAHL and NYHL ramped up significantly and are also on buys.

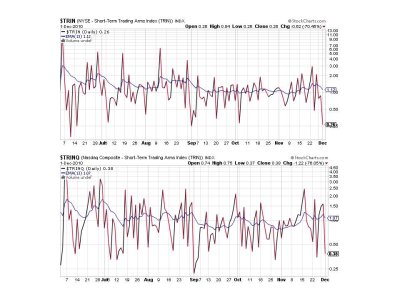

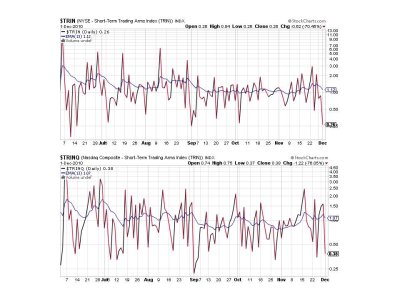

TRIN and TRINQ are both on buys and show overbought conditions. This suggests weakness may follow soon.

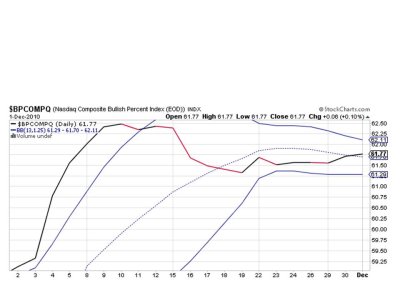

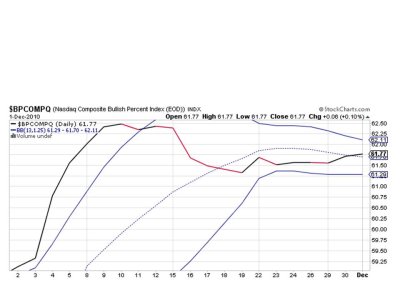

BPCOMPQ remains the lone sell signal and while it did improve a bit, it was a subtle move.

So we now have 6 of 7 signals flashing buys, but the system remains on a sell.

I chose to sell my 30% allocation in stocks today as I did not believe the sentinels would confirm a buy signal. Since they indeed remain on a sell, it may have been a good move. Only time will tell. But I still have another IFT should this market prove today's action was no fluke.

It appears our gains were led by news that both Europe and China had solid manufacturing data. Comments by the European Central Bank President was also seen as part of the catalyst as support was pledged for the EU financial system. What was odd, and perhaps a bit unsettling, was a report later in the day that indicated U.S. was willing to participate in a rescue fund for Europe.

As you may have noted, treasuries sold off on the news today and the dollar ended its trading down about 0.8%.

Then there was today's domestic market data, which also supported today's move higher. The ADP Employment Change data showed that private payrolls were up 93,000 in November. That was the highest total for that data point in three years.

The November ISM Manufacturing Index dipped modestly to 56.6 after posting an October reading of 56.9.

October construction spending was up 0.7%, which was a tad better than expected.

Third Quarter Nonfarm productivity increased 2.3%, which was just a bit under an anticipated 2.4% increase, but that was hardly going to dent the overall euphoria already generated by overseas markets.

The Sentinels improved quite a bit as a result of today's big move, but they still remain on a sell as the rally wasn't quite enough to trigger a buy. Here's the charts:

Back to buys for NAMO and NYMO.

NAHL and NYHL ramped up significantly and are also on buys.

TRIN and TRINQ are both on buys and show overbought conditions. This suggests weakness may follow soon.

BPCOMPQ remains the lone sell signal and while it did improve a bit, it was a subtle move.

So we now have 6 of 7 signals flashing buys, but the system remains on a sell.

I chose to sell my 30% allocation in stocks today as I did not believe the sentinels would confirm a buy signal. Since they indeed remain on a sell, it may have been a good move. Only time will tell. But I still have another IFT should this market prove today's action was no fluke.