I would think we're picking up some converts from the bear camp after today, as most mechanical systems should be flashing buys by now. The SS has been on a buy since 23 June and if you've held through the volatility you've been doing well. I'm expecting even higher prices in the days, and perhaps weeks ahead.

This morning the market received an ADP Employment reading coupled with an ISM Index reading that were both better than expected, but the market didn't exactly do cartwheels over it, although we did manage to close with solid gains in the C and S. As is typical on weeks where we have a nonfarm payrolls data release, the market is probably saving its real vote until it sees those numbers along with the associated data that accompanies it.

I certainly don't know how the market will react regardless of the numbers, but I do know that until the SS gives me a sell signal, I need to remain long.

Here's the charts:

NAMO and NYMO remain on buys.

NAHL and NYHL also remain on buys.

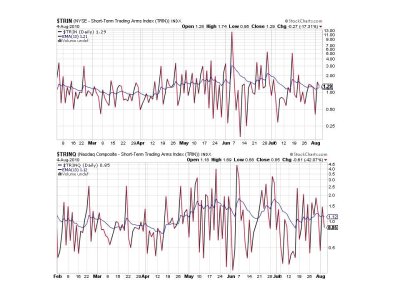

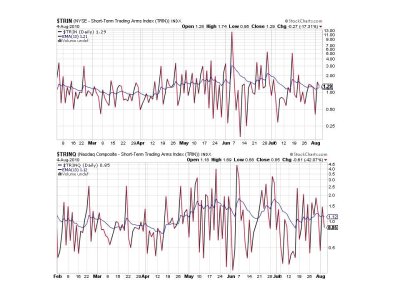

TRIN is just barely a sell, while TRINQ is a buy.

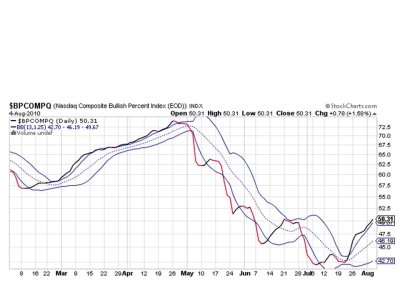

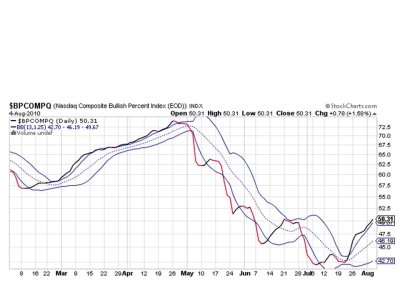

BPCOMPQ continues to move higher and remains on a buy.

So we have 6 of 7 signals on a buy, which keeps the system on a buy.

The charts look good and sentiment has not been particularly bullish, so we've had help keeping this market moving higher. As I've already stated, I'm looking for even higher prices ahead and I remain 100% S fund.

This morning the market received an ADP Employment reading coupled with an ISM Index reading that were both better than expected, but the market didn't exactly do cartwheels over it, although we did manage to close with solid gains in the C and S. As is typical on weeks where we have a nonfarm payrolls data release, the market is probably saving its real vote until it sees those numbers along with the associated data that accompanies it.

I certainly don't know how the market will react regardless of the numbers, but I do know that until the SS gives me a sell signal, I need to remain long.

Here's the charts:

NAMO and NYMO remain on buys.

NAHL and NYHL also remain on buys.

TRIN is just barely a sell, while TRINQ is a buy.

BPCOMPQ continues to move higher and remains on a buy.

So we have 6 of 7 signals on a buy, which keeps the system on a buy.

The charts look good and sentiment has not been particularly bullish, so we've had help keeping this market moving higher. As I've already stated, I'm looking for even higher prices ahead and I remain 100% S fund.