Market Forecast

July 26-30th

July 26-30th

Last week we established a higher high & lower low, sort of an outside week which could signal a turn for the markets. Although I remain cautious, we do appear poised to make a run for the 1125-1135 area. This is critical because this area could transition us from a Bear to Bull market, as we will have established higher highs & lows. Going into this week we also have the "now famous" Mutual Fund Monday, and historically we'll see some end of month buying.

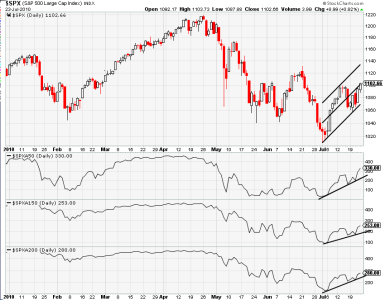

If you are a Channel Surfer, then you are probably starting to get optimistic. The channels are all within acceptable levels, with July & Mid-June's channel on target, with May's channel showing a potential test of 1125 before being considered overbought. You may have noticed that Mid-June's channel now has a slight rise to it, this it exactly what a transitioning market looks like.

For long-term traders looking at the Linear Regression Lines, going back 200 days we still have ever-so-slightly rising prices. The 200LRL is showing just how important this 1125 area is, as 200 days worth of prices currently reside in this area. You may have noticed the 20 has flipped over the 50 and this is great in the short-term, but what we really want to see is the 50 flip back over the 200.

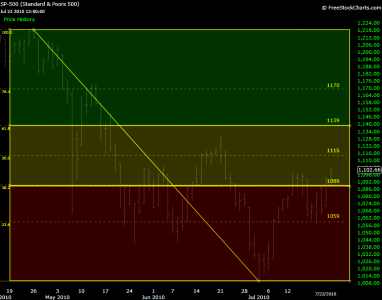

For Fibonacci fans, there are many different time-frames and price levels for which to choose, but for now I've chosen the May peak & July bottom. I chose this level because I believe it's the best defensive play to make, and right now it's showing we've broken into the neutral yellow zone. Over this time-frame we are neutral with a bearish bias. Once we break above the 50% 1115 level we become neutral with a bullish bias because a break above 50% will put prices in the bull camp. If we close above the 1139 61.8% level, I put on the bull cap and look for a test of 1220.

Going into Monday, the YTD Bollinger Band price performance chart shows 1.34% upside potential, with -7.54% downside potential. As a word of caution, I'd say this chart shows the classic "buy at the top" setup. Had the purchase been made at 1065, I would have called this a great entry point, coulda, shoulda, woulda...

Lastly, off the July bottom, the number of stocks trading above the 50/150/200 day moving average, are confirming the recent price trend.

To summarize, it's still a bear market, but the bulls have control over the short-mid term charts. I can easily see prices rising to 1125-1135 this week, but I'm not going to pretend this volatility hasn't been making a fool out of all of us too. My original plan was to use my last IFT to get into position going into August, however I may alter those plans and jump in Monday to get ahead of the price action.

Take care and trade safe...Jason