Different day, same results.

Stocks traded around the neutral line again today. At the close the S&P 500 eked out a 0.1% gain, while the DOW and Nasdaq fared a bit better with 0.45% and 0.29% gains respectively.

There was only one economic data point of interest and that was the June ISM Non-Manufacturing Survey, which came in at 53.3; under the 54.0 economists were looking for.

Perhaps traders are awaiting tomorrow's weekly initial jobless claims number along with the ADP Employment Report. Both occur one day before release of the Nonfarm Payrolls Report on Friday.

Notably, our I fund under-performed the C and S funds, which was due to a 0.6% advance by the dollar. That advance was largely at the euro's expense after analysts at Moody's downgraded Portugal's debt yesterday afternoon.

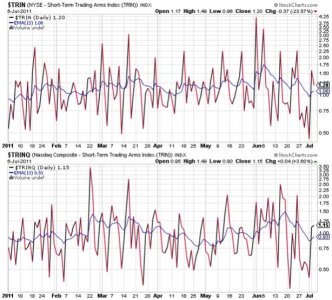

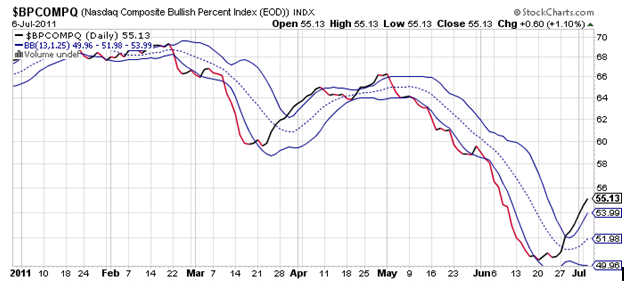

Here's today's charts:

Still on buys here.

Same here.

TRIN and TRINQ are near their respective neutral lines, but remain on sells.

BPCOMPQ edged up a bit more today. It remains in a buy condition.

So the signals are in the same condition they were yesterday, which keeps the system on a buy.

Perhaps the market will find its next catalyst among the employment data that's on tap for the balance of this week. In any event, I am going to be patient with my next entry point. Buying on strength doesn't make a lot of sense to me at the moment and with so much time left to the month I'd like to make the most of my two IFTs. A move lower now would probably be bought, but it will depend on much weakness we get whether I'll redeploy my capital. That's assuming we get that weakness of course.