Another low volume day, another day with no catalyst to drive the market. The S&P saw its streak of up days come to end today, albeit in modest fashion, but there was a spike in selling volume during the last 30 minutes of trading. A spike relative to the low volume we have been seeing anyway. It's just something I noted when looking at the chart and may or may not mean anything other than some profit taking. But the market has been clinging to the unchanged line for the first two trading days of this week which is noteworthy for timers. But it's tough to interpret the charts when the main players are not participating.

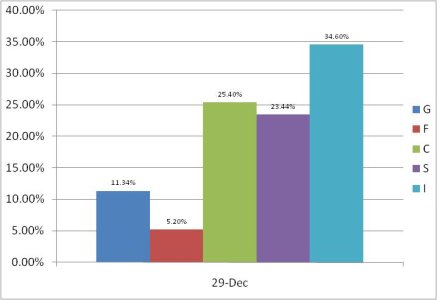

Here's the charts for today:

The modest selling pressure is taking its toll on the charts here. Three of them are flashing sells while NAMO is borderline.

TRIN and TRINQ have flipped to sells too, but BPCOMPQ remains on a buy, which is a positive if your bullish on the market.

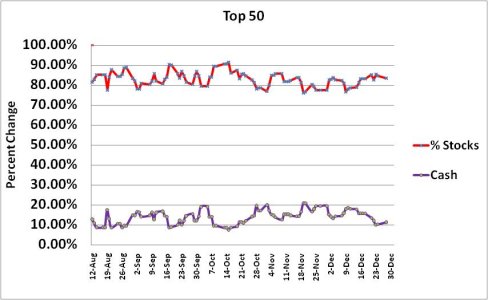

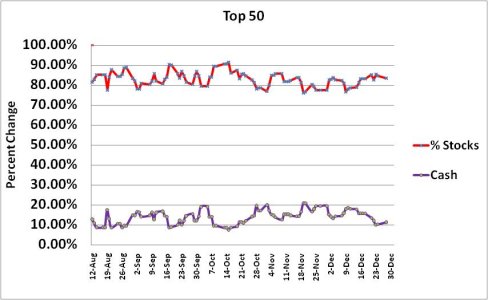

I made a minor change to the tracker graphs. Instead of using the Top 25% I'm now using the Top 50. We've had so many new folks join us on the tracker that I could no longer justify using a percentage, so we'll just track the top 50. I was using a total close to that number already, so there's really not much change to the charts.

So 5 of 7 sentinels are flashing sells, one is a borderline sell, and one is still on a buy. We are due for some profit taking so keep in mind that further selling pressure on the market could flip the last two sentinels to a sell triggering a sell for the system.

As I've mentioned already, it's difficult to interpret the charts in this low volume holiday activity so I can't draw any hard conclusions, but the market does look tired. See you tomorrow.

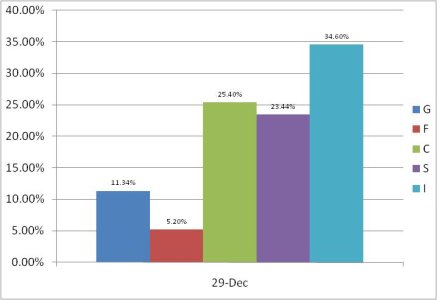

Here's the charts for today:

The modest selling pressure is taking its toll on the charts here. Three of them are flashing sells while NAMO is borderline.

TRIN and TRINQ have flipped to sells too, but BPCOMPQ remains on a buy, which is a positive if your bullish on the market.

I made a minor change to the tracker graphs. Instead of using the Top 25% I'm now using the Top 50. We've had so many new folks join us on the tracker that I could no longer justify using a percentage, so we'll just track the top 50. I was using a total close to that number already, so there's really not much change to the charts.

So 5 of 7 sentinels are flashing sells, one is a borderline sell, and one is still on a buy. We are due for some profit taking so keep in mind that further selling pressure on the market could flip the last two sentinels to a sell triggering a sell for the system.

As I've mentioned already, it's difficult to interpret the charts in this low volume holiday activity so I can't draw any hard conclusions, but the market does look tired. See you tomorrow.