The speed at which this market turns, along with the depth of the moves is making it impossible to trust most indicators. The Seven Sentinels did not flip back to a sell today, but that's hardly any consolidation to those who took a long position in the past couple of days(unless of course you took it today). Today's action was almost identical to the whipsaw I took that put me in a 100% S fund allocation to begin with.

We've really got two main choices here. Ride the volatility in buy and hold fashion, or sit in G until normalcy returns. And that could be quite a ways off yet. But it will be a no brainer position if this market falls off a cliff.

So what were the topics of the day? It started with Hungary stating that economic conditions in their country are grave and that talk of default is not an exaggeration. And they won't be following Greece's path of using austerity as a means to get well.

Hungary does not use the Euro, but that didn't prevent that currency from shedding a huge 1.7% to set a new four-year low of $1.1956.

Of course news of nonfarm payrolls for May didn't help the mood. They increased by 431,000, well below the 500,000 that was expected. And the media made sure to mention that the overwhelming majority of the jobs were public census jobs (read temporary), which really hit the market between the eyes. And to think, after all this the unemployment rate made a moved to 9.7% from 9.8%. I'm not sure what math one would use to derive that decline. Is there such a thing as political math?

Okay, down to brass tacks. Where do the Seven Sentinels sit now? Let's take a look:

Both NAMO and NYMO flipped back to sells today, but not by much. One could make an argument that were seeing higher highs and higher lows here, which may suggest higher prices are coming in spite of the volatility. I would not suscribe to that theory however.

Both NAHL and NYHL flipped to sells today too.

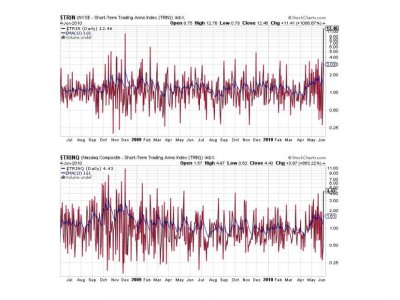

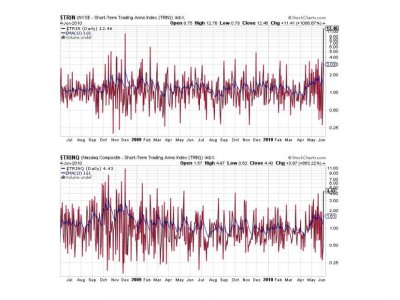

Wow. Take a look at TRIN. That's the highest reading in over 3 years. That's big time oversold. TRINQ is high as well, but not at nearly the same level. Both are now on sells.

This is the one lone buy signal, but it doesn't look good after today's drubbing.

So we now have 6 of 7 signals on a sell, which technically keeps the system on a buy, but I am not bullish. I'm still long too, as many on the tracker are as well. In fact, on June 2nd, the Top 50 had less than 15% allocated to stocks. that was Tuesday. For today's trading the Top 50 had about 40.5% in stocks. So many were hammered.

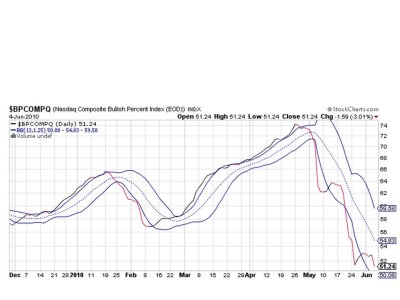

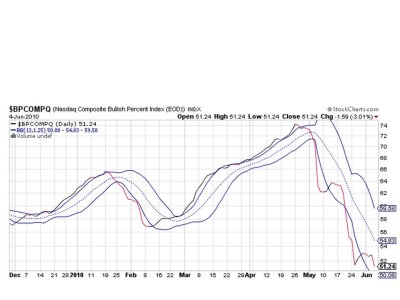

What happens next? I don't know, but I'd imagine bearish levels are going to rise now that the S&P closed below the "flash crash" low from last month. And the 200 dma is continuing to act as significant resistance. We are in a trading range at the moment, but which way will we break out? I'm thinking down given how BPCOMPQ looks. The weight of the bad news out there is really taking a toll on this market. I voted bullish on yesterday's sentiment survey, but I'd have to move that to a neutral now, and bearish if Monday follows Friday's lead.

I'll be posting the tracker charts some time this weekend. See you then.

We've really got two main choices here. Ride the volatility in buy and hold fashion, or sit in G until normalcy returns. And that could be quite a ways off yet. But it will be a no brainer position if this market falls off a cliff.

So what were the topics of the day? It started with Hungary stating that economic conditions in their country are grave and that talk of default is not an exaggeration. And they won't be following Greece's path of using austerity as a means to get well.

Hungary does not use the Euro, but that didn't prevent that currency from shedding a huge 1.7% to set a new four-year low of $1.1956.

Of course news of nonfarm payrolls for May didn't help the mood. They increased by 431,000, well below the 500,000 that was expected. And the media made sure to mention that the overwhelming majority of the jobs were public census jobs (read temporary), which really hit the market between the eyes. And to think, after all this the unemployment rate made a moved to 9.7% from 9.8%. I'm not sure what math one would use to derive that decline. Is there such a thing as political math?

Okay, down to brass tacks. Where do the Seven Sentinels sit now? Let's take a look:

Both NAMO and NYMO flipped back to sells today, but not by much. One could make an argument that were seeing higher highs and higher lows here, which may suggest higher prices are coming in spite of the volatility. I would not suscribe to that theory however.

Both NAHL and NYHL flipped to sells today too.

Wow. Take a look at TRIN. That's the highest reading in over 3 years. That's big time oversold. TRINQ is high as well, but not at nearly the same level. Both are now on sells.

This is the one lone buy signal, but it doesn't look good after today's drubbing.

So we now have 6 of 7 signals on a sell, which technically keeps the system on a buy, but I am not bullish. I'm still long too, as many on the tracker are as well. In fact, on June 2nd, the Top 50 had less than 15% allocated to stocks. that was Tuesday. For today's trading the Top 50 had about 40.5% in stocks. So many were hammered.

What happens next? I don't know, but I'd imagine bearish levels are going to rise now that the S&P closed below the "flash crash" low from last month. And the 200 dma is continuing to act as significant resistance. We are in a trading range at the moment, but which way will we break out? I'm thinking down given how BPCOMPQ looks. The weight of the bad news out there is really taking a toll on this market. I voted bullish on yesterday's sentiment survey, but I'd have to move that to a neutral now, and bearish if Monday follows Friday's lead.

I'll be posting the tracker charts some time this weekend. See you then.