Spaf

Honorary Hall of Fame Member

- Reaction score

- 45

imported post

In mid to late September the market had a upward stall at the S&P 1131, and started another cycle down. However, that cycle was interrupted at 1102 on Seprember 28th. A new upward trend developed going into the Q4, and currently 1131.

Q4 and January are generally good months. Factors that could hinder market growth now come from earnings, employment, and oil. The big picture of 2004 places the market in bearish cycles. Will Q4 be a break out? Possible, if the factors mentioned stay in check. We have a delicate favorable trend of gains that needs to be watched with caution. If factors stay controlled, market sentiment would improve. We will just have to wait and see.

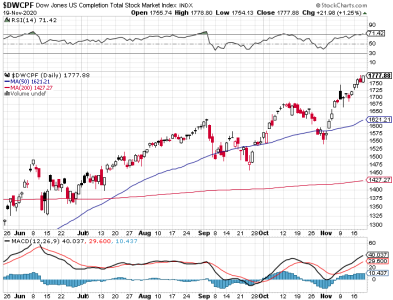

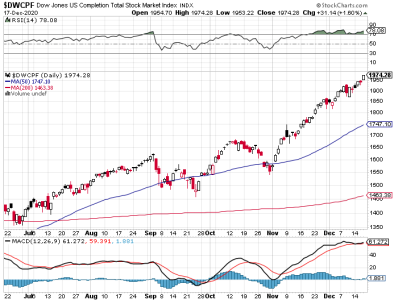

For the S-fund (^DWCP) the 20 day moving average and the parabolic SAR (for now) are under the price, (indicating to go long). Historical seasonality charts (Q4+Jan.) look good.

Stats + sentiment = favorable.Pending reports + oil = caution.

Currently 70%S, and 30%I (fingers crossed).

Have a great day. :^But, be careful! Rgds

In mid to late September the market had a upward stall at the S&P 1131, and started another cycle down. However, that cycle was interrupted at 1102 on Seprember 28th. A new upward trend developed going into the Q4, and currently 1131.

Q4 and January are generally good months. Factors that could hinder market growth now come from earnings, employment, and oil. The big picture of 2004 places the market in bearish cycles. Will Q4 be a break out? Possible, if the factors mentioned stay in check. We have a delicate favorable trend of gains that needs to be watched with caution. If factors stay controlled, market sentiment would improve. We will just have to wait and see.

For the S-fund (^DWCP) the 20 day moving average and the parabolic SAR (for now) are under the price, (indicating to go long). Historical seasonality charts (Q4+Jan.) look good.

Stats + sentiment = favorable.Pending reports + oil = caution.

Currently 70%S, and 30%I (fingers crossed).

Have a great day. :^But, be careful! Rgds