Stocks spiked higher at the beginning of trade today, but by 1000 EST peaked and began a slow a descent to around the unchanged mark by mid-day. They then tracked sideways till mid-afternoon before dropping to their low of the day late in the session and then retracing most of those losses in the final half hour.

So it was yet another mixed trading day with volatility evident as we drew closer to several major trading catalysts beginning with election results tomorrow.

Aside from the major news stories this week, we also have a great deal of market data to wade through. Today's October ISM Manufacturing data came in at 56.9, well above the 54.0 that was expected. September's U.S. construction spending was 0.5%. Much better than the 0.7% decline that was forecast.

We didn't do as well with September's personal income, which dipped 0.1% while spending was up a paltry 0.2%.

Uncertainty about this week's events is keeping a lid on volume as the NYSE traded less than a billion shares.

The market will be watching elections closely tomorrow, although I don't know whether we're likely to see as much volatility as we did today. I suspect we'll have to wait till Wednesday morning's open to see what the market thinks of those results. However, the afternoon trading session is when the FOMC announcement will be released, so Wednesday could be a wild day.

And the show's not over after Wednesday either, as Thursday brings initial claims and continuing claims, while Friday it's all about non-farm payrolls and the unemployment rate.

Here's today's charts:

NAMO sure looks like it's poised for further downside action here, while NYMO doesn't look quite as ragged. We have one flashing a sell and one flashing a buy.

NAHL and NYHL are both flashing buys.

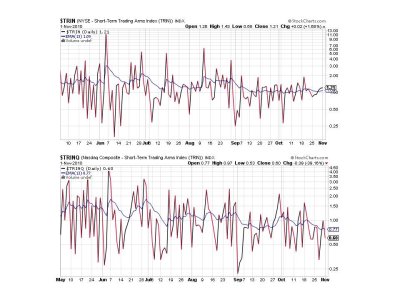

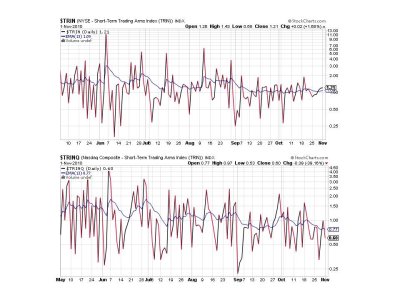

TRIN is on a sell, while TRINQ is on a buy.

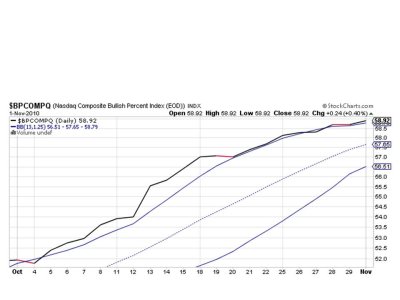

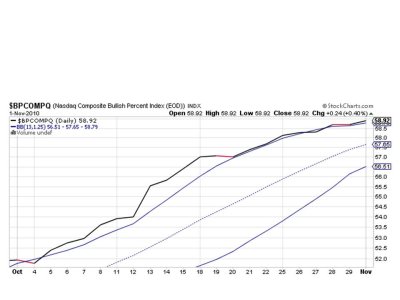

BPCOMPQ managed to move just a bit higher today, but remains very close the the upper bollinger band.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy.

The Sentinels can go either way right now as they have for the past several trading sessions. The mixed, lackluster trading activity we've been seeing is almost certainly going to give way to volatile action for much of the rest of this week. Place your bets, mid-term elections are upon us.

So it was yet another mixed trading day with volatility evident as we drew closer to several major trading catalysts beginning with election results tomorrow.

Aside from the major news stories this week, we also have a great deal of market data to wade through. Today's October ISM Manufacturing data came in at 56.9, well above the 54.0 that was expected. September's U.S. construction spending was 0.5%. Much better than the 0.7% decline that was forecast.

We didn't do as well with September's personal income, which dipped 0.1% while spending was up a paltry 0.2%.

Uncertainty about this week's events is keeping a lid on volume as the NYSE traded less than a billion shares.

The market will be watching elections closely tomorrow, although I don't know whether we're likely to see as much volatility as we did today. I suspect we'll have to wait till Wednesday morning's open to see what the market thinks of those results. However, the afternoon trading session is when the FOMC announcement will be released, so Wednesday could be a wild day.

And the show's not over after Wednesday either, as Thursday brings initial claims and continuing claims, while Friday it's all about non-farm payrolls and the unemployment rate.

Here's today's charts:

NAMO sure looks like it's poised for further downside action here, while NYMO doesn't look quite as ragged. We have one flashing a sell and one flashing a buy.

NAHL and NYHL are both flashing buys.

TRIN is on a sell, while TRINQ is on a buy.

BPCOMPQ managed to move just a bit higher today, but remains very close the the upper bollinger band.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy.

The Sentinels can go either way right now as they have for the past several trading sessions. The mixed, lackluster trading activity we've been seeing is almost certainly going to give way to volatile action for much of the rest of this week. Place your bets, mid-term elections are upon us.