JTH

TSP Legend

- Reaction score

- 1,158

JTH,

your charts and and ideas are always good guidance. We haven't seen any updates of your views for a few days. It is refreshing to see your opinions on the direction and most likely performance of the markets. Can you please update your views as of late? Thank you.

Some unseen force is pulling the markets up, it took control of my better judgment and made me

go 100% C today when my gut said wait for a lower entry.

It could be..... Greed!

Sorry friends, I've been negligent this week, and I'll be out of town this weekend, plus going back to the states at the end of the month.

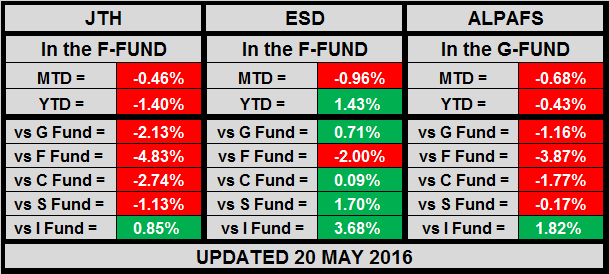

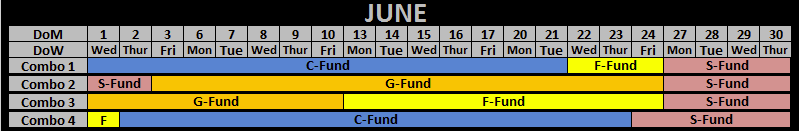

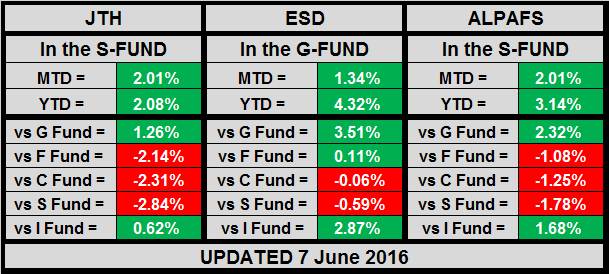

ESD is in the F-Fund and will stay there most of the month before going into the S-Fund.

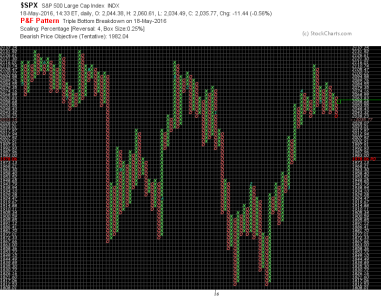

ALPAFS is bearish across the SPX/W4500/TRAN/NDX indexes (TRAN is close to flipping over)

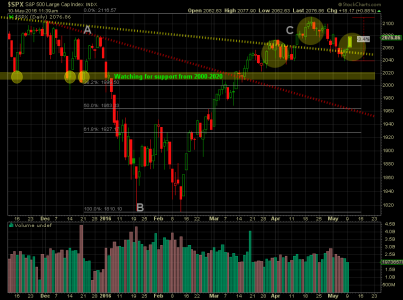

I'm looking at this as if it were a retracement bounce off a Head & Shoulders style pattern, meaning it looks to if we'll go lower. But we should also notice there hasn't been much of a surge in volume, so I'm not overly worried about this pullback (yet).

I may punch out today.