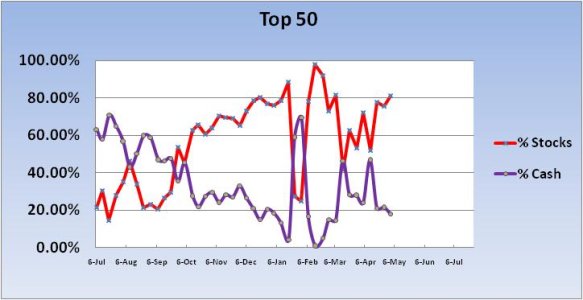

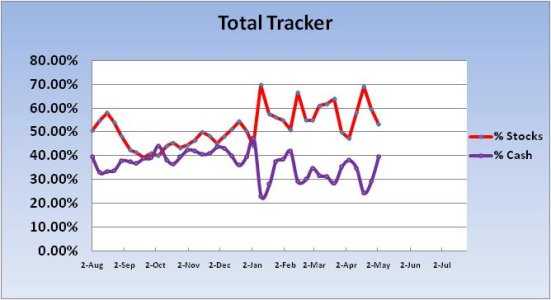

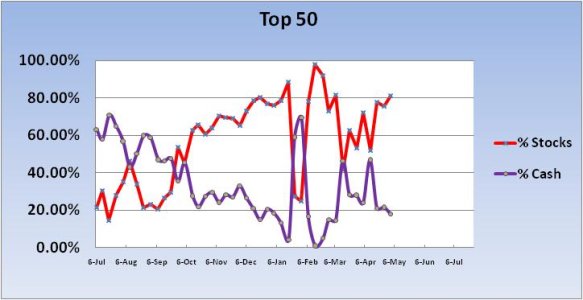

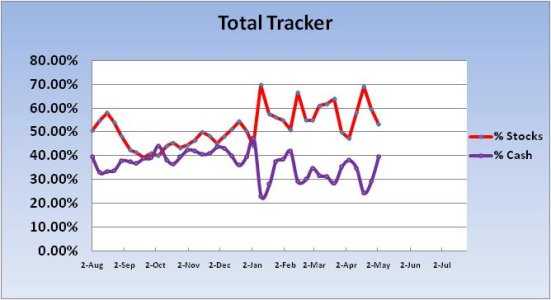

The Top 50 adds to its stock allocation for this coming week, while the Total Tracker shows the herd is playing it safe. Our sentiment survey is on a hold (S fund) for the new week. Here's the charts:

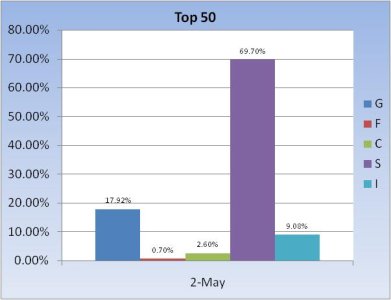

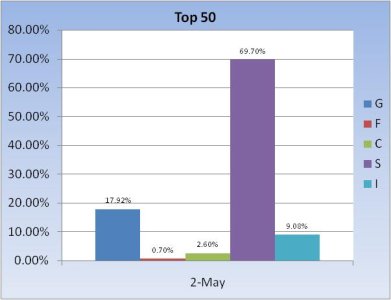

The Top 50 are over 80% allocated across the C,S, and I funds, with the S fund understandably the fund of choice.

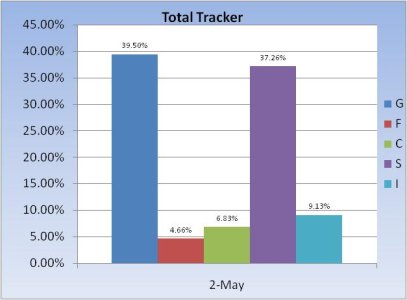

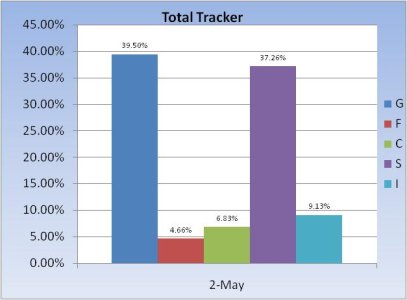

The Total Tracker showed stock allocations dropped for the 2nd week in a row. They were wrong last week, but they do remain over 50% allocated in stocks, which keeps the group bullish overall.

The Top 50 are over 80% allocated across the C,S, and I funds, with the S fund understandably the fund of choice.

The Total Tracker showed stock allocations dropped for the 2nd week in a row. They were wrong last week, but they do remain over 50% allocated in stocks, which keeps the group bullish overall.