Normally, I be looking forward to things getting beared up again, but this market just doesn't feel right to me. Volume is pathetic and I think that's a big clue. Many folks (just look at our tracker) are staying away from the stock market. And many of those same folks are not in a gambling mood, and that's what this market seems to offer. Gambling, but at Lost Wages rates. Sure, risk has always been there, but not like this. High frequency trading, volatile action, and little SEC oversight have really scared off a lot of investors. Getting taken to cleaners takes years to recover from, so who can really blame them.

I think the writing is on the wall. If you saw the video of Tony Robbins in my account talk thread warning his followers and anyone who will listen to protect themselves, then you'd know what I'm talking about. But Tony is hardly the only one who's bearish. And that's the problem. The bearishness doesn't seem to go away and so contrarians try to take advantage of sentiment to go long. It works most of the time. But sooner or later there's not enough money in it or risk gets too high for the big players and things begin to fall apart.

That's what it's feeling like to me. Color me bearish if you must, but taking the long side at the wrong time can be a very costly move. But I really can't say that things will fall apart. I can only surmise that the economic landscape is teetering on the edge (and I have a Seven Sentinels Sell Signal) and draw my conclusions from there.

At what point does risk outweigh reward?

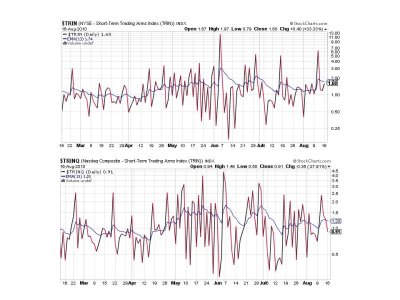

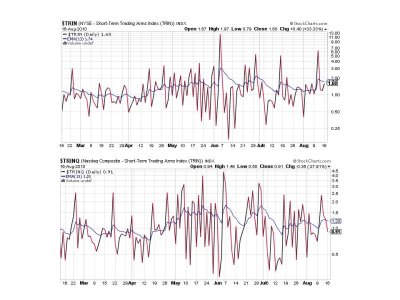

Here's tonight's charts:

Yes it's improved today, but the action in the market wasn't inspiring to say the least.

Same with NAHL and NYHL. Both remain on sells.

Both TRIN and TRINQ are on buys.

BPCOMPQ remains pointed downward.

So we have 5 of 7 signals flashing sells, which keeps the system on a sell.

This market may very well get a relief rally going, but in a thinly traded market the moves will almost certainly be fast in each direction should some momentum get behind the move. And I suspect we are once again in a whipsaw situation, so if this market does decide to rally hard for a day or two, it could trip the sentinels again.

But I don't think I'll be a buyer. My risk meter is now pegged.

See you tomorrow.

I think the writing is on the wall. If you saw the video of Tony Robbins in my account talk thread warning his followers and anyone who will listen to protect themselves, then you'd know what I'm talking about. But Tony is hardly the only one who's bearish. And that's the problem. The bearishness doesn't seem to go away and so contrarians try to take advantage of sentiment to go long. It works most of the time. But sooner or later there's not enough money in it or risk gets too high for the big players and things begin to fall apart.

That's what it's feeling like to me. Color me bearish if you must, but taking the long side at the wrong time can be a very costly move. But I really can't say that things will fall apart. I can only surmise that the economic landscape is teetering on the edge (and I have a Seven Sentinels Sell Signal) and draw my conclusions from there.

At what point does risk outweigh reward?

Here's tonight's charts:

Yes it's improved today, but the action in the market wasn't inspiring to say the least.

Same with NAHL and NYHL. Both remain on sells.

Both TRIN and TRINQ are on buys.

BPCOMPQ remains pointed downward.

So we have 5 of 7 signals flashing sells, which keeps the system on a sell.

This market may very well get a relief rally going, but in a thinly traded market the moves will almost certainly be fast in each direction should some momentum get behind the move. And I suspect we are once again in a whipsaw situation, so if this market does decide to rally hard for a day or two, it could trip the sentinels again.

But I don't think I'll be a buyer. My risk meter is now pegged.

See you tomorrow.