When last week's selling was not immediately bought, many dip buyers and fence sitters were surprised. Bullish levels initially rose early on, but by Friday many traders and bloggers were convinced that a larger correction had begun. In response, bearish levels and shorting began to rise. And that appears to be the main reason for the buying interest these past two days.

Earnings continue to be decidedly positive and all 10 market sectors finished in positive territory today on modestly below average volume.

Tomorrow we have two economic reports being released; Challenger Job cuts and ADP Employment Change. But the reports that the market may be more interested in come Friday when nonfarm payrolls and the unemployment rate are released. Some are expecting those numbers to surprise in a negative way. Perhaps that's why we're rallying now.

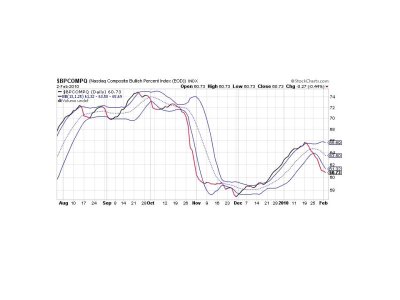

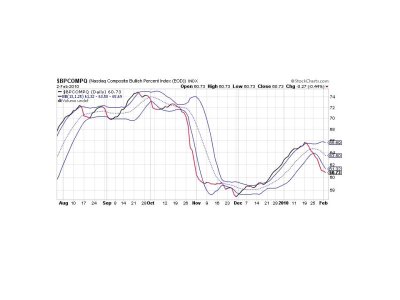

The big question many of you may be wondering is whether the Seven Sentinels issued a buy signal today. The quick answer is no, and once again it is BPCOMPQ that is not confirming this rally. Here's the charts:

NAMO and NYMO both look as though they could move higher. Especially when compared to previous rallies off the lows we saw on this past sell-off.

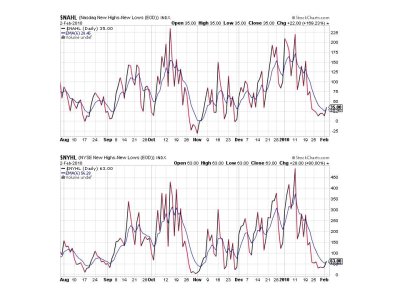

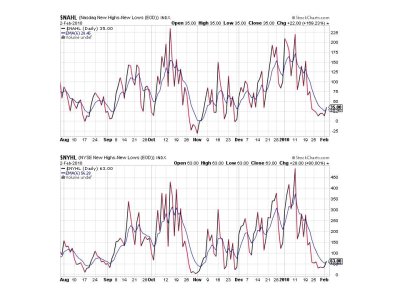

NAHL and NYHL are relatively flat, but positive. We have not retraced enough of the losses to see these two signals rise in a significant way yet

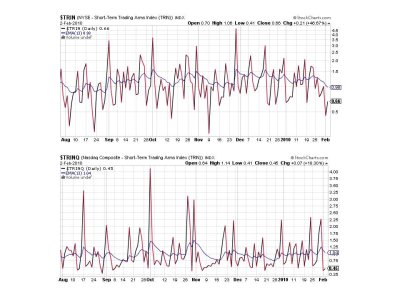

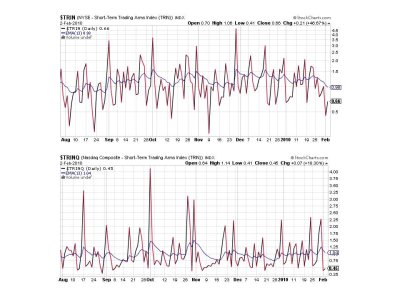

TRIN and TRINQ remained on a buy, but turned up a bit.

As we often see on bounces, BPCOMPQ remained the lone sell signal on consecutive up days, and even turned down a little more. We would need to see more retracement to flip this signal back to a buy. But this is a trend signal and it is still pointed down, so I would not dismiss this signal too quickly as being too slow to react to a buying opportunity. It remains to be seen if the market can hold its footing after last week's moderate carnage.

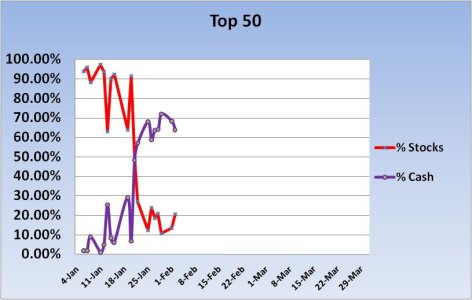

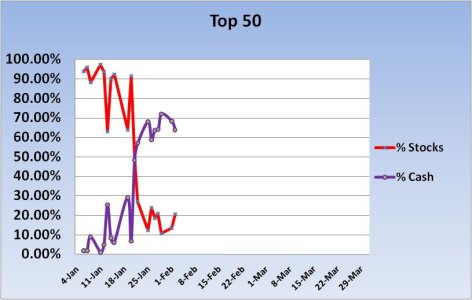

Our Top 50 remain largely in cash, but continued follow through to the upside will change that. The Top 15 made no changes today.

So the Seven Sentinels remain in a sell condition. We could go either way now as we are no longer oversold, but cash is still the place to be until a green light is given by the system. See you tomorrow.

Earnings continue to be decidedly positive and all 10 market sectors finished in positive territory today on modestly below average volume.

Tomorrow we have two economic reports being released; Challenger Job cuts and ADP Employment Change. But the reports that the market may be more interested in come Friday when nonfarm payrolls and the unemployment rate are released. Some are expecting those numbers to surprise in a negative way. Perhaps that's why we're rallying now.

The big question many of you may be wondering is whether the Seven Sentinels issued a buy signal today. The quick answer is no, and once again it is BPCOMPQ that is not confirming this rally. Here's the charts:

NAMO and NYMO both look as though they could move higher. Especially when compared to previous rallies off the lows we saw on this past sell-off.

NAHL and NYHL are relatively flat, but positive. We have not retraced enough of the losses to see these two signals rise in a significant way yet

TRIN and TRINQ remained on a buy, but turned up a bit.

As we often see on bounces, BPCOMPQ remained the lone sell signal on consecutive up days, and even turned down a little more. We would need to see more retracement to flip this signal back to a buy. But this is a trend signal and it is still pointed down, so I would not dismiss this signal too quickly as being too slow to react to a buying opportunity. It remains to be seen if the market can hold its footing after last week's moderate carnage.

Our Top 50 remain largely in cash, but continued follow through to the upside will change that. The Top 15 made no changes today.

So the Seven Sentinels remain in a sell condition. We could go either way now as we are no longer oversold, but cash is still the place to be until a green light is given by the system. See you tomorrow.