And a good time was had by all...unless you're a bear of course. New 52 week highs were the order of the day today as the S&P made it three straight advances in as many days.

It's obvious economic data is of little import right now as the market didn't seem to react to today's releases. PPI for February dropped 0.6%, which was lower than expected, but Core PPI only advanced 0.1%, which was in-line with estimates.

Tomorrow morning, five economic reports will be released; Core CPI, CPI, Initial Claims, Continuing Claims, and Current Account Balance. I doubt we see much reaction to these either. Not with a market breaking out the way this one is.

Here's today's charts:

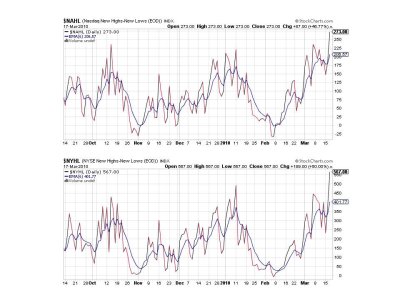

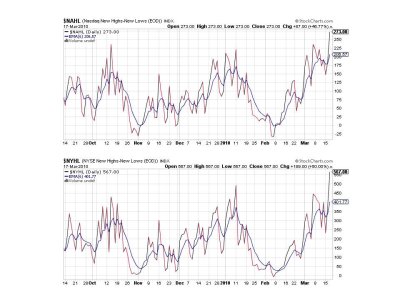

NAMO moved a bit higher today, but remains on a sell (barely) and NYMO crossed its 6 day EMA flipping it back to a buy. Neither are extreme readings and I'm now expecting them to move higher given the underlying strength we're seeing in the market.

Nothing bearish about either of these signals. They have breakout written all over them.

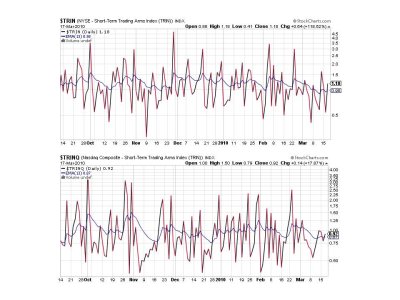

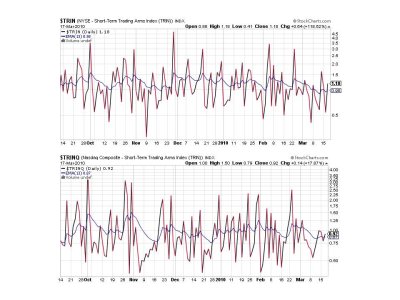

TRIN and TRINQ flipped to sells, but are riding their 13 day EMA. Good news for bulls.

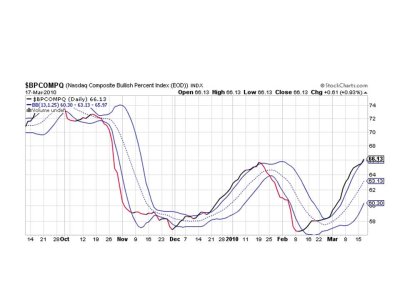

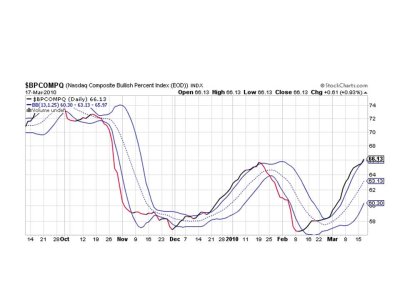

Looks like we're going higher with BPCOMPQ although it's riding its upper bollinger band. At this point that's not a problem. The signal is on an upward trajectory and that's bullish.

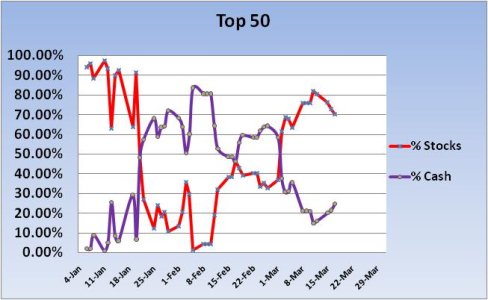

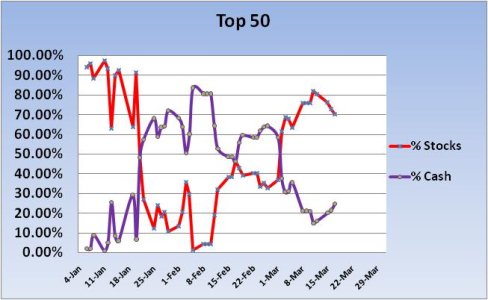

Yesterday I showed you how the Top 15 were positioned going into today's trading. Today I'm posting the Top 50. They're starting to get conservative.

So 4 of 7 signals are in buy territory and the system appears to be on a solid buy yet. It had looked a tad dicey prior the FOMC announcement, but not now. If you hadn't noticed, I took a 100% position in the S fund this morning. My patience to buy a dip just wasn't paying off. But that's okay. I suspect I'll make up for it when the next system sell signal is finally triggered.

See you tomorrow.

It's obvious economic data is of little import right now as the market didn't seem to react to today's releases. PPI for February dropped 0.6%, which was lower than expected, but Core PPI only advanced 0.1%, which was in-line with estimates.

Tomorrow morning, five economic reports will be released; Core CPI, CPI, Initial Claims, Continuing Claims, and Current Account Balance. I doubt we see much reaction to these either. Not with a market breaking out the way this one is.

Here's today's charts:

NAMO moved a bit higher today, but remains on a sell (barely) and NYMO crossed its 6 day EMA flipping it back to a buy. Neither are extreme readings and I'm now expecting them to move higher given the underlying strength we're seeing in the market.

Nothing bearish about either of these signals. They have breakout written all over them.

TRIN and TRINQ flipped to sells, but are riding their 13 day EMA. Good news for bulls.

Looks like we're going higher with BPCOMPQ although it's riding its upper bollinger band. At this point that's not a problem. The signal is on an upward trajectory and that's bullish.

Yesterday I showed you how the Top 15 were positioned going into today's trading. Today I'm posting the Top 50. They're starting to get conservative.

So 4 of 7 signals are in buy territory and the system appears to be on a solid buy yet. It had looked a tad dicey prior the FOMC announcement, but not now. If you hadn't noticed, I took a 100% position in the S fund this morning. My patience to buy a dip just wasn't paying off. But that's okay. I suspect I'll make up for it when the next system sell signal is finally triggered.

See you tomorrow.