It was choppy trading on this day before OPEX, but the broader market managed to stay above the neutral line most of the day and closed with modestly higher gains across the board.

Prior to the open, the initial jobless claims number was released, which saw claims drop to 409,000, which is less than the 420,000 economists were looking for. This seemed to help set the tone for a follow through day to the upside, although the market ran into trouble shortly after the May Philadelphia Fed Index was released at 10:00 EST. It came in at 3.9, which was significantly lower that the 18.0 that was anticipated.

Other data released at the same time was the April Leading Indicators, which dropped 0.3%. Obviously another negative for the market to digest.

And finally, existing home sales came in below estimates at 5.05 million for the month of April. The expected number of units was 5.23 million.

So the market fell after those reports were issued and found its low of the day around 11:15 EST. Shortly after noon the market found its footing and moved back into positive territory where it vacillated the rest of the afternoon. Of course the dollar was a big part of the reason for the turn around as it fell on the day for a loss of 0.4%.

Here's today's charts:

A bit higher for NAMO and NYMO. Both are still in a buy condition. I'm reading these two signals as neutral for now.

NAHL and NYHL moved higher on the day and also remain in a buy condition.

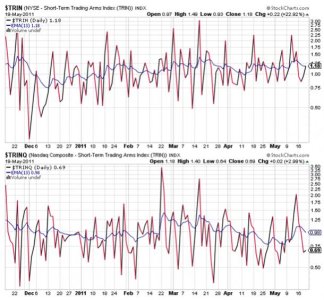

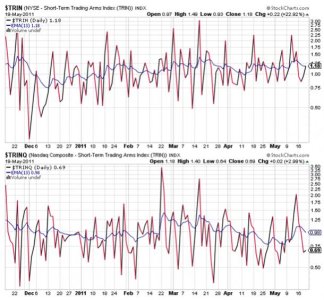

TRIN moved to a neutral stance today, while TRINQ remained on a buy.

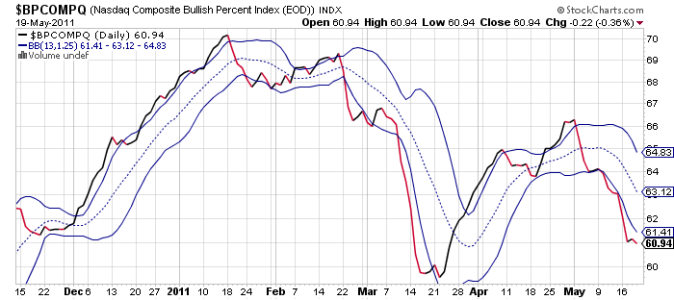

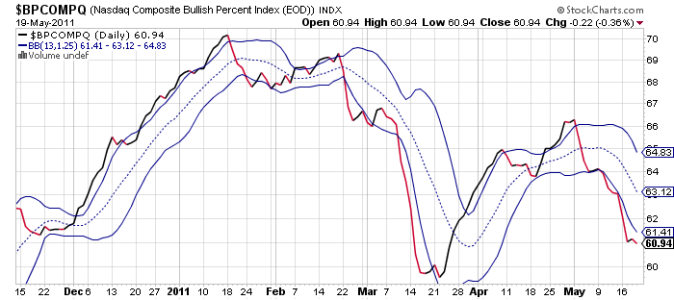

BPCOMPQ ebbed a bit lower and remains on a sell. This signal has been pointing down since the first trading day of May and today's action didn't change that view. Lower prices are very much suggested here.

So the signals are mixed, but BPCOMPQ tells me caution is still very much warranted in spite of the overall buy condition of the Seven Sentinels.

Tomorrow is OPEX, which means market activity will be subject to repositioning by the Options players. We can't gauge true market behavior in that kind of environment, but it's only for one day. What happens next week will be more important.

As for myself, I am back into a conservative posture at 100% F fund. I'm out of IFTs and that's quite alright given the condition of the indicators right now. This market needs some time to stabilize, and I'm of the opinion that will require more selling pressure in the days and weeks ahead.

Prior to the open, the initial jobless claims number was released, which saw claims drop to 409,000, which is less than the 420,000 economists were looking for. This seemed to help set the tone for a follow through day to the upside, although the market ran into trouble shortly after the May Philadelphia Fed Index was released at 10:00 EST. It came in at 3.9, which was significantly lower that the 18.0 that was anticipated.

Other data released at the same time was the April Leading Indicators, which dropped 0.3%. Obviously another negative for the market to digest.

And finally, existing home sales came in below estimates at 5.05 million for the month of April. The expected number of units was 5.23 million.

So the market fell after those reports were issued and found its low of the day around 11:15 EST. Shortly after noon the market found its footing and moved back into positive territory where it vacillated the rest of the afternoon. Of course the dollar was a big part of the reason for the turn around as it fell on the day for a loss of 0.4%.

Here's today's charts:

A bit higher for NAMO and NYMO. Both are still in a buy condition. I'm reading these two signals as neutral for now.

NAHL and NYHL moved higher on the day and also remain in a buy condition.

TRIN moved to a neutral stance today, while TRINQ remained on a buy.

BPCOMPQ ebbed a bit lower and remains on a sell. This signal has been pointing down since the first trading day of May and today's action didn't change that view. Lower prices are very much suggested here.

So the signals are mixed, but BPCOMPQ tells me caution is still very much warranted in spite of the overall buy condition of the Seven Sentinels.

Tomorrow is OPEX, which means market activity will be subject to repositioning by the Options players. We can't gauge true market behavior in that kind of environment, but it's only for one day. What happens next week will be more important.

As for myself, I am back into a conservative posture at 100% F fund. I'm out of IFTs and that's quite alright given the condition of the indicators right now. This market needs some time to stabilize, and I'm of the opinion that will require more selling pressure in the days and weeks ahead.