We haven't seen many closes in the red this month, but we did get one today. Certainly not enough to do much technical damage, however.

We did get some market data today. Durable goods orders for December were up 2.1% less autos and up 3.0% including autos. Weekly initial jobless claims pretty much hit estimates at 377,000, while new home sales fell to an annualized rate of 307,000 in December. Also, leading indicators for December were up 0.4%, but that was under estimates looking for a 0.7% advance.

So what do we make of today's negative close? Is the market finally losing steam or simply gathering more strength?

Let's look at the charts:

Back to sells for NAMO and NYMO.

NAHL and NYHL are showing more strength and remain in buy conditions.

Both TRIN and TRINQ flipped to sells. While the readings are not overly negative, they do suggest the selling pressure may not be over.

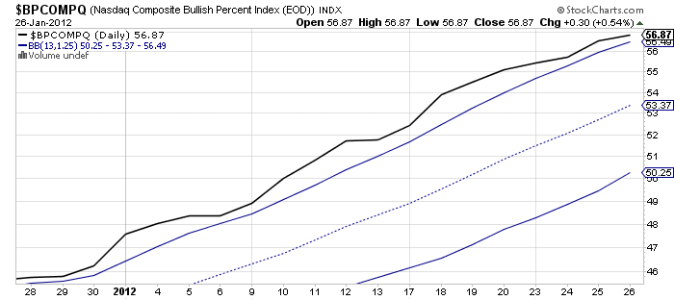

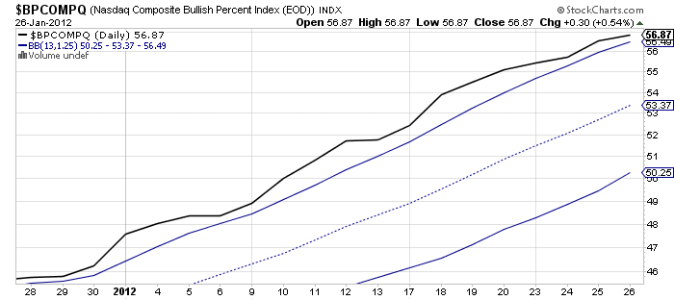

BPCOMPQ tracked a bit higher today and continues to skirt along that upper bollinger band. It remains on a buy.

So the signals are mixed, but the system remains in a buy condition.

Given the readings for TRIN and TRINQ I'd have to think there's a reasonable chance that we'll see some measure of continued weakness next week. It's not a high confidence call to get overly bearish here though, until I see these signals turn down some more. Follow through to the downside would be more meaningful, but the up trend is strong and getting too defensive at this point may not be the best play.

Stop by Sunday evening and I'll have the tracker charts posted. Last week we were holding high levels of cash (G fund). I had said that this was probably a good indication of limited downside, which is certainly was. Has that changed? We'll see.

We did get some market data today. Durable goods orders for December were up 2.1% less autos and up 3.0% including autos. Weekly initial jobless claims pretty much hit estimates at 377,000, while new home sales fell to an annualized rate of 307,000 in December. Also, leading indicators for December were up 0.4%, but that was under estimates looking for a 0.7% advance.

So what do we make of today's negative close? Is the market finally losing steam or simply gathering more strength?

Let's look at the charts:

Back to sells for NAMO and NYMO.

NAHL and NYHL are showing more strength and remain in buy conditions.

Both TRIN and TRINQ flipped to sells. While the readings are not overly negative, they do suggest the selling pressure may not be over.

BPCOMPQ tracked a bit higher today and continues to skirt along that upper bollinger band. It remains on a buy.

So the signals are mixed, but the system remains in a buy condition.

Given the readings for TRIN and TRINQ I'd have to think there's a reasonable chance that we'll see some measure of continued weakness next week. It's not a high confidence call to get overly bearish here though, until I see these signals turn down some more. Follow through to the downside would be more meaningful, but the up trend is strong and getting too defensive at this point may not be the best play.

Stop by Sunday evening and I'll have the tracker charts posted. Last week we were holding high levels of cash (G fund). I had said that this was probably a good indication of limited downside, which is certainly was. Has that changed? We'll see.