The market started out a bit ugly, but a strong bull market tends to shrug off negativity and today the dip buyers stepped back in to keep losses contained.

The situation across the pond (Greece and Portugal front and center) continues to spook markets to some extent as creditors and EU Pols keep applying pressure. I've been posting media reports about this situation in my account talk thread during the week, so I won't get into any details here.

There was only a couple data points released today. Personal income in December rose 0.5%, while personal spending was flat. Neither number was a surprise.

Let's get to the charts:

NAMO and NYMO both dipped today and do give the appearance that they may be poised to dip further still. I think there's a good chance in the short term that they will too, but I'm still of the opinion total downside will be limited. Both are now in sell conditions.

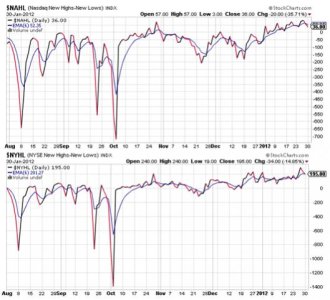

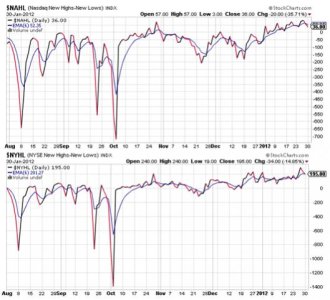

NAHL and NYHL both dipped today as well and also flipped to sells.

TRIN fell a bit today, but remained on a sell, while TRINQ flipped to buy. These signals suggest downward pressure may be limited.

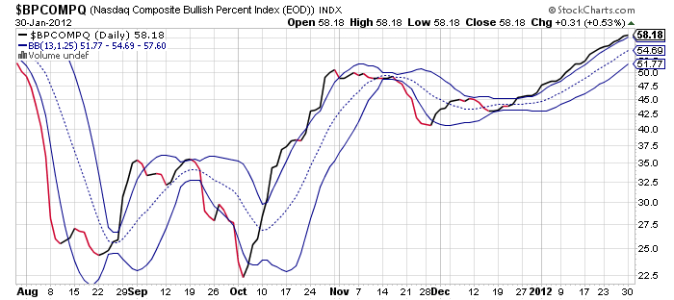

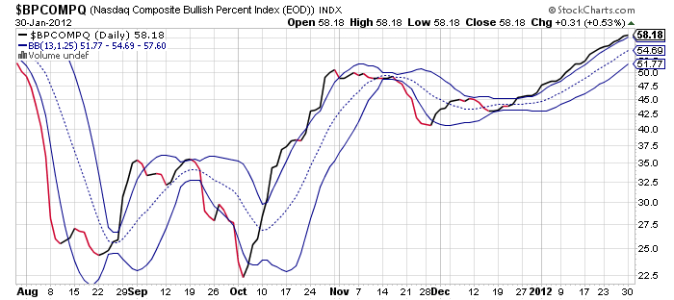

BPCOMPQ continues to track along that upper bollinger band and remains on a buy.

So the signals are mixed, which keeps the Seven Sentinels in a buy condition.

I continue to believe higher prices are coming; short term downside pressure notwithstanding. Things could change, but I think sentiment will have to get more bulled up in many pockets before we might see an intermediate term leg to the downside.

The situation across the pond (Greece and Portugal front and center) continues to spook markets to some extent as creditors and EU Pols keep applying pressure. I've been posting media reports about this situation in my account talk thread during the week, so I won't get into any details here.

There was only a couple data points released today. Personal income in December rose 0.5%, while personal spending was flat. Neither number was a surprise.

Let's get to the charts:

NAMO and NYMO both dipped today and do give the appearance that they may be poised to dip further still. I think there's a good chance in the short term that they will too, but I'm still of the opinion total downside will be limited. Both are now in sell conditions.

NAHL and NYHL both dipped today as well and also flipped to sells.

TRIN fell a bit today, but remained on a sell, while TRINQ flipped to buy. These signals suggest downward pressure may be limited.

BPCOMPQ continues to track along that upper bollinger band and remains on a buy.

So the signals are mixed, which keeps the Seven Sentinels in a buy condition.

I continue to believe higher prices are coming; short term downside pressure notwithstanding. Things could change, but I think sentiment will have to get more bulled up in many pockets before we might see an intermediate term leg to the downside.