JTH

TSP Legend

- Reaction score

- 1,158

Shouldn't that be anything you can do I can do worse.

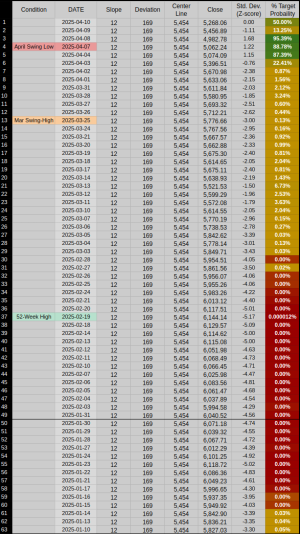

We just crossed standard deviation 4 on the 52-Week Linear Regression Channel. It's so rare I usually don't even bother to track it.

Including last week, a close below has happened 7 times in 63 years.

2025-03-31

2020-03-16

2020-03-09

2008-10-06

1994-03-28

1987-10-19

1987-10-12

In a normal distribution:

- About 68% of data falls within ±1σ,

- 95% within ±2σ,

- 99.7% within ±3σ,

- And ±4σ captures about 99.994% of the data.