JTH

TSP Legend

- Reaction score

- 1,158

Good morning

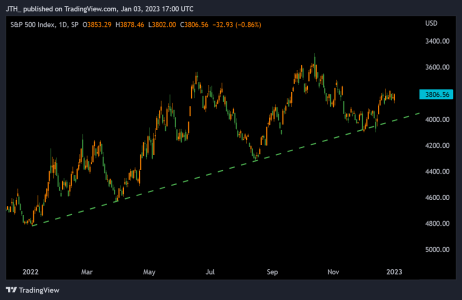

In Poland we are burning coal, and at times the air can get thick, so if Santa is coming to town, I probably won't be able see him For myself, I'm ready to put this year behind us and focus on performing better in 2023. Setting aside Sunday's bearish charts, here's the historical stats going into this week and next weeks post Holiday Monday. Have great week!

For myself, I'm ready to put this year behind us and focus on performing better in 2023. Setting aside Sunday's bearish charts, here's the historical stats going into this week and next weeks post Holiday Monday. Have great week!

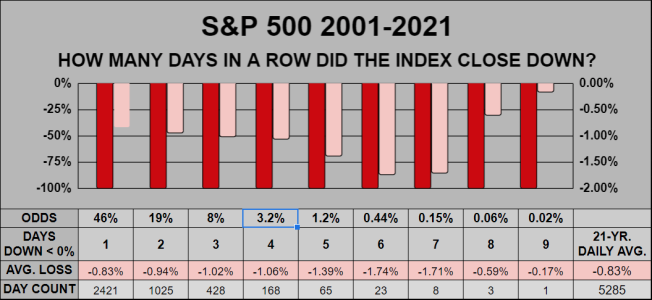

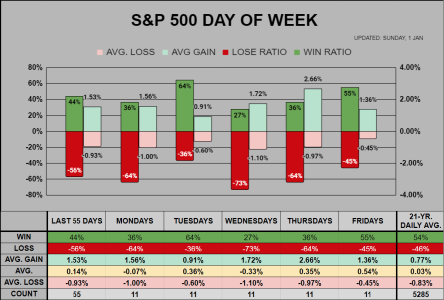

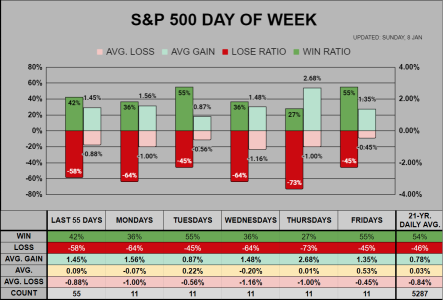

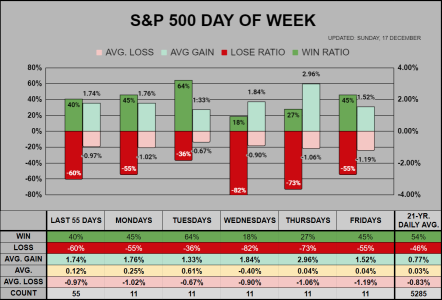

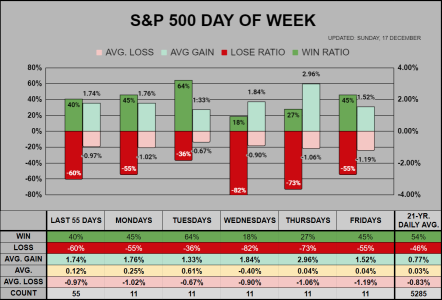

For the Day of the week chart, the last 55 days are still significantly below the 21-year daily average. Tuesdays have taken the lead as the clear winner, while Wednesday & Thursday are stinkers. Lastly, the last 4 Fridays have closed down.

___

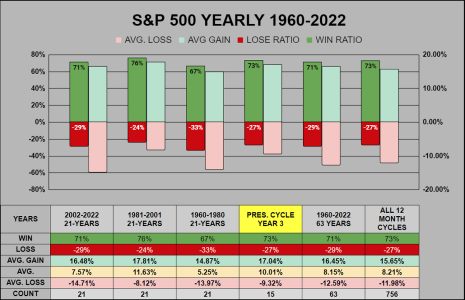

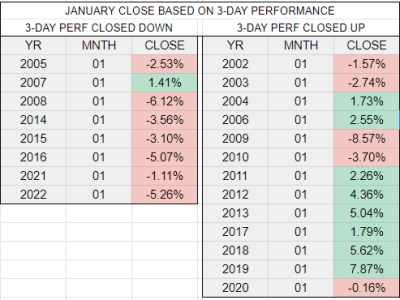

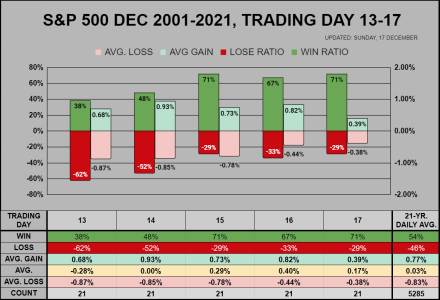

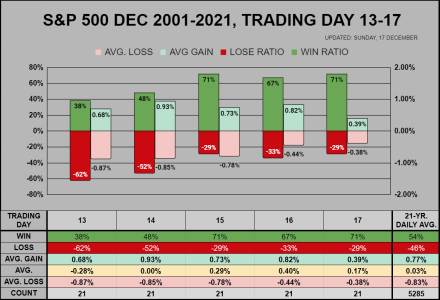

For trading days 13-17, days 15-17 look great, but day 17 has weaker than average gains/losses going into the market holiday.

___

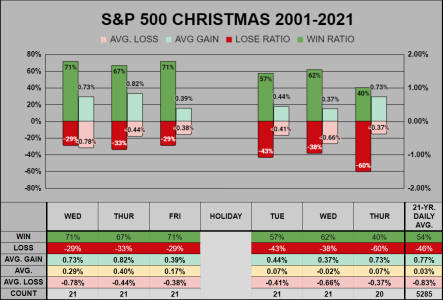

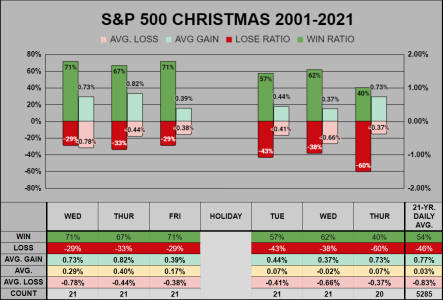

Here's the last 21 years surrounding the Christmas holiday. Three days prior looks good, post 2 days look good, from there (Thursday 29 Dec) the stats fade under the 21-year averages.

In Poland we are burning coal, and at times the air can get thick, so if Santa is coming to town, I probably won't be able see him

For the Day of the week chart, the last 55 days are still significantly below the 21-year daily average. Tuesdays have taken the lead as the clear winner, while Wednesday & Thursday are stinkers. Lastly, the last 4 Fridays have closed down.

___

For trading days 13-17, days 15-17 look great, but day 17 has weaker than average gains/losses going into the market holiday.

___

Here's the last 21 years surrounding the Christmas holiday. Three days prior looks good, post 2 days look good, from there (Thursday 29 Dec) the stats fade under the 21-year averages.