Today wasn't nearly as volatile as I expected, but what didn't surprise me was how futures turned out to be a fade. The dip buyers are now convinced we have another intermediate term uptrend. It's being declared in many places, which makes me skeptical. Skeptical, but not bearish.

I won't bother trying to analyze the action today as it was OPEX, which is more about the Options players getting positioned for the next month than anything else.

Of course the Seven Sentinels remain on a buy as no damage was done to technicals all week. Here's today's charts:

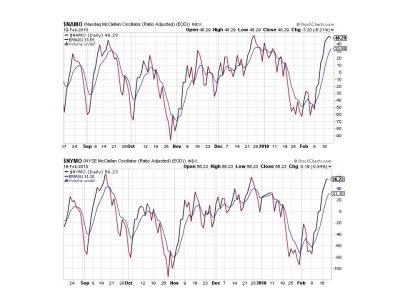

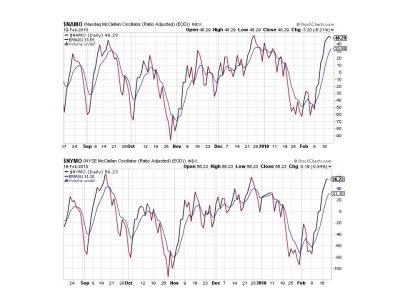

Looks like a top may be forming on NAMO and NYMO, which leads me to believe we will see some selling next week, but it needn't be significant. Notice the 6 day EMA is now as high as it's been since last summer. We're due for some consolidation at the very least.

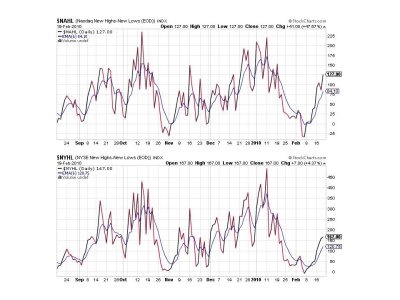

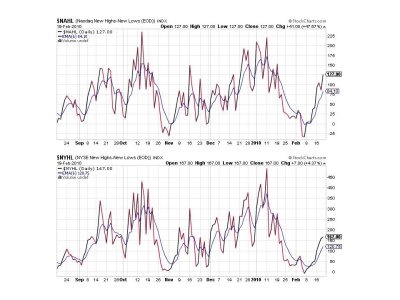

NAHL flipped higher again, while NYHL extended to the upside. Looks bullish to me.

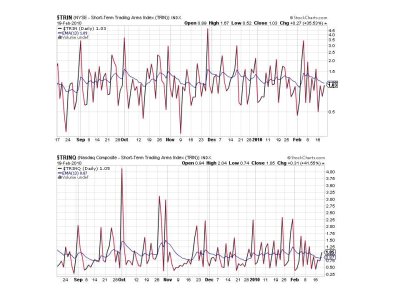

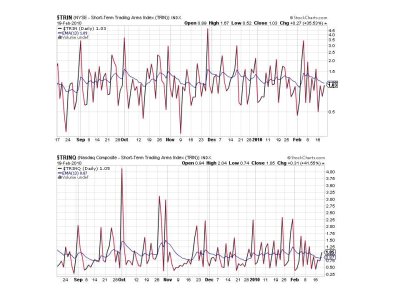

TRIN and TRINQ remain close to their 13 day EMAs, but TRINQ did flip to a sell. No concerns here either.

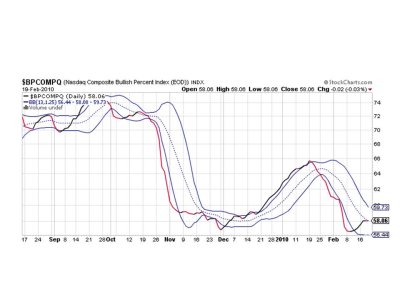

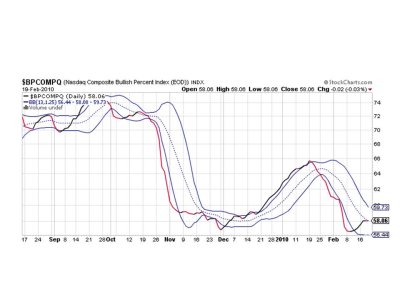

BPCOMPQ continued yesterday's sideways action, but is well within the bollinger bands and should remain on a buy even with moderate selling pressure.

All in all the charts look bullish, but due for a rest. Dips are likely to be bought again too, so if we get a good decline you might want to consider buying it. As long as the SS remain on a buy it should be a good play. We aren't seeing as extreme of reversals as we saw last year (so far), so I'd tend to be a little more patient with the signals at this point. For now this uptrend looks like the real deal.

I'm hoping the last week of February brings some consolidation/selling pressure though (it usually happens after OPEX), as it would afford me, and anyone else currently out of IFTs, an opportunity to buy back in again the first week of March. I just have to pick my spot, assuming things don't fall apart first, which I don't see happening at this point.

The Top 15 made a few moves today and the Top 50 increased their cash position. I'll post those charts later this weekend. See you then.

I won't bother trying to analyze the action today as it was OPEX, which is more about the Options players getting positioned for the next month than anything else.

Of course the Seven Sentinels remain on a buy as no damage was done to technicals all week. Here's today's charts:

Looks like a top may be forming on NAMO and NYMO, which leads me to believe we will see some selling next week, but it needn't be significant. Notice the 6 day EMA is now as high as it's been since last summer. We're due for some consolidation at the very least.

NAHL flipped higher again, while NYHL extended to the upside. Looks bullish to me.

TRIN and TRINQ remain close to their 13 day EMAs, but TRINQ did flip to a sell. No concerns here either.

BPCOMPQ continued yesterday's sideways action, but is well within the bollinger bands and should remain on a buy even with moderate selling pressure.

All in all the charts look bullish, but due for a rest. Dips are likely to be bought again too, so if we get a good decline you might want to consider buying it. As long as the SS remain on a buy it should be a good play. We aren't seeing as extreme of reversals as we saw last year (so far), so I'd tend to be a little more patient with the signals at this point. For now this uptrend looks like the real deal.

I'm hoping the last week of February brings some consolidation/selling pressure though (it usually happens after OPEX), as it would afford me, and anyone else currently out of IFTs, an opportunity to buy back in again the first week of March. I just have to pick my spot, assuming things don't fall apart first, which I don't see happening at this point.

The Top 15 made a few moves today and the Top 50 increased their cash position. I'll post those charts later this weekend. See you then.