The market began the trading day modestly lower, but managed to find a bottom shortly after the first half hour of trading. From there it chopped higher until early afternoon before chopping lower in the close. Overall, it was a mixed day with the major indexes closing relatively flat.

It was another light day for market data, but we did see ISM Services for March drop to 57.3 from its previous reading 59.7 in February.

Afternoon trade was influenced to some extent by the release of the minutes from the last FOMC meeting. Not surprisingly, the Fed Chiefs are not in agreement on the way forward. Evidence of a stronger recovery with higher inflation or rising inflation expectations prompted some of the voting members to suggest reducing the current asset purchase program in response to those concerns, while others wanted no adjustments at this time. It also appears to be their collective belief that the recent increases in the prices of energy and other commodities will only have a transitory increase in inflation.

So far this week the bullish sentiment we've been seeing is being supported by the continued liquidity being pumped into the market. This has been a common theme since last September, although it took awhile for bullish levels to rise when the bull run first began. And that "V" bottom we saw a couple weeks ago seems like a distant memory already.

But the S&P is hitting major resistance as it has yet to eclipse its previous 2 year high, which was set on the 17th of February when it closed at 1343.01. I'm anticipating that the index will eventually push past this level, but will we see some weakness first? You've heard me say it before, and that is liquidity may not allow for much downside action. And so far that's been the case. Having said that, if we do get any weakness it'll probably be bought, so I'm not so sure I'd wait too long to get reinvested should that opportunity present itself. But there is also plenty of room for caution as I'll show you in this evening's charts:

NAMO and NYMO have taken a breather and remain on buys, but look how high their 6 day EMAs are. I put up 1 year charts this evening so you can see that the 6 day EMA is getting close to levels not seen since last July and September. In July when we hit near this level we had a moderate decline before moving higher again, then chopping around sideways, before finally dropping about 100 S&P points over a 3 week period. But in September the market did a grind higher instead, while the momentum in these signals moved lower. I think QE2 favors the latter outcome, but you can see where the risk is.

NAHL and NYHL also are at relatively high 6 day EMAs. NAHL just did flip to a sell today, while NYHL remained on a buy.

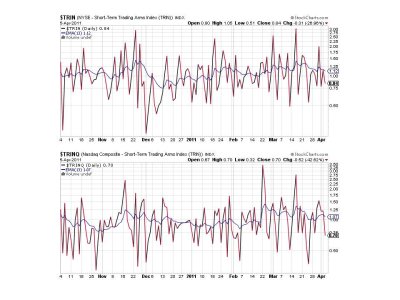

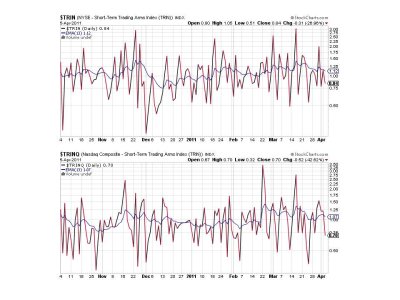

TRIN and TRINQ are flashing buys today.

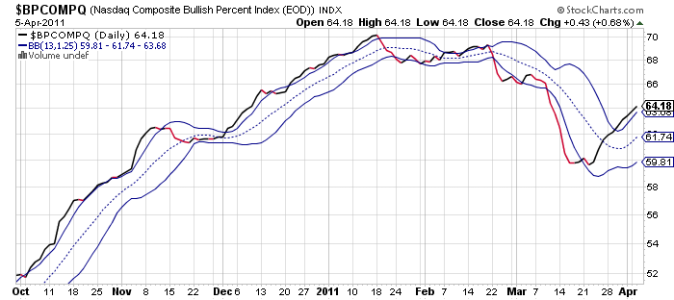

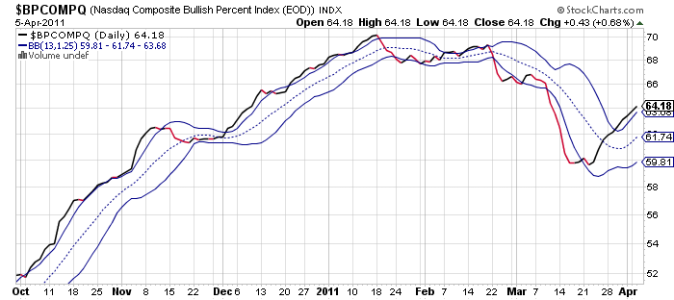

BPCOMPQ ticked higher still and remains above that upper bollinger band, which suggests weakness in the short term.

So the Seven Sentinels remain in a buy condition and I believe that as long as liquidity continues to get pumped, this market should grind higher even if we do get a short term bout of weakness. I'm not looking for a deep pullback, and in fact we may not get much of anything at all if the last two trading days are any indication. But it's hard to ignore that sentiment survey sell signal all the same.

It was another light day for market data, but we did see ISM Services for March drop to 57.3 from its previous reading 59.7 in February.

Afternoon trade was influenced to some extent by the release of the minutes from the last FOMC meeting. Not surprisingly, the Fed Chiefs are not in agreement on the way forward. Evidence of a stronger recovery with higher inflation or rising inflation expectations prompted some of the voting members to suggest reducing the current asset purchase program in response to those concerns, while others wanted no adjustments at this time. It also appears to be their collective belief that the recent increases in the prices of energy and other commodities will only have a transitory increase in inflation.

So far this week the bullish sentiment we've been seeing is being supported by the continued liquidity being pumped into the market. This has been a common theme since last September, although it took awhile for bullish levels to rise when the bull run first began. And that "V" bottom we saw a couple weeks ago seems like a distant memory already.

But the S&P is hitting major resistance as it has yet to eclipse its previous 2 year high, which was set on the 17th of February when it closed at 1343.01. I'm anticipating that the index will eventually push past this level, but will we see some weakness first? You've heard me say it before, and that is liquidity may not allow for much downside action. And so far that's been the case. Having said that, if we do get any weakness it'll probably be bought, so I'm not so sure I'd wait too long to get reinvested should that opportunity present itself. But there is also plenty of room for caution as I'll show you in this evening's charts:

NAMO and NYMO have taken a breather and remain on buys, but look how high their 6 day EMAs are. I put up 1 year charts this evening so you can see that the 6 day EMA is getting close to levels not seen since last July and September. In July when we hit near this level we had a moderate decline before moving higher again, then chopping around sideways, before finally dropping about 100 S&P points over a 3 week period. But in September the market did a grind higher instead, while the momentum in these signals moved lower. I think QE2 favors the latter outcome, but you can see where the risk is.

NAHL and NYHL also are at relatively high 6 day EMAs. NAHL just did flip to a sell today, while NYHL remained on a buy.

TRIN and TRINQ are flashing buys today.

BPCOMPQ ticked higher still and remains above that upper bollinger band, which suggests weakness in the short term.

So the Seven Sentinels remain in a buy condition and I believe that as long as liquidity continues to get pumped, this market should grind higher even if we do get a short term bout of weakness. I'm not looking for a deep pullback, and in fact we may not get much of anything at all if the last two trading days are any indication. But it's hard to ignore that sentiment survey sell signal all the same.