DreamboatAnnie

TSP Legend

- Reaction score

- 838

I love this chart!!!! If I could give you reputation points I would... It says I can't but will come back to it later!!! This is a great chart! Now I know you were going to Europe and all. So you leave this week. I wanted to wish you a safe trip and hope you have a great time visiting and having little adventures!

However, how long will it be before you post again?

However, how long will it be before you post again?

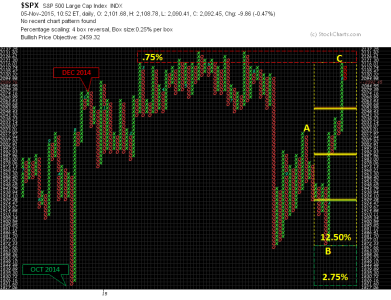

Never done messin with stuff, here's the revised version.

Did my best to get as much info in there as possible, while keeping the fonts big (for the older folks) and staying within the size limitations for posting in the forum. If anyone is color blind, and having issues, please let me know.

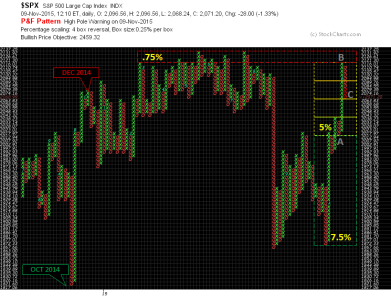

This one is for November

View attachment 35810