Which fund should you be in? C, S, F, or I? (No, I'm not in the G Fund currently).

Here's how I analyze which fund to be in...

Rather than look at all four stock funds, let's take a look at just two for now.

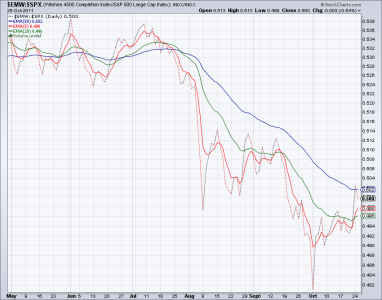

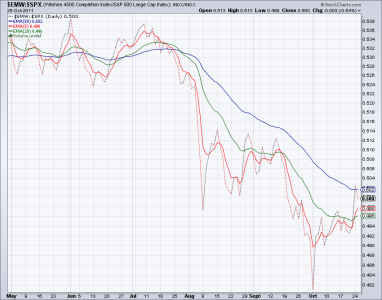

This is a basic relative strength analysis of the S Fund vs the C Fund. When the S Fund is outperforming the C Fund, the dotted line (and moving averages) will be heading higher. When the C Fund is outperforming the S Fund, the dotted line (and moving averages) will be heading lower.

As you can see from the graph, since mid July, the S Fund has been lagging the performance of the C Fund (line heading lower). The small cap stock fund bottomed on October 1, and is beginning to show positive relative strength compared to large cap stocks. You can see the 5 day EMA bottoming and heading higher as well. Price action continues to pull the 5 day EMA higher.

This has almost always been the case. When the market turns positive, and I get a "Buy" signal, it's usually been best to go fully into the small cap fund. It's usually the fund that has been beaten down the hardest, and is usually the fund that outperforms the others when the market turns positive (as it has now).

My allocation is currently 45% S, 45% C, and 10% I.

I'll keep my eyes on the market over the course of the next week or so to see if the market continues to move higher. If it does, I may go 100% S.

Hope this helps!

John Ross