One day after the broader market posted huge gains it came as no particular surprise that it decided to take a breather.

For the day, the DOW and S&P 500 shed 0.21% and 0.19% respectively, while the Nasdaq posted a gain of 0.22%.

News was light, but some data was released. The November ISM Manufacturing Index rose to 52.7 from 50.8 the prior month. That was a bit more than the anticipated reading of 51.0.

In October, domestic construction spending was up 0.8%, which easily beat estimates calling for a 0.3% increase.

And finally, weekly initial jobless claims moved higher to 402,000, which was higher than 390,000 that were expected.

Not much change in the charts this evening:

NAMO and NYMO remain on buys.

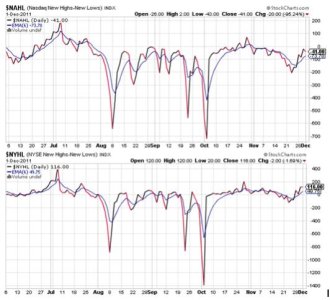

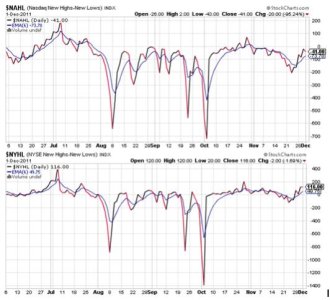

Same for NAHL and NYHL.

TRIN and TRINQ also remained on buys, but they are no longer suggesting an overbought market by this measure.

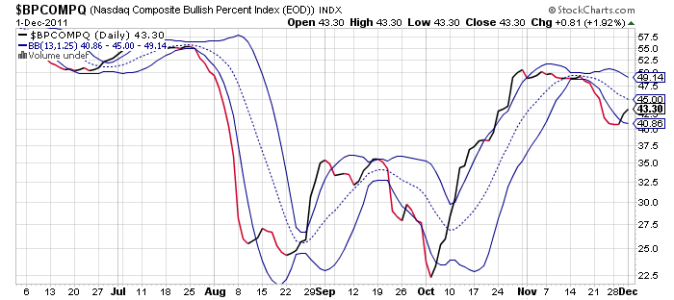

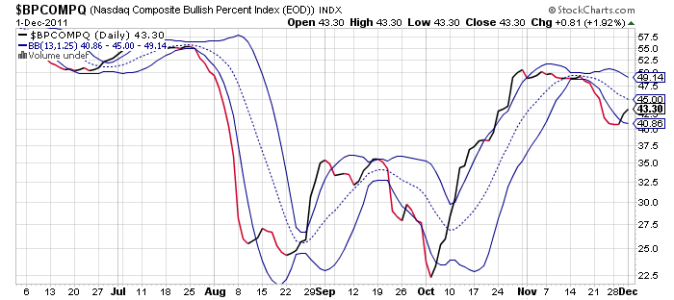

BPCOMPQ moved up a bit more today and also remains on a buy.

So all seven signals remain on buys from yesterday, which means the system has issued its second consecutive "unofficial" buy signal in as many days.

Officially, the system remains in an intermediate term sell condition.

My view hasn't changed since yesterday. There's a pretty reasonable chance the market moves higher at some point given yesterday's announcement of global Central Bank intervention. Longer term, I don't think it's a good thing, but I suspect it will push prices higher over the coming days/weeks. The only caveat I'd posit is that I'm not the only one who thinks CB intervention will boost prices and if sentiment has gotten bullish as a result, that bullishness may need to be punished first. We'll see how our sentiment survey for next week fares soon, so that may give us a clue.

For the day, the DOW and S&P 500 shed 0.21% and 0.19% respectively, while the Nasdaq posted a gain of 0.22%.

News was light, but some data was released. The November ISM Manufacturing Index rose to 52.7 from 50.8 the prior month. That was a bit more than the anticipated reading of 51.0.

In October, domestic construction spending was up 0.8%, which easily beat estimates calling for a 0.3% increase.

And finally, weekly initial jobless claims moved higher to 402,000, which was higher than 390,000 that were expected.

Not much change in the charts this evening:

NAMO and NYMO remain on buys.

Same for NAHL and NYHL.

TRIN and TRINQ also remained on buys, but they are no longer suggesting an overbought market by this measure.

BPCOMPQ moved up a bit more today and also remains on a buy.

So all seven signals remain on buys from yesterday, which means the system has issued its second consecutive "unofficial" buy signal in as many days.

Officially, the system remains in an intermediate term sell condition.

My view hasn't changed since yesterday. There's a pretty reasonable chance the market moves higher at some point given yesterday's announcement of global Central Bank intervention. Longer term, I don't think it's a good thing, but I suspect it will push prices higher over the coming days/weeks. The only caveat I'd posit is that I'm not the only one who thinks CB intervention will boost prices and if sentiment has gotten bullish as a result, that bullishness may need to be punished first. We'll see how our sentiment survey for next week fares soon, so that may give us a clue.