It was a battle between bulls and bears today, with the bulls initially winning for the first hour of trade, but then the bears found their footing and mounted what appeared might be a scary decline, which saw the S&P hit a low of the day of 1294.26 just before 2pm EST. At that point the bulls took charge again and rallied the broader market back into the green before a final bout of selling pressure hit in the final half hour of trade. Ultimately, the broader market finished mixed, but the question of whether we've seen the bottom has still not been answered.

Of course, political and social unrest in the Middle East and North Africa continue to dominate global headlines. With respect to those headlines, oil had run up past $103 per barrel overnight, but couldn't hold those gains during the trading day, closing with a 0.8% loss at $97.28 per barrel.

Early this morning initial jobless claims came in at 391,000, which was down 22,000 from last week and more importantly lower than the expected 410,000 economists were looking for. Continuing claims fell 145,000 to 3.79 million.

January durable goods orders were up 2.7%, which was in line with estimates, but once transportation is stripped out that number reveals a loss of -3.6%, which was well below expectations.

Let's look at the charts:

NAMO and NYMO show improvement, but only modestly so for NYMO. But remain on sells.

NAHL and NYHL also improved modestly, but remain on sells.

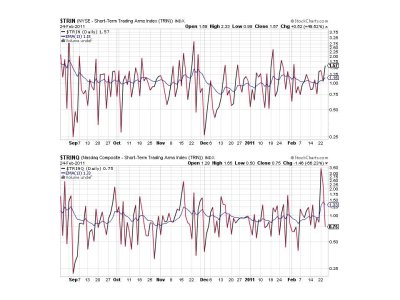

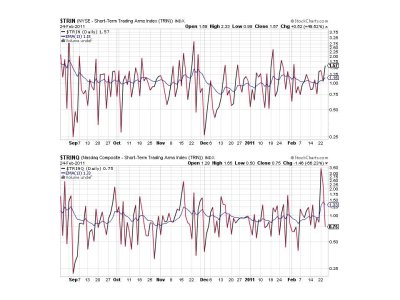

TRIN flipped to a sell today, while TRINQ improved to a buy.

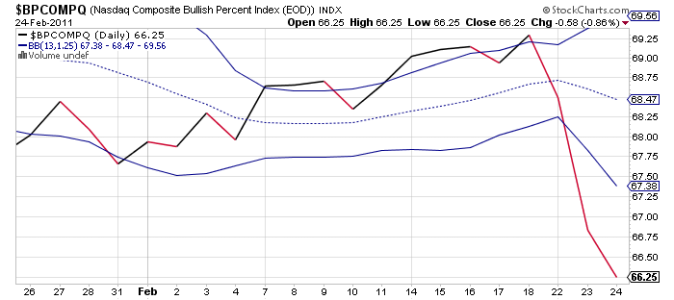

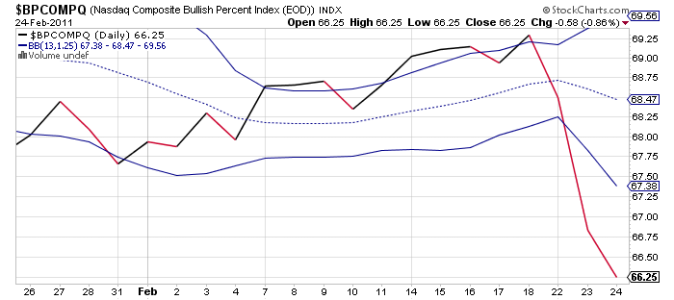

BPCOMPQ dipped a bit lower and remains on a sell.

So the system remains on a buy as NYMO did not hit a 28 day trading low.

Volatility is up, and so is volume. The market showed some signs of life today, but the issues wearing on traders remain. It was a mixed bag overall, but the good news is the bulls fought back, so buyers are showing up.

I am watching sentiment again and see that our survey is leaning decidedly bearish so far. The system is on a hold for this week. We'll know soon if it can flip back to a buy.

Of course, political and social unrest in the Middle East and North Africa continue to dominate global headlines. With respect to those headlines, oil had run up past $103 per barrel overnight, but couldn't hold those gains during the trading day, closing with a 0.8% loss at $97.28 per barrel.

Early this morning initial jobless claims came in at 391,000, which was down 22,000 from last week and more importantly lower than the expected 410,000 economists were looking for. Continuing claims fell 145,000 to 3.79 million.

January durable goods orders were up 2.7%, which was in line with estimates, but once transportation is stripped out that number reveals a loss of -3.6%, which was well below expectations.

Let's look at the charts:

NAMO and NYMO show improvement, but only modestly so for NYMO. But remain on sells.

NAHL and NYHL also improved modestly, but remain on sells.

TRIN flipped to a sell today, while TRINQ improved to a buy.

BPCOMPQ dipped a bit lower and remains on a sell.

So the system remains on a buy as NYMO did not hit a 28 day trading low.

Volatility is up, and so is volume. The market showed some signs of life today, but the issues wearing on traders remain. It was a mixed bag overall, but the good news is the bulls fought back, so buyers are showing up.

I am watching sentiment again and see that our survey is leaning decidedly bearish so far. The system is on a hold for this week. We'll know soon if it can flip back to a buy.