jpcavin

TSP Legend

- Reaction score

- 97

true. but I am really, really tired of being on the wrong side of the market...

Also, every whip day(up or down) lessens our final returns...

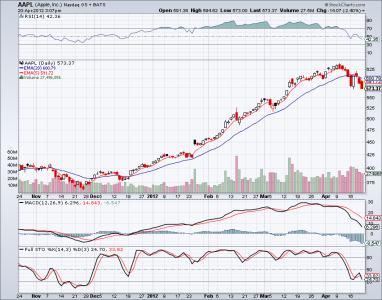

Relax, grasshopper. I am holding because I am already in. If I was out, I would be waiting for some confirmation just like Mr Ross is. It's not the time to go back in yet.