Aside from Large-cap tech boosting the Nasdaq from the red to finish flat, weakness in the broader market kept the rest of the indicies on the negative side. News and earnings did not seem to matter today, so I'd say profit taking was the primary catalyst.

Tomorrow we have four economic reports due; Initial Claims, Continuing Claims, Productivity-Prel, and Preliminary Unit Labor Costs. But as I said last night, the big reports come Friday, so the market may look past everything else to focus on that.

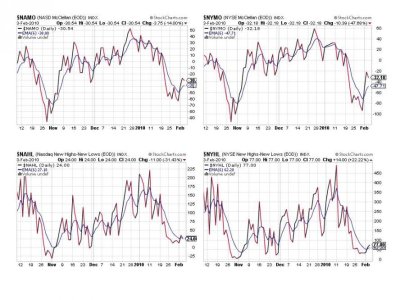

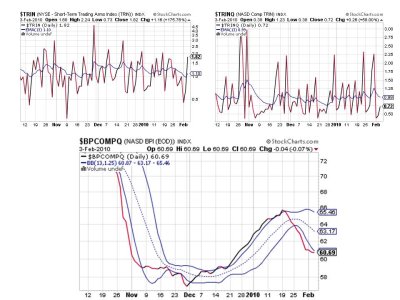

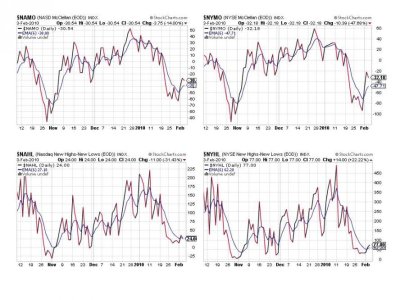

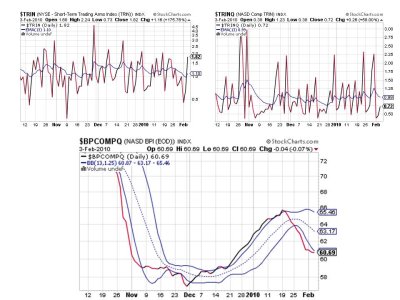

Today's weakness contributed to some deterioration in the Seven Sentinel signals, but all in all it wasn't too bad. Here's the chart:

NAMO and NYMO remain on a buy, while NAHL just did flip to a sell. NYHL however, inched up a bit, remaining in a buy condition.

TRIN flipped to a sell, while TRINQ remained on a buy. BPCOMPQ was flat, but the lower bollinger band is getting close to touching that signal.

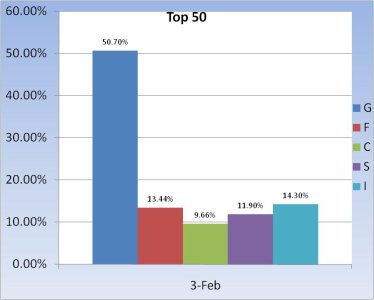

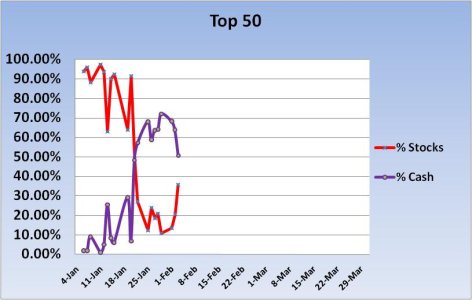

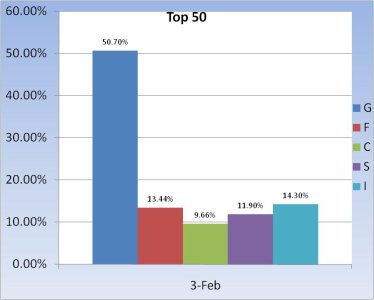

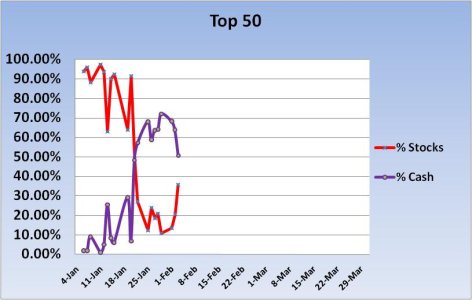

As expected after 2 days of rally the Top 50 show more stock exposure, but still remain largely in cash.

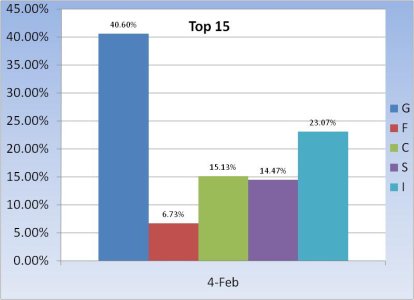

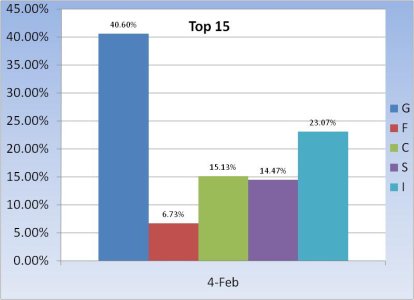

This is how our Top 15 is positioned for tomorrow's trading activity.

So it's a mixed picture here. We could get a buy signal if enough buying pressure comes into the market soon, but that's a big if at the moment. It would seem a lot of traders are waiting for Friday's reports before they make any decisions. The word is that the employment picture will take a turn for the worse, and since the media has been speaking to that already, it won't come as a surprise. So I have no idea what to expect. How about volatility. I expect that.

But for now the seven sentinels remain in a sell condition. See you tomorrow.

Tomorrow we have four economic reports due; Initial Claims, Continuing Claims, Productivity-Prel, and Preliminary Unit Labor Costs. But as I said last night, the big reports come Friday, so the market may look past everything else to focus on that.

Today's weakness contributed to some deterioration in the Seven Sentinel signals, but all in all it wasn't too bad. Here's the chart:

NAMO and NYMO remain on a buy, while NAHL just did flip to a sell. NYHL however, inched up a bit, remaining in a buy condition.

TRIN flipped to a sell, while TRINQ remained on a buy. BPCOMPQ was flat, but the lower bollinger band is getting close to touching that signal.

As expected after 2 days of rally the Top 50 show more stock exposure, but still remain largely in cash.

This is how our Top 15 is positioned for tomorrow's trading activity.

So it's a mixed picture here. We could get a buy signal if enough buying pressure comes into the market soon, but that's a big if at the moment. It would seem a lot of traders are waiting for Friday's reports before they make any decisions. The word is that the employment picture will take a turn for the worse, and since the media has been speaking to that already, it won't come as a surprise. So I have no idea what to expect. How about volatility. I expect that.

But for now the seven sentinels remain in a sell condition. See you tomorrow.