I'm going straight to the charts tonight as I'm running a bit late this evening.

NAMO and NYMO both improved, but remain just inside of sell territory.

NAHL also improved, but remains on a sell while NYHL just did turn back to a buy.

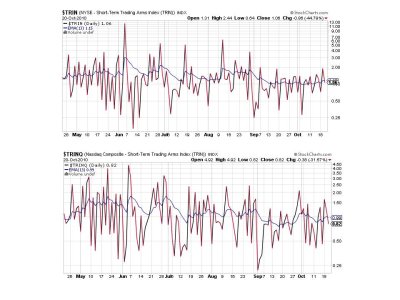

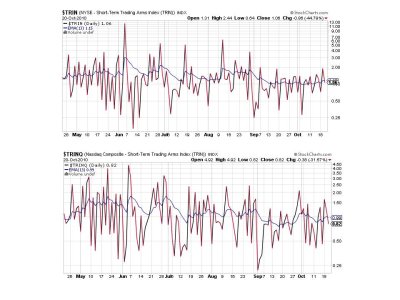

TRIN and TRINQ both flipped back to buys.

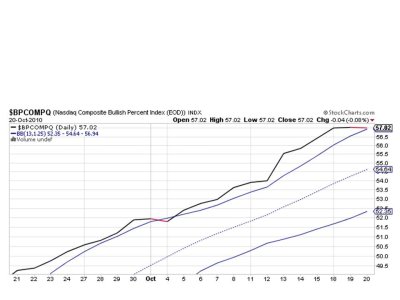

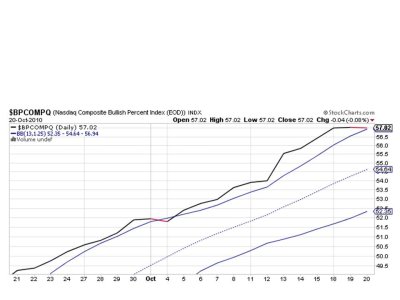

BPCOMPQ remains on a buy, but didn't make a bullish move today. This is not necessarily a problem at the moment, but I need to see this signal turn back up to maintain a higher level of confidence in the intermediate term buy signal.

So we have 4 of 7 signals flashing buys, which keeps the system on a buy. I am looking for volatility now. I really don't think today was a dead cat bounce, but I also don't think we've seen the last of the short term selling pressure. Today's action in the market was bullish overall, and I think sentiment is going to put a floor under the market, but where that floor is I cannot be sure.

If we get any follow-through upside pressure tomorrow, I will probably lighten up a bit more, but not too much just yet. Not as long as I have a Sentinels buy signal. I just don't think we've seen "the" top yet, but we may be starting a drawn out top forming process which will eventually give us a top. For now I remain cautiously bullish, but looking to draw down stock exposure on strength.

NAMO and NYMO both improved, but remain just inside of sell territory.

NAHL also improved, but remains on a sell while NYHL just did turn back to a buy.

TRIN and TRINQ both flipped back to buys.

BPCOMPQ remains on a buy, but didn't make a bullish move today. This is not necessarily a problem at the moment, but I need to see this signal turn back up to maintain a higher level of confidence in the intermediate term buy signal.

So we have 4 of 7 signals flashing buys, which keeps the system on a buy. I am looking for volatility now. I really don't think today was a dead cat bounce, but I also don't think we've seen the last of the short term selling pressure. Today's action in the market was bullish overall, and I think sentiment is going to put a floor under the market, but where that floor is I cannot be sure.

If we get any follow-through upside pressure tomorrow, I will probably lighten up a bit more, but not too much just yet. Not as long as I have a Sentinels buy signal. I just don't think we've seen "the" top yet, but we may be starting a drawn out top forming process which will eventually give us a top. For now I remain cautiously bullish, but looking to draw down stock exposure on strength.