Our sentiment survey gave a buy for the next week. It seems we've become overly bearish going into next week, but does our tracker reflect this bearishness? The preliminary charts I'm looking at suggest we have not made a move to cash as compared to last week, and today's data looks to bump up the stock allocation from where it was yesterday.

I can't say that I'm particularly bullish about Monday, in spite of our sentiment. Being bearish is one thing, but when the charts show virtually no movement I have to wonder if it's really all that meaningful. I'd tend to favor what the tracker is showing instead.

Today saw stocks drop for a fourth straight loss, and that leaves the S&P 500 down 3.8% for the week.

And in case you didn't notice, the eurozone had a stronger-than-expected GDP report today and all the major European bourses did was drop about 1% after the report.

This morning we saw July consumer prices move higher by 0.3%, but excluding food and energy prices were only up 0.1%.

June business inventories increased 0.3%, and that's not a good thing given weaker sales numbers data. I don't know how much longer inventories can increase if goods aren't moving much.

Retail sales was up 0.4%, but that's a bit below expectations. Strip out autos and the number drops to 0.2%.

Then there's the ever fickle consumer confidence survey, which saw a small up-tick to 69.6.

Aside from all this data today the fact is the major averages tried to stage a rally today, only to close at or near their lows of the day. And the Sentinels aren't getting any more bullish either.

Here's the charts:

NAMO and NYMO continue their downward movement.

Interestingly, internals improved today with NAHL and NYHL both moving back up again, but they still remain on sells for now.

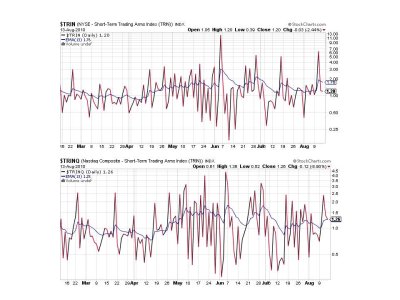

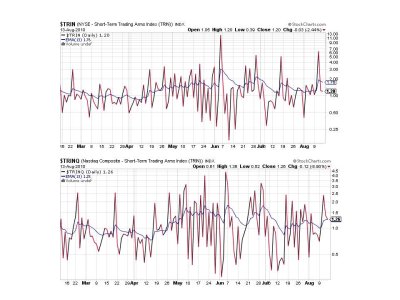

TRIN remains on a buy, while TRINQ remains on a sell, but is very close to its 13 day EMA.

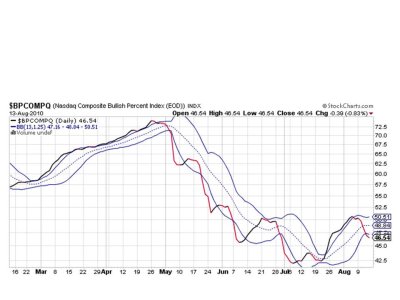

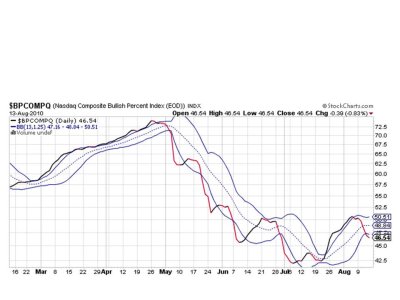

Lower still for BPCOMPQ.

So we still have 6 of 7 signals flashing sells and that keeps the system on a sell.

Monday may save the day for those looking for an exit, but it's possible we may see an intra-day rally that doesn't hold into the close. If we rally at all. I don't really know, but I'm very wary this time around.

Still 100% G. See you this weekend when I post the tracker charts.

I can't say that I'm particularly bullish about Monday, in spite of our sentiment. Being bearish is one thing, but when the charts show virtually no movement I have to wonder if it's really all that meaningful. I'd tend to favor what the tracker is showing instead.

Today saw stocks drop for a fourth straight loss, and that leaves the S&P 500 down 3.8% for the week.

And in case you didn't notice, the eurozone had a stronger-than-expected GDP report today and all the major European bourses did was drop about 1% after the report.

This morning we saw July consumer prices move higher by 0.3%, but excluding food and energy prices were only up 0.1%.

June business inventories increased 0.3%, and that's not a good thing given weaker sales numbers data. I don't know how much longer inventories can increase if goods aren't moving much.

Retail sales was up 0.4%, but that's a bit below expectations. Strip out autos and the number drops to 0.2%.

Then there's the ever fickle consumer confidence survey, which saw a small up-tick to 69.6.

Aside from all this data today the fact is the major averages tried to stage a rally today, only to close at or near their lows of the day. And the Sentinels aren't getting any more bullish either.

Here's the charts:

NAMO and NYMO continue their downward movement.

Interestingly, internals improved today with NAHL and NYHL both moving back up again, but they still remain on sells for now.

TRIN remains on a buy, while TRINQ remains on a sell, but is very close to its 13 day EMA.

Lower still for BPCOMPQ.

So we still have 6 of 7 signals flashing sells and that keeps the system on a sell.

Monday may save the day for those looking for an exit, but it's possible we may see an intra-day rally that doesn't hold into the close. If we rally at all. I don't really know, but I'm very wary this time around.

Still 100% G. See you this weekend when I post the tracker charts.