What began as a choppy trading session, took new life early in the afternoon when buyers stepped in and pushed the major averages higher.

The Dow and Nasdaq settled above their 200-day averages for the first time in about a month, but the S&P 500 remained well below its 200-day average. The consolation here is that it did manage to close well above the 1100 mark, which had been very tough resistance until today

Oddly, the European bank stress tests did not move the market in either direction when the news was first announced. Of 91 banks involved in the stress test, only 7 failed.

Exactly why the market moved higher when it did remains unclear to me. But I'll take it any way I can get it.

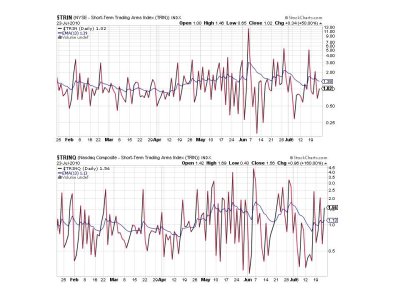

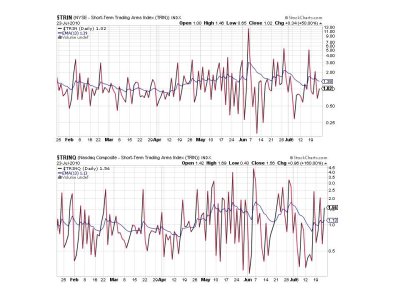

Here's today's charts:

Nothing bearish about these two signals.

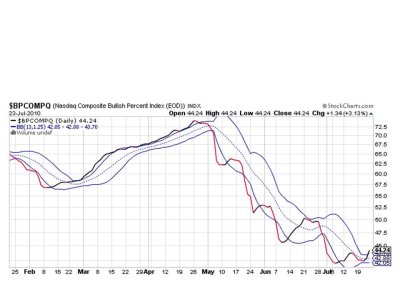

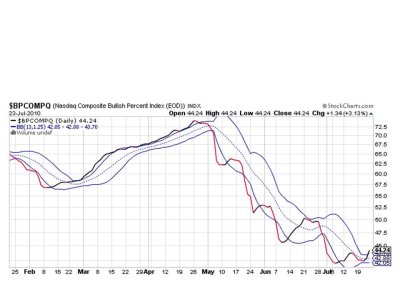

Looking good here too.

TRIN remains on a buy, but TRINQ did flip to a sell.

BPCOMPQ looks like it may be in the early stages of a bullish move higher and remains on a buy.

So we have 6 of 7 signals on a buy, which keeps the system on a buy.

I believe today's action spells trouble for the bears and suspect we have a fair amount of upside left in this Intermediate Term move. I'm holding tight to my 100% S fund position. See you later this weekend when I post the tracker charts.

The Dow and Nasdaq settled above their 200-day averages for the first time in about a month, but the S&P 500 remained well below its 200-day average. The consolation here is that it did manage to close well above the 1100 mark, which had been very tough resistance until today

Oddly, the European bank stress tests did not move the market in either direction when the news was first announced. Of 91 banks involved in the stress test, only 7 failed.

Exactly why the market moved higher when it did remains unclear to me. But I'll take it any way I can get it.

Here's today's charts:

Nothing bearish about these two signals.

Looking good here too.

TRIN remains on a buy, but TRINQ did flip to a sell.

BPCOMPQ looks like it may be in the early stages of a bullish move higher and remains on a buy.

So we have 6 of 7 signals on a buy, which keeps the system on a buy.

I believe today's action spells trouble for the bears and suspect we have a fair amount of upside left in this Intermediate Term move. I'm holding tight to my 100% S fund position. See you later this weekend when I post the tracker charts.