Another lackluster day, but at least we closed positive.

There's not a lot to say about this trading environment. We continue to trade in a tight range with no meaningful movement up or down. One thing to be aware of though is sentiment. Our survey is currently showing 62% bulls. If other polls remain bullish as they did last week, we could be in for more sideways trading. At best lighter volume trading may push the indicies higher, but that remains to be seen. The fact is, I don't like the high bullish readings in some surveys. But we aren't selling off the market to shake them loose either.

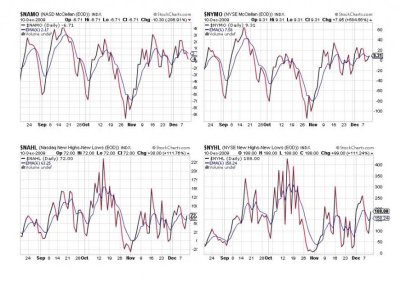

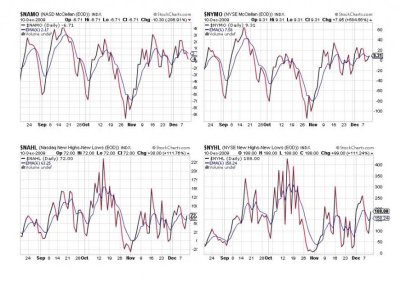

Here's today's charts:

Some improvement here, but no big moves. We have 3 buys and 1 sell.

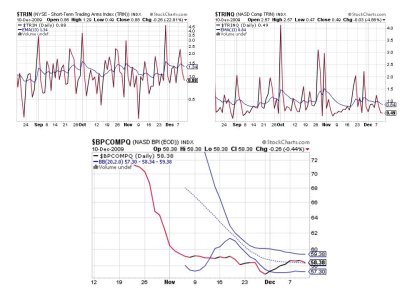

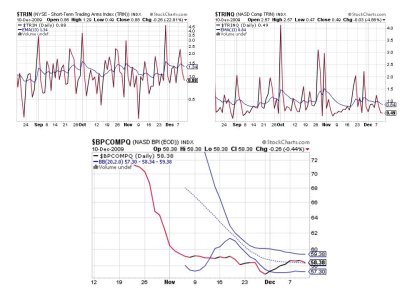

All on a buy here, but BPCOMPQ is no longer inching higher.

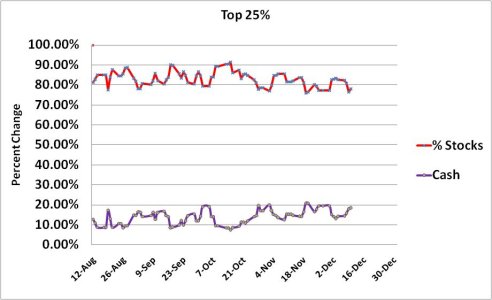

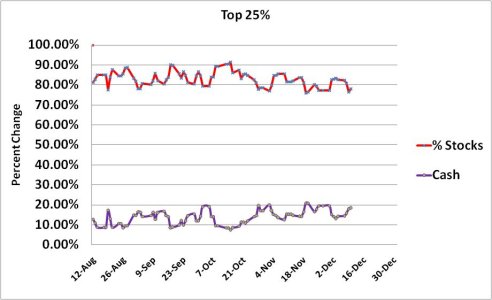

Our Top 25% is holding steady.

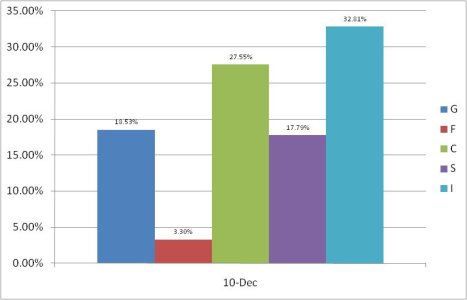

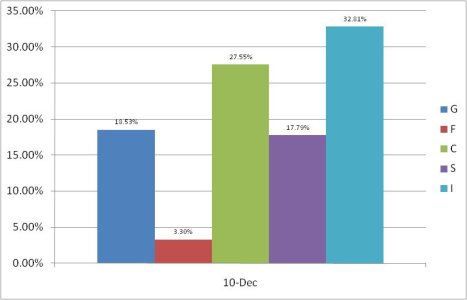

So we have 6 of 7 signals on a buy, but the market is not showing much action. Maybe this will change next week, but with sentiment getting bulled up it may not be the kind of change we want. Unless of course you're in the G fund.

See you tomorrow.

There's not a lot to say about this trading environment. We continue to trade in a tight range with no meaningful movement up or down. One thing to be aware of though is sentiment. Our survey is currently showing 62% bulls. If other polls remain bullish as they did last week, we could be in for more sideways trading. At best lighter volume trading may push the indicies higher, but that remains to be seen. The fact is, I don't like the high bullish readings in some surveys. But we aren't selling off the market to shake them loose either.

Here's today's charts:

Some improvement here, but no big moves. We have 3 buys and 1 sell.

All on a buy here, but BPCOMPQ is no longer inching higher.

Our Top 25% is holding steady.

So we have 6 of 7 signals on a buy, but the market is not showing much action. Maybe this will change next week, but with sentiment getting bulled up it may not be the kind of change we want. Unless of course you're in the G fund.

See you tomorrow.