Yesterday I said the market often doesn't reveal its true direction until we're past the Fed announcement. Today the market made its move and it wasn't even volatile. We had strong, broad-based buying pretty much all day as a result of the Fed's quantitative easing plan. In fact, the major indexes set fresh 2-year highs as a result.

And it wasn't just stocks that rallied, bonds also tacked on impressive gains as well as the 10 year Note saw its yield drop to 2.48%. Of course the dollar dropped in today's action and ended the day with a 0.5% loss.

Lost in the QE2 party was the fact that the President was now open to extending the Bush tax cuts for all incomes.

Economic data really didn't matter again today as initial jobless claims rose to 457,000, which is higher than the 445,000 that was expected. Continuing claims fell to 4.34 million.

Volume spiked today, hitting its highest level in two weeks, while the VIX is back near its 6 month low.

Here's today's charts:

Both NAMO and NYMO spike higher today and remain on buys.

Big spike up for both NAHL and NYHL too. Two more buys.

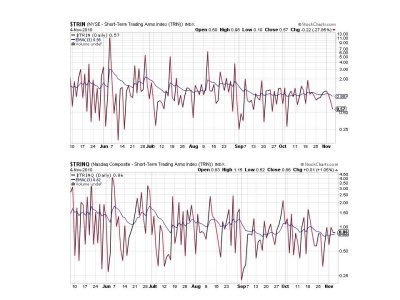

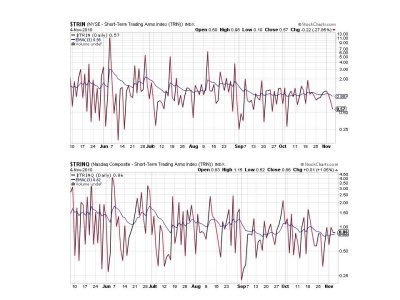

TRIN remains on a buy, while TRINQ is a weak sell.

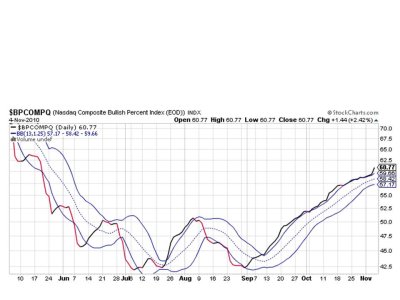

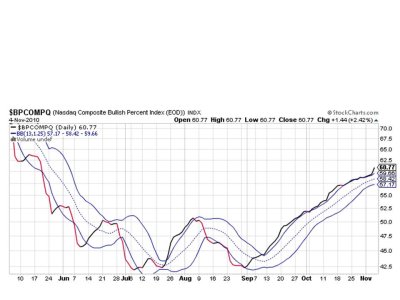

So we have 6 of 7 signals flashing buys, which keeps the system on a buy.

The momentum today was impressive and the charts certainly appear bullish. What remains to be seen is how sentiment responds to this week's events and how the market reacts to tomorrow's non-farm payroll numbers.

And it wasn't just stocks that rallied, bonds also tacked on impressive gains as well as the 10 year Note saw its yield drop to 2.48%. Of course the dollar dropped in today's action and ended the day with a 0.5% loss.

Lost in the QE2 party was the fact that the President was now open to extending the Bush tax cuts for all incomes.

Economic data really didn't matter again today as initial jobless claims rose to 457,000, which is higher than the 445,000 that was expected. Continuing claims fell to 4.34 million.

Volume spiked today, hitting its highest level in two weeks, while the VIX is back near its 6 month low.

Here's today's charts:

Both NAMO and NYMO spike higher today and remain on buys.

Big spike up for both NAHL and NYHL too. Two more buys.

TRIN remains on a buy, while TRINQ is a weak sell.

So we have 6 of 7 signals flashing buys, which keeps the system on a buy.

The momentum today was impressive and the charts certainly appear bullish. What remains to be seen is how sentiment responds to this week's events and how the market reacts to tomorrow's non-farm payroll numbers.