I was watching the President's State of the Union Address on the Bloomberg Channel last night, so I could monitor futures while the speech was given. I found it interesting that futures began modesty higher at the beginning of the speech and didn't vary too much until the last 20 minutes or so when they moved markedly higher. That gave me the impression that the President's speech would be used as a catalyst the next trading day (not necessarily up either), but by early morning those futures were just above the flat line. Once trading began a negative bias set in and we remained red the rest of the day.

While we closed well off the lows, it was still an ugly day for the bulls as any kind of meaningful rally seems to be getting elusive.

Earnings continue to be ignored by the stock market, except when it comes to individual stocks perhaps, but the broader market is getting sold.

Tomorrow we have three economic reports being released (GDP-Adv. Chain Deflator-Adv., and Employment Cost Index). I don't expect these reports to offer a postive catalyst even if the news is good. We appear to be in a down trend now with any rally generally being sold.

Here's today's charts:

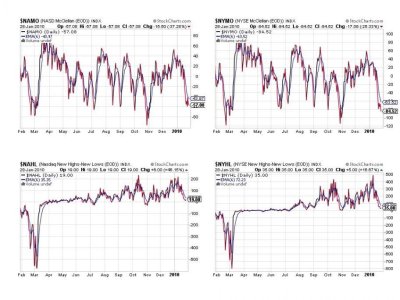

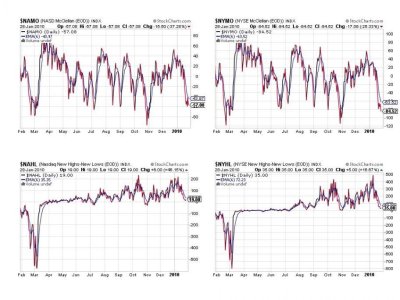

I provided a one year view again this time, although not as stretched out, but we can still readily see the peaks and troughs here. All four remain on a sell.

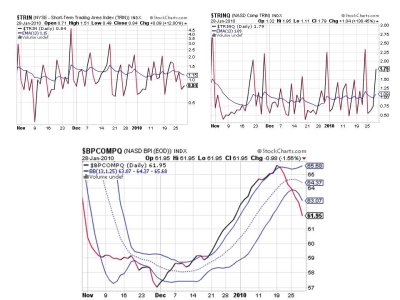

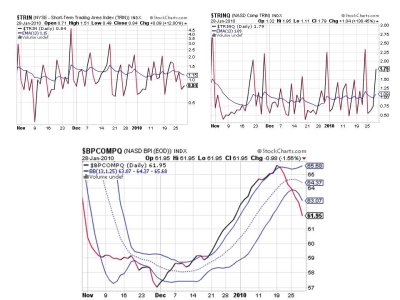

TRIN remains on a buy but TRINQ flipped to a sell while BPCOMPQ dropped lower still. This signal alone suggests this decline may be longer lasting than any we've seen in many months. Especially when considering how market character has changed this past week or so.

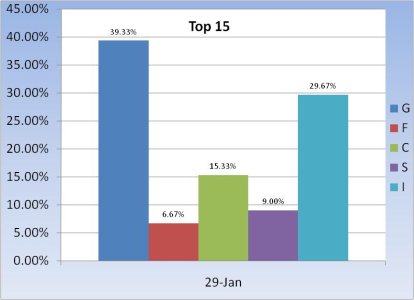

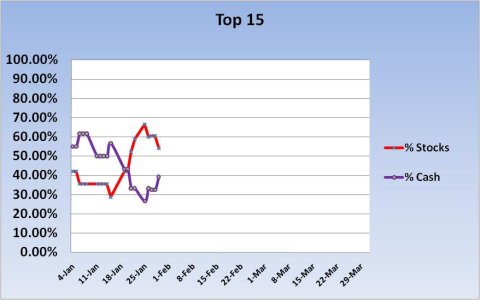

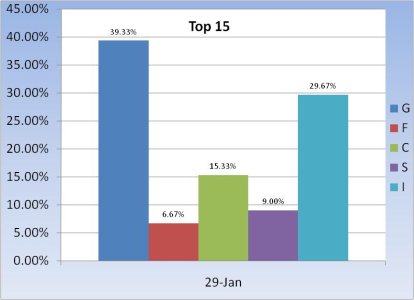

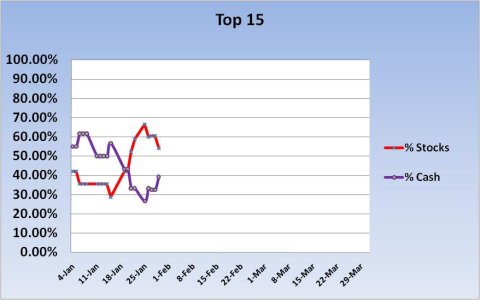

Here's our Top 15. They've gotten a bit defensive the past couple days, but still have a fair amount of stock exposure. The I fund is losing some of its allure now, but with the dollar rally suggesting more upside to come that's to be expected.

The Seven Sentinels remain on a sell and I am getting the impression that this signal may be more enduring than the sell signals we've had these past several months. If that's the case, our trading opportunities should be more profitable. That's how this system was working prior to the 2009 March lows. That's it for this evening. See you tomorrow.

While we closed well off the lows, it was still an ugly day for the bulls as any kind of meaningful rally seems to be getting elusive.

Earnings continue to be ignored by the stock market, except when it comes to individual stocks perhaps, but the broader market is getting sold.

Tomorrow we have three economic reports being released (GDP-Adv. Chain Deflator-Adv., and Employment Cost Index). I don't expect these reports to offer a postive catalyst even if the news is good. We appear to be in a down trend now with any rally generally being sold.

Here's today's charts:

I provided a one year view again this time, although not as stretched out, but we can still readily see the peaks and troughs here. All four remain on a sell.

TRIN remains on a buy but TRINQ flipped to a sell while BPCOMPQ dropped lower still. This signal alone suggests this decline may be longer lasting than any we've seen in many months. Especially when considering how market character has changed this past week or so.

Here's our Top 15. They've gotten a bit defensive the past couple days, but still have a fair amount of stock exposure. The I fund is losing some of its allure now, but with the dollar rally suggesting more upside to come that's to be expected.

The Seven Sentinels remain on a sell and I am getting the impression that this signal may be more enduring than the sell signals we've had these past several months. If that's the case, our trading opportunities should be more profitable. That's how this system was working prior to the 2009 March lows. That's it for this evening. See you tomorrow.