- Reaction score

- 2,451

Re: Sunday: Small pullback

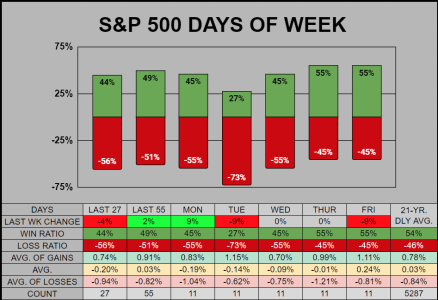

Yes, I've noticed that fading the crossover for a short term counter move works, but only short-term. It's because to get to the crossover, the chart is usually somewhat overbought (or oversold on a downward crossover.)

Yes, I've noticed that fading the crossover for a short term counter move works, but only short-term. It's because to get to the crossover, the chart is usually somewhat overbought (or oversold on a downward crossover.)

Good morning

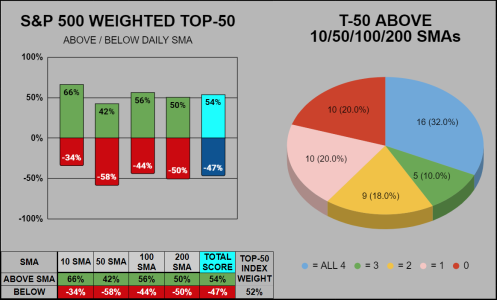

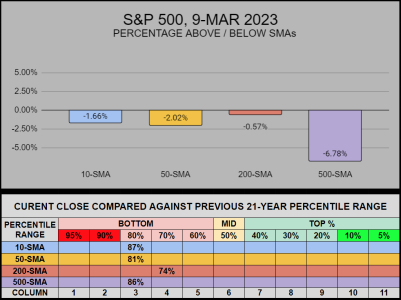

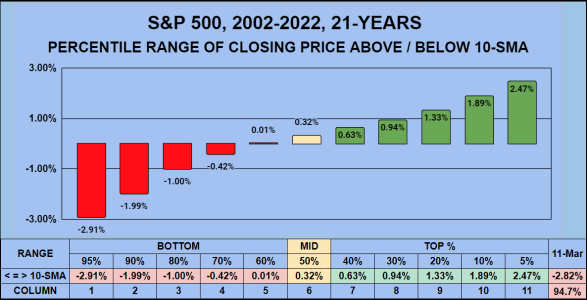

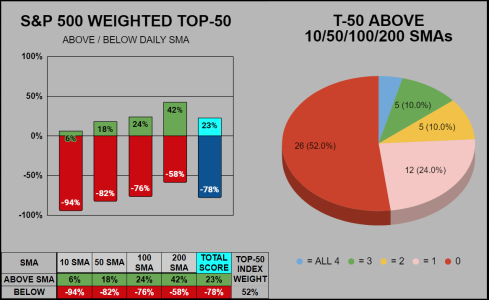

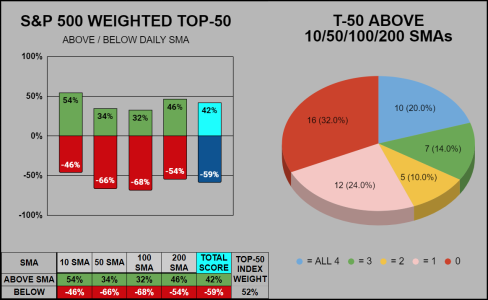

Here's a good example of why I don't care to trade based on moving average crossovers. The 50/200 SMA Golden Cross marked the most recent high, to the exact day. Since this golden cross, we've retraced -6.37%