12/16/25

The Nasdaq's big tech leaders continue to be a drag on the large cap indices, and over the last couple of days, small caps have fallen in sympathy. The mid-December hiccup continues and the bulls are looking for a late month rally. The I-fund held onto a gain yesterday and continues to flirt with all time highs.

The Santa Claus rally officially starts near December 21st, but on average the lows in December are made closer to the 15th. That's on average, not every year as we have had some poor December in the last decade.

Yields and the dollar were down yesterday but both closed off the lows as they remain below resistance, but the 10-year continues to flirt with that overhead 200-day average.

The dollar was down most of the day and remains below some key levels keeping it in a downtrend. That favors the I-fund which was the only TSP stock fund with a gain yesterday.

The S&P 500 (C-fund) continues to fill out what looks like the right shoulder of an inverted head and shoulders pattern. The left shoulder took 3+ weeks to form. There doesn't have to be a correlation, but we're about three weeks into the right shoulder's development. With this inverted head and shoulders pattern, the S&P has basically moved sideways for two months, which is pretty good consolidation, and these tend to break upward, but sometimes they retest the middle of the head first, which would not be ideal. I didn't like that the high yesterday was at the old broken support line.

Apple had an interesting day yesterday so let's take a look since it is such an integral part of the S&P 500.

After looking like a good set up for a rally off support, Apple created a negative outside reversal day yesterday. Those are not usually good news for a chart, but interestingly the last negative outside reversal day on this chart was in August, and that turned out to be a low. Then the chart held on every test of that 30 day average since. It's at a pivotal spot here.

The recent leaders have been the Dow Transportation Index and the small caps of the Russell 2000. Both have pulled back recently and are testing the bottom of their narrow trading channels. There's plenty of room for these to pullback after those big rallies, but the calendar may try to help them keep running.

They may or may not get help help from the jobs report, which comes out this morning before the opening bell. We will get both the October and the November data. Estimates for the October report are a gain of 55,000 jobs, and November's estimate is +25,000.

The question is, will a strong jobs report be good or bad for stocks? Too strong and the Fed may pass on future interest rates. Too weak and the economy could be in trouble. We may need a Goldilocks report that is just right.

The DWCPF Index (S-Fund) pulled back for a second straight day, retracing the two day rally prior to the pullback. If this is creating a right shoulder of an inverted head and shoulders pattern, it may have some room to fall, but a shoulder doesn't have to fill out completely. Just some consolidation below the highs would suffice, but it certainly looks like there's some short term vulnerability.

ACWX (I-fund) was up yesterday, hanging around its all time highs. It looks like a failed breakout right now as it remains below the highs, but the narrow rising channel, or F-flag, remains intact. If a proper right shoulder wants to form, the open gap near 65.50 would be a potential target, but will they make it that easy for the chart readers? The I-fund is up over 30% this year.

BND (bonds / F-fund) was up after a modest dip in yields yesterday, and the bond market may have its eyes on the jobs report to determine if it wants to recapture the broken support line and keep the rally going, or if wants to fall back below the 50-day average and perhaps start a down trend.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The Nasdaq's big tech leaders continue to be a drag on the large cap indices, and over the last couple of days, small caps have fallen in sympathy. The mid-December hiccup continues and the bulls are looking for a late month rally. The I-fund held onto a gain yesterday and continues to flirt with all time highs.

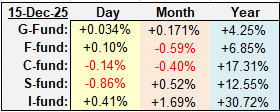

| Daily TSP Funds Return More returns |

The Santa Claus rally officially starts near December 21st, but on average the lows in December are made closer to the 15th. That's on average, not every year as we have had some poor December in the last decade.

Yields and the dollar were down yesterday but both closed off the lows as they remain below resistance, but the 10-year continues to flirt with that overhead 200-day average.

The dollar was down most of the day and remains below some key levels keeping it in a downtrend. That favors the I-fund which was the only TSP stock fund with a gain yesterday.

The S&P 500 (C-fund) continues to fill out what looks like the right shoulder of an inverted head and shoulders pattern. The left shoulder took 3+ weeks to form. There doesn't have to be a correlation, but we're about three weeks into the right shoulder's development. With this inverted head and shoulders pattern, the S&P has basically moved sideways for two months, which is pretty good consolidation, and these tend to break upward, but sometimes they retest the middle of the head first, which would not be ideal. I didn't like that the high yesterday was at the old broken support line.

Apple had an interesting day yesterday so let's take a look since it is such an integral part of the S&P 500.

After looking like a good set up for a rally off support, Apple created a negative outside reversal day yesterday. Those are not usually good news for a chart, but interestingly the last negative outside reversal day on this chart was in August, and that turned out to be a low. Then the chart held on every test of that 30 day average since. It's at a pivotal spot here.

The recent leaders have been the Dow Transportation Index and the small caps of the Russell 2000. Both have pulled back recently and are testing the bottom of their narrow trading channels. There's plenty of room for these to pullback after those big rallies, but the calendar may try to help them keep running.

They may or may not get help help from the jobs report, which comes out this morning before the opening bell. We will get both the October and the November data. Estimates for the October report are a gain of 55,000 jobs, and November's estimate is +25,000.

The question is, will a strong jobs report be good or bad for stocks? Too strong and the Fed may pass on future interest rates. Too weak and the economy could be in trouble. We may need a Goldilocks report that is just right.

The DWCPF Index (S-Fund) pulled back for a second straight day, retracing the two day rally prior to the pullback. If this is creating a right shoulder of an inverted head and shoulders pattern, it may have some room to fall, but a shoulder doesn't have to fill out completely. Just some consolidation below the highs would suffice, but it certainly looks like there's some short term vulnerability.

ACWX (I-fund) was up yesterday, hanging around its all time highs. It looks like a failed breakout right now as it remains below the highs, but the narrow rising channel, or F-flag, remains intact. If a proper right shoulder wants to form, the open gap near 65.50 would be a potential target, but will they make it that easy for the chart readers? The I-fund is up over 30% this year.

BND (bonds / F-fund) was up after a modest dip in yields yesterday, and the bond market may have its eyes on the jobs report to determine if it wants to recapture the broken support line and keep the rally going, or if wants to fall back below the 50-day average and perhaps start a down trend.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.