It seems the stock market is now preoccupied with the question of how much QE2 the Fed may use and in what manner of distribution. Talk of using QE2 in a measured manner vice the shock and awe method used previously is causing the dollar to increase in strength and treasuries to sell off. In just two weeks the dollar is up close to 3%, which as you are probably already aware is having a significant negative impact on the I fund's valuation.

That dollar strength once again led to weakness in equities for most of day, but dip buyers stepped in once again late in the trading day turning significant losses into modest ones, although the Nasdaq ended the day up almost .25%.

Treasuries have not been benefiting from stock losses of late either as AGG was down 0.19%. Our F fund has not seen this kind of pressure is quite some time.

On the data front today, durable goods orders for September were up 3.3%, which was significantly better than the expected 1.8% increase, but minus transportation orders actually fell 0.8%, which was more than expected.

New home sales for September were up 6.6%, which was bit better than expected.

The selling pressure we saw early on today put the Seven Sentinels in jeopardy of triggering a sell signal, but that late day rally was enough to prevent that from happening. At least for now. Here's today's charts:

We have two sells for NAMO and NYMO and both are now in negative territory.

NAHL and NYHL are also on sells.

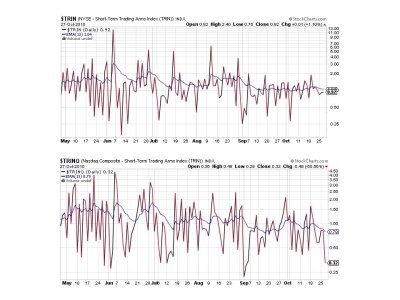

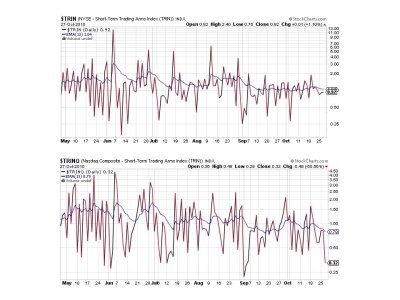

Both TRIN and TRINQ managed to remain in buy status today.

BPCOMPQ crossed that upper band to the downside today, which triggers a sell for this signal, putting the system that much closer to a sell than yesterday's close.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy. But this market certainly appears dicey and the Sentinels, while on a buy, look ragged. It's very difficult to say how this market will trade over the next week with elections and FOMC decisions hanging in the balance. I am inclined to think we are seeing topping action in this intermediate term advance, and that may prove to be true, but this volatility could go on for a few days yet and keep the market in a relatively tight range before we break out one way or the other.

That dollar strength once again led to weakness in equities for most of day, but dip buyers stepped in once again late in the trading day turning significant losses into modest ones, although the Nasdaq ended the day up almost .25%.

Treasuries have not been benefiting from stock losses of late either as AGG was down 0.19%. Our F fund has not seen this kind of pressure is quite some time.

On the data front today, durable goods orders for September were up 3.3%, which was significantly better than the expected 1.8% increase, but minus transportation orders actually fell 0.8%, which was more than expected.

New home sales for September were up 6.6%, which was bit better than expected.

The selling pressure we saw early on today put the Seven Sentinels in jeopardy of triggering a sell signal, but that late day rally was enough to prevent that from happening. At least for now. Here's today's charts:

We have two sells for NAMO and NYMO and both are now in negative territory.

NAHL and NYHL are also on sells.

Both TRIN and TRINQ managed to remain in buy status today.

BPCOMPQ crossed that upper band to the downside today, which triggers a sell for this signal, putting the system that much closer to a sell than yesterday's close.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy. But this market certainly appears dicey and the Sentinels, while on a buy, look ragged. It's very difficult to say how this market will trade over the next week with elections and FOMC decisions hanging in the balance. I am inclined to think we are seeing topping action in this intermediate term advance, and that may prove to be true, but this volatility could go on for a few days yet and keep the market in a relatively tight range before we break out one way or the other.