MARCON

Is it time to throw in the towel?

Is it time to throw in the towel?

Reminder: All MARCON charts are judged off the 6-month window. The horizontal lines represent percentile levels within the 6-month high/low

Green = 90% of the highest intraday and lowest intraday price within the 6-month high/low

Blue = 75% of the highest intraday and lowest intraday price within the 6-month high/low

Yellow = 50% of the highest intraday and lowest intraday price within the 6-month high/low

Orange = 25% of the highest intraday and lowest intraday price within the 6-month high/low

Red = 10% of the highest intraday and lowest intraday price within the 6-month high/low

F-Fund: Trading in a 26-day intermediate uptrend, within a 93-day long-term downtrend. This week AGG is the strongest chart gaining 8% now trading at 60%. Back in 2009 I did a blog called AGG's Spike Highs Those two white circles represent what I believe to be a decent example of a spike high. We also failed to close above a 50% replacement off the 6-month high/low. From my perspective, this is not a good place to take an entry, in the big picture AGG is still in a Bear market. If you were thinking of an entry, I would wait (and judge) the reaction off the bottom green rising trend line.

C-Fund: Trading in a 20-day intermediate downtrend, within a 108-day long-term uptrend. This week the S&P 500 is the weakest chart losing 16% now trading at 40%. Falling 41% that's a fair amount of technical damage. For the Bulls, within the white box, look for a close above 1296.56 and 1320.32 . For the Bears a press and/or close below the current low of 1249.05 indicates more technical damage to be had.

S-Fund: Trading in a 20-day intermediate downtrend, within a 107-day long-term uptrend. This week the W4500 is in the middle of the pack, losing 14% now trading at 46%. Roughly the same analysis as the S&P 500, except it fell 35% (instead of the S&P 500's 41%.) For the Bulls, within the white box, look for a close above 681.96 and 695.89 . For the Bears a press and/or close below the current low of 654.10 indicates more technical damage to be had.

I-Fund: Overall falling 14% to 54%

EFA: Falling 28% to 32% EFA is Trading in a 20-day intermediate downtrend, within a 107-day long-term uptrend. This is essentially a slow-motion gappy crash with prices falling 91% but hey, check out the 46% (off the 16 Feb low) bounce! That's promising, especially when you consider it closed above the 50% level within the 6-month window.

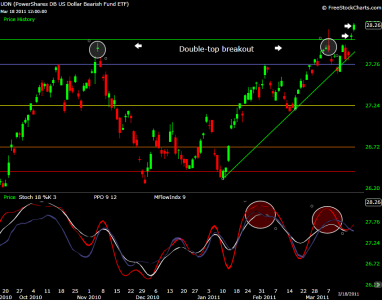

UDN: The Bearish Dollar ETF remains the same at 76% currently trading within a 6-month high. 2 closes above two prior tops making for a Double-top breakout! One word or caution here, (see red circles) the Momentum, Trend, and Volume indicators are showing a divergence from prices.

Observations: Most indexes closed on Friday with above average positive volume.

Personal note: As I write this, world events from Japan to Libya are on the front burner. I can't predict the outcome of what effect these events will have on the markets, what I can do is watch prices and make judgments based on my own risk tolerance, and my last entry into stocks. For myself, I need more than a .75% exit to have made this last IFT worth my while.

Take care...Jason