Today's early morning data points didn't provide much in the way of momentum for stocks to move higher, but it was enough to help the S&P 500 make a modest 52-week high. But it was mostly a lackluster day of trading in any event.

Tomorrow morning, three economic reports are scheduled to be released before the open: Core CPI, CPI, and the Empire Manufacturing Survey.

The CPI has the potential to move the market, but it is OPEX and all bets are off when it comes to knowing how the market will ultimately trade.

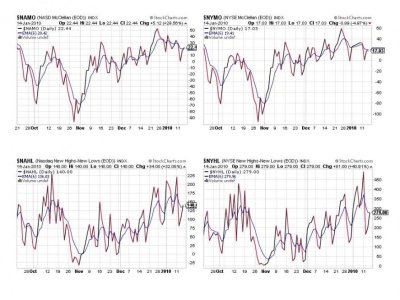

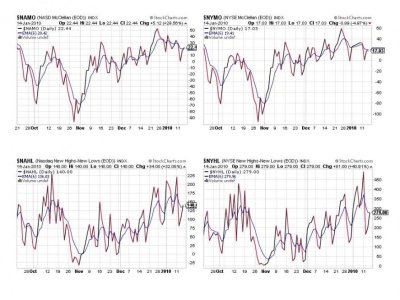

The Seven Sentinels remain on a buy, but could roll over to a sell with enough selling pressure. I mention this because several of the signals are still on a buy, but they look toppy. Of course, that's nothing new this month. Here's the charts:

Two buy signals and two sell signals, and all of them are near their respective 6 day Exponential Moving Average. They could go either way depending on which direction the market goes (assuming we don't chop sideways).

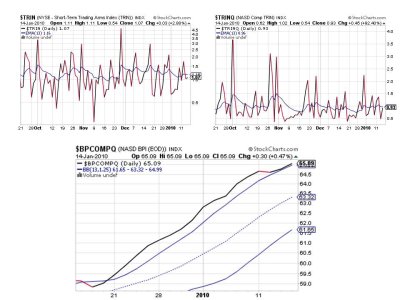

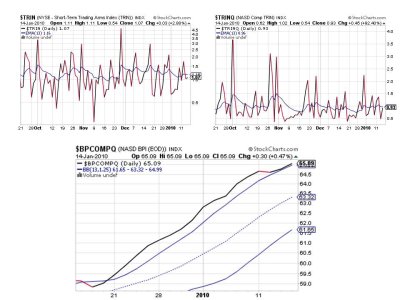

TRIN and TRINQ are flashing a buy, but are very close their 13 day EMAs so the same logic applies. BPCOMPQ is tracking along the upper bollinger band still. If it crosses to the down side it'll trigger a sell.

So my point is one I've already made, while several of the signals are in buy mode, the charts themselves are vulnerable to a pullback, which could easily trigger a sell condition for the system.

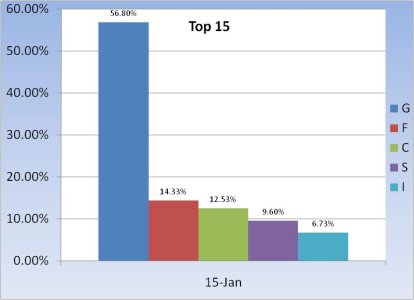

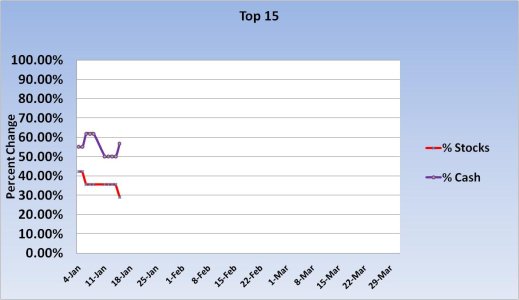

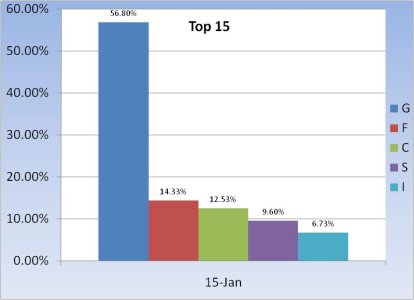

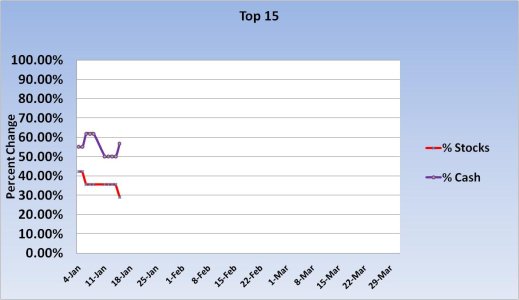

The Top 15 raised more cash today. They may have been bearish early this year, but I would not bet against them for the long term.

So we remain on a buy with the Seven Sentinels, but it's getting tenuous. But if one is comfortable with the bullish case then hold until we get a sell signal. If one would prefer to hold on to any gains made for the month, it might not be a bad idea to get defensive now.

That's it for today, see you tomorrow.

Tomorrow morning, three economic reports are scheduled to be released before the open: Core CPI, CPI, and the Empire Manufacturing Survey.

The CPI has the potential to move the market, but it is OPEX and all bets are off when it comes to knowing how the market will ultimately trade.

The Seven Sentinels remain on a buy, but could roll over to a sell with enough selling pressure. I mention this because several of the signals are still on a buy, but they look toppy. Of course, that's nothing new this month. Here's the charts:

Two buy signals and two sell signals, and all of them are near their respective 6 day Exponential Moving Average. They could go either way depending on which direction the market goes (assuming we don't chop sideways).

TRIN and TRINQ are flashing a buy, but are very close their 13 day EMAs so the same logic applies. BPCOMPQ is tracking along the upper bollinger band still. If it crosses to the down side it'll trigger a sell.

So my point is one I've already made, while several of the signals are in buy mode, the charts themselves are vulnerable to a pullback, which could easily trigger a sell condition for the system.

The Top 15 raised more cash today. They may have been bearish early this year, but I would not bet against them for the long term.

So we remain on a buy with the Seven Sentinels, but it's getting tenuous. But if one is comfortable with the bullish case then hold until we get a sell signal. If one would prefer to hold on to any gains made for the month, it might not be a bad idea to get defensive now.

That's it for today, see you tomorrow.